Boeing 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis

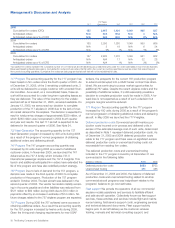

factors, values for the various aircraft types serving as collateral

in BCC’s portfolio generally have not increased. Aircraft valua-

tions could decline if significant numbers of aircraft, particularly

types with relatively few operators, are placed out of service. At

the same time, the credit ratings of many airlines, particularly in

the United States, have remained at low levels.

Aircraft values and lease rates are impacted by the number and

type of aircraft that are currently out of service. Approximately

1,900 commercial jet aircraft (10.2% of current world fleet) con-

tinue to be parked, including both in production and out-of-

production aircraft types of which over 50% are not expected

to return to service.

At December 31, 2005, $2.6 billion of BCC’s portfolio was col-

lateralized by 717 aircraft. During 2005, BCC and the Other

segment provided $25 million and $76 million in valuation

reserves due to a decrease in the collateral value of the 717

aircraft. Should the 717 aircraft suffer an additional decline in

value, such impacts could result in a potential material adverse

effect on the Other Segment’s earnings, cash flows and/or

financial position.

In October 2003, Commercial Airplanes announced the deci-

sion to end production of the 757 aircraft, and the final 757 air-

craft was produced in October 2004. At December 31, 2005,

$1.2 billion of BCC’s portfolio was collateralized by the 757 air-

craft. During the year ended December 31, 2005, the Other

segment provided $22 million in our valuation reserve due to a

decrease in the collateral value of the 757 aircraft. Should the

757 aircraft suffer a decline in value and market acceptance,

such impacts could result in a potential material adverse effect

on our earnings, cash flow and/or financial position.

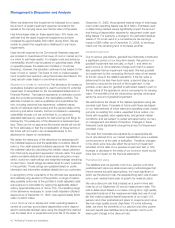

Significant Customer Contingencies

A substantial portion of BCC’s portfolio is concentrated among

U.S. commercial airline customers. Certain customers have

filed for bankruptcy protection or requested lease or loan

restructurings; these negotiations were in various stages as of

December 31, 2005. BCC does not expect that the current

bankruptcies or reorganizations of ATA Holdings Corp (ATA),

Viacao Aerea Rio-Grandense (VARIG), Delta or Northwest

including a return of some or all of the aircraft financed will

have a material adverse effect on our earnings, cash flows

and/or financial position.

United Airlines, Inc. At December 31, 2005 and 2004, United

Airlines, Inc. (United) accounted for $1.1 billion (11.7%) of

BCC’s total portfolio. At December 31, 2005, United was

BCC’s second largest customer based on portfolio carrying

value. At December 31, 2005, the United portfolio was secured

by security interests in two 767 aircraft and 13 777 aircraft and

by an ownership and security interest in five 757 aircraft. At

December 31, 2005, United was current on all of its obligations

related to these 20 aircraft.

On February 1, 2006, United emerged from bankruptcy and

has assumed all our financing which were restructured in

September 2003 as part of the bankruptcy proceeding.

ATA Holdings Corp. At December 31, 2005 and 2004, ATA

accounted for $253 million and $705 million (2.7% and 7.3%)

of BCC’s total portfolio. At December 31, 2005, the ATA portfo-

lio consisted of six operating leases for 757 aircraft and a note

receivable.

On October 26, 2004, ATA filed for Chapter 11 bankruptcy pro-

tection. As a result, on December 29, 2004, BCC entered into

an agreement in principle with ATA whereby ATA agreed to

continue to lease 12 757 aircraft under restructured terms and

agreed to return eight of the 12 757 aircraft during the second

half of 2005 and early 2006. ATA is obligated to pay rent on all

aircraft until returned. BCC concurrently entered into an agree-

ment with Continental Airlines (Continental) to lease each of

these eight 757 aircraft as they are returned by ATA. In

February 2005, following completion of certain conditions, BCC

reclassified the 12 757 aircraft from finance leases to operating

leases. On July 14, 2005, the bankruptcy court approved the

assumption of 11 of the restructured 757 aircraft leases by

mutual agreement between BCC and ATA, one 757 aircraft

lease was rejected and the aircraft returned to accommodate

BCC’s timely re-leasing of the aircraft to Continental. The bank-

ruptcy court order also approved a settlement agreement set-

ting forth BCC’s deficiency claim for the four 757 aircraft to be

retained by ATA and a process for determining the amount of

our deficiency claims for the remaining eight 757 aircraft that

will be returned to BCC. During 2005, six of the eight aircraft

were returned and subsequently delivered to Continental. The

remaining two aircraft were returned to BCC and delivered to

Continental in January 2006.

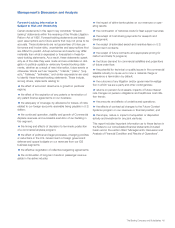

Viacao Aerea Rio-Grandense. At December 31, 2005 and

2004, VARIG accounted for $270 million and $400 million

(2.9% and 4.1%) of BCC’s total portfolio. At December 31,

2005 the VARIG portfolio consisted of two 737 aircraft and six

MD-11 aircraft. We exercised early lease termination rights and

took possession of two MD-11 aircraft in the second quarter of

2005 with a carrying value of $73 million. The aircraft were sub-

sequently sold to another customer. On June 17, 2005, VARIG

filed a request for reorganization which was granted on June

22, 2005 by Brazilian Reorganization Courts. In October 2005,

VARIG returned one MD-11 aircraft which was immediately re-

leased to another customer. In December 2005, VARIG’s reor-

ganization plan was approved both by the creditors and the

Brazilian Reorganization Court. In recent years, VARIG has

repeatedly defaulted on its obligations under leases with BCC,

which has resulted in deferrals and restructurings, some of

which are ongoing.

Delta Air Lines, Inc. At December 31, 2005 and 2004, Delta

accounted for $118 million and $146 million (1.3% and 1.5%)

of BCC’s total portfolio. At December 31, 2005, the Delta port-

folio consisted of two EETCs secured by 17 767 aircraft, 18

737 aircraft and 13 757 aircraft. On September 14, 2005, Delta

filed for Chapter 11 bankruptcy protection. Delta retains certain

rights by operating under Chapter 11 bankruptcy protection,

including the right to reject the restructuring terms with its cred-

itors and return aircraft, including BCC aircraft. To date, none of

the aircraft securing BCC’s investments have been rejected or

returned. Although Delta has affirmed its obligations for the two

38 The Boeing Company and Subsidiaries