Boeing 2005 Annual Report Download - page 81

Download and view the complete annual report

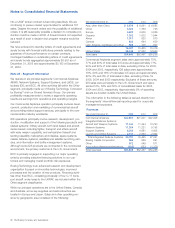

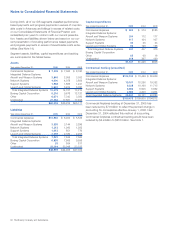

Please find page 81 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

of recorded costs on the A-12 contract, against which we have

established a loss provision of $350. The amount of the provi-

sion, which was established in 1990, was based on McDonnell

Douglas Corporation’s belief, supported by an opinion of out-

side counsel, that the termination for default would be con-

verted to a termination for convenience, and that the best

estimate of possible loss on termination for convenience was

$350.

On August 31, 2001, the U.S. Court of Federal Claims issued a

decision after trial upholding the Government’s default termina-

tion of the A-12 contract. The court did not, however, enter a

money judgment for the U.S. Government on its claim for unliq-

uidated progress payments. In 2003, the Court of Appeals for

the Federal Circuit, finding that the trial court had applied the

wrong legal standard, vacated the trial court’s 2001 decision

and ordered the case sent back to that court for further pro-

ceedings. This follows an earlier trial court decision in favor of

the Team and reversal of that initial decision on appeal.

If, after all judicial proceedings have ended, the courts deter-

mine, contrary to our belief, that a termination for default was

appropriate, we would incur an additional loss of approximately

$275, consisting principally of remaining inventory costs and

adjustments, and, if the courts further hold that a money judg-

ment should be entered against the Team, we would be

required to pay the U.S. Government one-half of the unliqui-

dated progress payments of $1,350 plus statutory interest from

February 1991 (currently totaling approximately $1,210). In that

event, our loss would total approximately $1,548 in pre-tax

charges. Should, however, the March 31, 1998 judgment of the

United States Court of Federal Claims in favor of the Team be

reinstated, we would receive approximately $1,026, including

interest.

We believe that the termination for default is contrary to law

and fact and that the loss provision established by McDonnell

Douglas Corporation in 1990, which was supported by an

opinion from outside counsel, continues to provide adequately

for the reasonably possible reduction in value of A-12 net con-

tracts in process as of December 31, 2005. Final resolution of

the A-12 litigation will depend upon the outcome of further pro-

ceedings or possible negotiations with the U.S. Government.

EELV litigation In 1999, two employees were found to have in

their possession certain information pertaining to a competitor,

Lockheed, under the EELV Program. The employees, one of

whom was a former employee of Lockheed, were terminated

and a third employee was disciplined and resigned. On July 24,

2003, the USAF suspended certain organizations in our space

launch services business and the three former employees from

receiving government contracts as a direct result of alleged

wrongdoing relating to possession of the Lockheed information

during the EELV source selection in 1998. On March 4, 2005,

the USAF lifted the suspension from government contracting of

our space launch services business after we entered into an

Interim Administrative Agreement. Under the terms of the

Interim Administrative Agreement between us and the USAF

(the Agreement), the USAF can reinstate the suspension if we

are indicted or convicted in connection with the EELV matter, or

if material new evidence is discovered. The Agreement requires

periodic reporting to the USAF and also provides for appoint-

ment of a Special Compliance Officer responsible for verifying

our implementation of remedial measures and compliance with

other provisions of the Agreement. We have reimbursed the

USAF $1.9 for costs relating to its investigation and have

agreed that certain costs relating to the EELV matter and

improvements to our Ethics and Business Conduct Program

will be treated as unallowable. The USAF also terminated 7 out

of 21 of our EELV launches previously awarded through a

mutual contract modification and disqualified the launch serv-

ices business from competing for three additional launches

under a follow-on procurement. The same incident is under

investigation by the U.S. Attorney in Los Angeles, who indicted

two of the former employees in July 2003. In addition, in June

2003, Lockheed filed a lawsuit in the United States District

Court for the Middle District of Florida against us and the three

individual former employees arising from the same facts.

Subsequently, Lockheed filed an amended complaint which

added McDonnell Douglas Corporation and Boeing Launch

Services as defendants and sought injunctive relief, compensa-

tory damages in excess of $2,000 and treble and punitive

damages. In August 2004, we filed counterclaims against

Lockheed seeking compensatory and punitive damages. In

addition, the Department of Justice has informed us that it is

considering filing potential civil claims against us relating to the

EELV incident and the 2004 guilty pleas of Darlene Druyun and

Mike Sears relating to federal employee conflict-of-interest

laws. Such claims, if asserted, could be of sufficient magnitude

to be material, although it is not possible to determine at this

time the likelihood of an adverse outcome.

As discussed in Note 12, on May 2, 2005, we entered into a

Joint Venture Agreement with Lockheed to provide launch serv-

ices to the U.S. Government. Pursuant to the terms of the Joint

Venture Agreement and court order, the civil lawsuit has been

stayed pending closing of the transaction, whereupon the par-

ties have agreed to immediately dismiss all claims against each

other. If the transaction does not close or if the Joint Venture

Agreement is terminated according to its terms before April 1,

2006, either party may reinstate its claims against the other. It

is not possible at this time to determine whether an adverse

outcome would have a material adverse effect on our financial

position should the claims be reinstated.

Shareholder derivative lawsuits In September 2003, two virtually

identical shareholder derivative lawsuits were filed in Cook

County Circuit Court, Illinois, against us as nominal defendant

and against each then current member of our Board of

Directors. These suits have now been consolidated. The plain-

tiffs allege that the directors breached their fiduciary duties in

failing to put in place adequate internal controls and means of

supervision to prevent the EELV incident described above, the

July 2003 charge against earnings, and various other events

that have been cited in the press during 2003. The lawsuit

seeks an unspecified amount of damages against each direc-

tor, the return of certain salaries and other remunerations and

The Boeing Company and Subsidiaries 79