Boeing 2005 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

impairment may exist. Our annual testing date is April 1. We

test goodwill for impairment by first comparing the carrying

value of net assets to the fair value of the related operations. If

the fair value is determined to be less than carrying value, a

second step is performed to compute the amount of the

impairment. In this process, a fair value for goodwill is esti-

mated, based in part on the fair value of the operations, and is

compared to its carrying value. The shortfall of the fair value

below carrying value represents the amount of goodwill impair-

ment.

As a result of IDS reorganizing from four business segments

into three business segments, we will be performing a goodwill

impairment assessment as of January 1, 2006, in addition to

our annual test as of April 1, 2006.

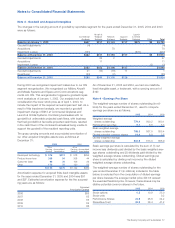

Our finite-lived acquired intangible assets are amortized on a

straight-line basis over their estimated useful lives as follows:

developed technology, 5 to 12 years; product know-how, 30

years; customer base, 12 to 15 years; and other, 2 to 17 years.

In accordance with SFAS No. 144, we evaluate the potential

impairment of finite-lived acquired intangible assets when

appropriate. If the carrying value is no longer recoverable based

upon the undiscounted future cash flows of the asset, the

amount of the impairment is the difference between the carry-

ing amount and the fair value of the asset.

Investments

We classify investments as either operating or non-operating.

Operating investments are strategic in nature, which means

they are integral components of our operations. Non-operating

investments are those we hold for non-strategic purposes.

Earnings from operating investments, including our share of

income or loss from equity method investments, dividend

income from certain cost method investments, and any

gain/loss on the disposition of these investments, are recorded

in Income from operating investments, net. Earnings from non-

operating investments, including marketable debt and equity

securities and certain cost method investments, are recorded in

Other income, net on the Consolidated Statements of

Operations. Other income also includes interest income related

to income taxes.

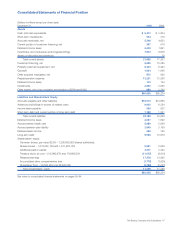

We account for certain non-operating investments as available-

for-sale securities, including marketable securities, preferred

stock, Equipment Trust Certificates (ETCs) and Enhanced

Equipment Trust Certificates (EETCs). Available-for-sale securi-

ties are recorded at their fair values and unrealized gains and

losses are reported as part of Accumulated other comprehen-

sive loss on the Consolidated Statements of Financial Position.

Available-for-sale securities are assessed for impairment quar-

terly. To determine if an impairment is other than temporary we

consider the duration of the loss position, the strength of the

underlying collateral, the duration to maturity, credit reviews and

analyses of the counterparties. Losses on operating invest-

ments deemed other-than-temporary are recorded in Cost of

products or Cost of services.

The fair value of marketable securities is based on quoted mar-

ket prices. The fair value of non-publicly traded securities, such

as EETCs, is based on independent third party pricing sources

except when it is probable that recovery of our investment will

come from recovery of collateral, in which case the fair value is

based on the underlying collateral value.

Derivatives

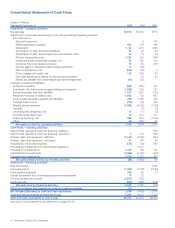

All derivative instruments are recognized in the financial state-

ments and measured at fair value regardless of the purpose or

intent of holding them. We record our interest rate swaps, for-

eign currency swaps and commodity contracts at fair value

based on discounted cash flow analysis and for warrants and

other option type instruments based on option pricing models.

For derivatives designated as hedges of the exposure to

changes in the fair value of a recognized asset or liability or a

firm commitment (referred to as fair value hedges), the gain or

loss is recognized in earnings in the period of change together

with the offsetting loss or gain on the hedged item attributable

to the risk being hedged. The effect of that accounting is to

reflect in earnings the extent to which the hedge is not effective

in achieving offsetting changes in fair value. For our cash flow

hedges, the effective portion of the derivative’s gain or loss is

initially reported in shareholders’ equity (as a component of

Accumulated other comprehensive loss) and is subsequently

reclassified into earnings in the same period or periods during

which the hedged forecasted transaction affects earnings. The

ineffective portion of the gain or loss of a cash flow hedge is

reported in earnings immediately. We also hold certain instru-

ments for economic purposes that do not qualify for hedge

accounting treatment. For these derivative instruments as well

as other derivatives not receiving hedge accounting treatment

the changes in fair value are also recorded in earnings.

Aircraft valuation

Used aircraft under trade-in commitments and aircraft under

repurchase commitments In conjunction with signing a defini-

tive agreement for the sale of new aircraft (Sale Aircraft), we

have entered into specified-price trade-in commitments with

certain customers that give them the right to trade in used air-

craft upon the purchase of Sale Aircraft. Additionally, we have

entered into contingent repurchase commitments with certain

customers wherein we agree to repurchase the Sale Aircraft at

a specified price, generally ten years after delivery of the Sale

Aircraft. Our repurchase of the Sale Aircraft is contingent upon

a future, mutually acceptable agreement for the sale of addi-

tional new aircraft. If we execute an agreement for the sale of

additional new aircraft, and if the customer exercises its right to

sell the Sale Aircraft to us, a contingent repurchase commit-

ment would become a trade-in commitment. Our historical

experience is that no contingent repurchase agreements have

become trade-in commitments.

All trade-in commitments at December 31, 2005 and 2004 are

solely attributable to Sale Aircraft and did not originate from

contingent repurchase agreements. Exposure related to trade-

in commitments may take the form of:

(1) Adjustments to revenue for the difference between the

contractual trade-in price in the definitive agreement and our

best estimate of the fair value of the trade-in aircraft as of

54 The Boeing Company and Subsidiaries