Boeing 2005 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis

and deliver items in sufficient time to meet our production

schedules. The need for such arrangements with suppliers and

vendors arises due to the extended production planning hori-

zon for many of our products, including commercial aircraft,

military aircraft and other products where delivery to the cus-

tomer occurs over an extended period of time. A significant

portion of these inventory commitments is supported by firm

contracts from customers, and/or has historically resulted in

settlement through reimbursement from such customers for

penalty payments to the supplier should the customer not take

delivery. These amounts are also included in our forecasts of

costs for program and contract accounting. Some inventory

procurement contracts may include escalation adjustments. In

these limited cases, we have included our best estimate of the

effect of the escalation adjustment in the amounts disclosed in

the table above.

Industrial participation agreements We have entered into various

industrial participation agreements with certain customers in

foreign countries to effect economic flow back and/or technol-

ogy transfer to their businesses or government agencies, as

the result of their procurement of goods and/or services from

us. These commitments may be satisfied by our placement of

direct work or vendor orders for supplies, opportunities to bid

on supply contracts, transfer of technology, or other forms of

assistance to the foreign country. However, in certain cases,

our commitments may be satisfied through other parties (such

as our vendors) who purchase supplies from our foreign cus-

tomers. We do not commit to industrial participation agree-

ments unless a contract for sale of our products or services is

signed. In certain cases, penalties could be imposed if we do

not meet our industrial participation commitments. During

2005, we incurred no such penalties. As of December 31,

2005, we have outstanding industrial participation agreements

totaling $6.3 billion that extend through 2019. In cases where

we satisfy our commitments through the purchase of supplies

and the criteria described in “purchase obligations” are met,

amounts are included in the table above. To be eligible for such

a purchase order commitment from us, the foreign country or

customer must have sufficient capability to meet our require-

ments and must be competitive in cost, quality and schedule.

Purchase obligations recorded on the

Consolidated Statement of Financial Position

Purchase obligations recorded on the statement of financial

position primarily include accounts payable and certain other

liabilities including accrued compensation and dividends

payable.

Off-Balance Sheet Arrangements

We are a party to certain off-balance sheet arrangements in-

cluding certain guarantees and variable interests in unconsolidated

entities. For discussion of these arrangements, see Note 21.

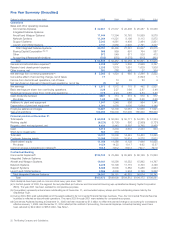

Commercial commitments The following table summarizes our

commercial commitments outstanding as of December 31,

2005, as well as an estimate of when these commitments are

expected to expire.

Total Amounts

Committed/Maximum Less than 1-3 4-5 After 5

(Dollars in millions) Amount of Loss 1 year years years years

Standby letters of

credit and surety bonds $««3,957 $3,719 $«««112 ««««««« $«««126

Aircraft financing

commercial commitments 13,496 872 6,672 $1,997 3,955

Total commercial

commitments $17,453 $4,591 $6,784 $1,997 $4,081

Related to the issuance of certain standby letters of credit and

surety bonds included in the above table, we received advance

payments of $274 million as of December 31, 2005.

Aircraft financing commercial commitments include commit-

ments to arrange or provide financing related to aircraft on

order or under option for deliveries scheduled through the year

2012. Based on historical experience, it is not anticipated that

all of these commitments will be exercised by our customers.

(See Note 21).

Industrial Revenue Bonds We utilize Industrial Revenue Bonds

(IRB) issued by the City of Wichita, Kansas and Fulton County,

Georgia to finance the purchase and/or construction of real

and personal property (See Note 21).

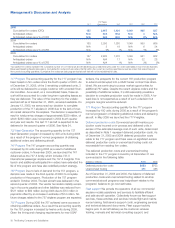

Segment Results of Operations and Financial Condition

Commercial Airplanes

Business Environment and Trends

Airline Industry Environment Gross domestic product (GDP)

growth, the primary driver of air traffic growth, remained

resilient in the face of rising energy prices in 2005. As a result,

worldwide passenger traffic growth continued above the long-

term trend in 2005 following double digit growth in 2004. Traffic

growth outpaced capacity increases pushing world load factors

to historical highs. Industry forecasts predict above average

traffic growth through at least 2007, although disease out-

breaks, increasing armed conflict or terrorist attacks, and

global economic imbalances represent ongoing risks.

Crude oil prices have almost doubled since the beginning of

2004. In addition, the price differential between oil and jet fuel

rose to historically high levels in 2005, triple the average over

the last 20 years. Although economic indicators show that the

world economy has adjusted to the current higher oil price lev-

els without significant slowdown, the rise in jet fuel prices is

outpacing airlines’ ability to increase revenues through fare

hikes and fuel surcharges and is pressuring less efficient airlines

in particular.

Worldwide, many airlines continue to report operating profits

although performance varies significantly by region and busi-

ness model. Industry financials generally show increasing unit

revenues and some improvement in fares. Combined with

progress on cost-cutting initiatives and efficiency improve-

ments, these trends are helping many airlines remain profitable

despite rising fuel prices and intense competition. Although the

industry’s aggregate financial health remains under the shadow

of the U.S. network carriers whose financial difficulties are

The Boeing Company and Subsidiaries 27