Boeing 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

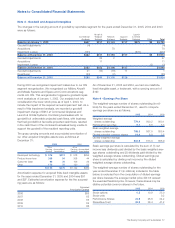

Concession sharing arrangements We account for sales con-

cessions to our customers in consideration of their purchase of

products and services as a reduction to revenue (sales conces-

sions) when the related products and services are delivered.

However, when the sales concessions incurred are partially

reimbursed by a supplier in accordance with a concession

sharing arrangement, we reduce the sales concessions by the

reimbursement. This reduction in sales concessions results in

an increase to revenue.

Under Emerging Issues Task Force (EITF) Issue No. 02-16,

Accounting by a Customer (including a reseller) for Certain

Consideration Received from a Vendor (EITF 02-16), reimburse-

ments received by a customer from a vendor are presumed to

be a reduction in the price of the vendor’s products or services

and should be treated as a reduction of cost of sales when

recognized in the customer’s income statement. EITF 02-16

applies to new arrangements or modifications to existing

arrangements entered into after December 31, 2002. We have

a concession sharing agreement that was entered into in 1993.

Although we are not required to apply EITF 02-16 to that long-

term supplier agreement, we have determined that we will

adopt the provisions of EITF 02-16 beginning January 1, 2006.

Had we applied those provisions beginning January 1, 2005,

the result would have been a decrease in both sales of prod-

ucts and cost of products of approximately $1,200 for the year

ended December 31, 2005.

Service revenue Service revenue is recognized when the serv-

ice is performed. Service activities primarily include the follow-

ing: Delta launches, ongoing maintenance of International

Space Station, Space Shuttle and explosive detection systems,

support agreements associated with military aircraft and heli-

copter contracts and technical and flight operation services for

commercial aircraft. Lease and financing revenue arrangements

are also included in Sales of services on the Consolidated

Statements of Operations.

Sales-type/finance leases At lease inception, we record an

asset (net investment) representing the aggregate future mini-

mum lease payments, estimated residual value of the leased

equipment and deferred incremental direct costs less unearned

income. Income is recognized over the life of the lease to

approximate a level rate of return on the net investment.

Residual values, which are reviewed quarterly, represent the

estimated amount we expect to receive at lease termination

from the disposition of leased equipment. Actual residual values

realized could differ from these estimates. Write-downs of esti-

mated residual value are recognized as permanent impairments

in the current period cost of services.

Operating leases Revenue on leased aircraft and equipment

representing rental fees and financing charges is recorded on a

straight-line basis over the term of the lease. Operating lease

assets, included in Customer financing, are recorded at cost and

depreciated over the longer of the term of the lease or projected

economic life of the asset, on a straight-line basis, to an estimated

residual or salvage value. We periodically review our estimates

of residual value on initial leases. We record forecasted decreases

in residual value by prospectively adjusting depreciation expense.

Notes receivable When a note receivable is issued for the pur-

chase of aircraft or equipment, we record the note and any

unamortized discounts. Interest income and amortization of any

discounts are recorded ratably over the related term of the

note.

Captive Insurance Our wholly-owned insurance subsidiary,

Astro Ltd., participates in a reinsurance pool. The member

agreements and practices of the reinsurance pool minimize any

participating members’ individual risk. Reinsurance revenues

earned were $101 and $129 during 2005 and 2004 respec-

tively, and related to premiums received and claims recovered

from the reinsurance pool. Reinsurance costs incurred were

$115 and $129 during 2005 and 2004 respectively, and related

to premiums and claims paid to the reinsurance pool. Both rev-

enues and costs are presented net in Cost of products and

Cost of services in the Consolidated Statements of Operations.

Fleet support

We provide the operators of all our commercial airplane models

assistance and services to facilitate efficient and safe aircraft

operation. Collectively known as fleet support services, these

activities and services include flight and maintenance training,

field service support costs, engineering services and technical

data and documents. Fleet support activity begins prior to air-

craft delivery as the customer receives training, manuals and

technical consulting support, and continues throughout the

operational life of the aircraft. Services provided after delivery

include field service support, consulting on maintenance, repair,

and operational issues brought forth by the customer or regula-

tors, updating manuals and engineering data, and the issuance

of service bulletins that impact the entire model’s fleet. Field

service support involves our personnel located at customer

facilities providing and coordinating fleet support activities and

requests. The costs for fleet support are expensed as incurred

as Cost of services.

Research and development

Research and development (R&D) includes costs incurred for

experimentation, design and testing and are expensed as

incurred unless the costs are related to certain contractual

arrangements. Costs that are incurred pursuant to such con-

tractual arrangements are recorded over the period that rev-

enue is recognized, consistent with our contract accounting

policy. We have certain research and development arrange-

ments that meet the requirement for best efforts research and

development accounting. Accordingly, the amounts funded by

the customer are recognized as an offset to our research and

development expense rather than as contract revenues.

During the year ended December 31, 2004, we established

cost sharing arrangements with some suppliers for the 787

program, which have enhanced our internal development capa-

bilities and have offset a substantial portion of the financial risk

of developing this aircraft. Our cost sharing arrangements

explicitly state that the supplier contributions are for reimburse-

ments of costs we incur for experimentation, basic design and

testing activities during the development of the 787. In each

arrangement, we retain substantial rights to the 787 part or

The Boeing Company and Subsidiaries 51