Boeing 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis

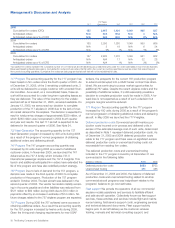

based in part upon estimated quantities and timing of launch

missions for existing and anticipated contracts, referred to as

the Mission Manifest, to determine the allocation of fixed costs

to individual launches. Revenue estimates include probable

price adjustments due to contractual statement of work

changes where we have established contractual entitlement. If

these price adjustments do not occur, it could impact the finan-

cial performance of the Delta programs. The Mission Manifest

represents management’s best estimate of the launch services

market taking into account all known information. Due to the

volatility of the government launch market, it is possible that

changes in quantity and timing of launches could occur that

would change the Mission Manifest and, therefore, the financial

performance of the Delta programs. We have Delta IV inventory

of $1.0 billion and fixed assets of $1.0 billion that may be sub-

ject to impairment if we are unable to obtain future contracts

and appropriate pricing. Based on the mission manifest (esti-

mated quantities and timing of launch missions for existing and

anticipated contracts) we believe we will recover these costs.

The Delta II and IV programs are reported in the L&OS segment.

Satellites As is the standard for the commercial satellite indus-

try, contracts are fixed-price in nature and include on-orbit

incentive payments. Many of the existing satellite programs

have very complex designs including unique phased array

antenna designs. As technical or quality issues arise, we have

continued to experience schedule delays and cost impacts. If

the issues continue, they could result in a material charge.

These programs are ongoing, and while we believe the cost

estimates incorporated in the financial statements are appropri-

ate, the technical complexity of the satellites creates financial

risk as additional completion costs may become necessary or

scheduled delivery dates could be missed, which could trigger

termination for default (TFD) provisions or other financially sig-

nificant exposure. We have one commercial satellite program

that could expose us to a TFD notification risk of $137 million.

Management believes a TFD is not likely due to continued per-

formance to contract requirements and continuing contractual

efforts in process. Our satellite programs are reported in either

the Network Systems or L&OS segments.

See discussion of Boeing Satellite Systems International, Inc.

(BSSI)/ICO Global Communications (Operations), Ltd. (ICO) liti-

gation in note 24.

On September 10, 2004, a group of insurance underwriters for

Thuraya Satellite Telecommunications (Thuraya) requested arbi-

tration before the International Chamber of Commerce (ICC),

against BSSI. The Request for Arbitration alleges that BSSI

breached its contract with Thuraya for sale of a 702 Satellite

which experienced anomalies with its concentrator solar arrays.

The claimants seek approximately $199 million (plus claims of

interest, costs and fees) consisting of insurance payments

made to Thuraya and further reserved the right to seek an

additional $39 million currently in dispute between Thuraya and

certain of its insurers. Thuraya has reserved its rights to seek

uninsured losses that could increase the total amount disputed

to $365 million. We believe that these claims lack merit and

intend to vigorously defend against them.

In certain launch and satellite sales contracts, we include provi-

sions for replacement launch services or hardware if we do not

meet specified performance criteria. We have historically pur-

chased insurance to cover these exposures when allowed

under the terms of the contract. The current insurance market

reflects unusually high premium rates and also suffers from a

lack of capacity to handle all insurance requirements. We make

decisions on the procurement of insurance based on our analy-

sis of risk. There is one contractual launch currently scheduled

for the second quarter of 2006 for which full insurance cover-

age has not been procured. We estimate that the potential

uninsured amount for that launch could range from $65 million

to $315 million, depending on the nature of the uninsured event.

Future Combat Systems On April 5, 2005 the U.S. Army

announced that it plans to convert the Future Combat Systems

(FCS) program from an Other Transaction Agreement (OTA) to

a standard DoD contract. An OTA is contracted under a differ-

ent congressional authority than a standard DoD contract and

generally imposes fewer administrative contractual require-

ments. The current OTA has been modified to incorporate

clauses relating to the Truth in Negotiations Act, Cost

Accounting Standards, and the Procurement Integrity Act. We

signed a Federal Acquisition Regulations-based Undefinitized

Contract Authorization with the Army on September 23 and

definitization is scheduled for March 2006. Based on our

assessment of the possible contractual changes, we do not

believe there will be a significant impact to earnings, cash flow

and/or financial position.

Future Imagery Architecture On September 28, 2005 we

received a partial stop-work order from the National

Reconnaissance Office for the Future Imagery Architecture (FIA)

program, which makes it probable that our scope of work will

be reduced. In the third quarter, revised cost and fee estimates

were included in our financial statements to reflect our assess-

ment of the probable outcome. If the final cost and fee out-

come is materially different than our current assessment, it

could impact our financial performance. The revenue loss was

immaterial in 2005. This program is included in the Network

Systems segment.

767 Tanker Program Prior to the fourth quarter of 2004, we

incurred substantial pre-contract costs for development of one

in-production aircraft for the 767 Tanker program. These costs

were being deferred based on our assessment that it was

probable we would recover these costs when we were

awarded the USAF 767 Tanker contract. The pre-contract

costs were being deferred and recorded in inventory based on

AICPA Statement of Position 81-1, Accounting for Performance

of Construction-Type and Certain Production-Type Contracts,

which states that costs may be deferred if they can be associ-

ated with a specific anticipated contract, and if their recover-

ability from that contract is probable. Our assessment of

probability was based on the fact that the DoD Appropriations

Act for fiscal year 2005 provided $100 million funding for tanker

replacement and the National Defense Authorization Act for

fiscal year 2005 provided authorization for the procurement of

100 tanker aircraft and associated support contracts. In

addition, we believed, based on our understanding of the

The Boeing Company and Subsidiaries 33