Boeing 2005 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Our sales agreement for the sale of our Commercial Airplanes

facilities in Wichita, Kansas and Tulsa and McAlester, Oklahoma

to Spirit provides indemnification to Spirit for certain environ-

mental contamination that existed on or prior to June 16, 2005,

which was the closing date of the sale. Per the agreement,

notice must be given by Spirit of this contamination within

seven and a half years from the closing date. As it is impossible

to assess whether there will be any additional environmental lia-

bilities in the future or the amounts thereof, we cannot estimate

the maximum potential amount of future payments under this

guarantee. Therefore, no liability has been recorded. (See Note

24.)

Product warranties

We provide product warranties in conjunction with certain

product sales. The majority of our warranties are issued by our

Commercial Airplanes segment. Generally, aircraft sales are

accompanied by a three- to four-year standard warranty for

systems, accessories, equipment, parts and software manufac-

tured by us or manufactured to certain standards under our

authorization. Additionally, on occasion we have made commit-

ments beyond the standard warranty obligation to correct fleet

wide major warranty issues of a particular model. These costs

are included in the program’s estimate at completion (EAC) and

expensed as aircraft are delivered. These warranties cover fac-

tors such as non-conformance to specifications and defects in

material and design. Warranties issued by our IDS segments

principally relate to sales of military aircraft and weapons hard-

ware. These sales are generally accompanied by a six to

twelve-month warranty period and cover systems, accessories,

equipment, parts and software manufactured by us to certain

contractual specifications. These warranties cover factors such

as non-conformance to specifications and defects in material

and workmanship.

Estimated costs related to standard warranties are recorded in

the period in which the related product sales occur. The war-

ranty liability recorded at each balance sheet date reflects the

estimated number of months of warranty coverage outstanding

for products delivered times the average of historical monthly

warranty payments, as well as additional amounts for certain

major warranty issues that exceed a normal claims level. The

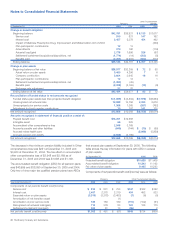

following table summarizes product warranty activity recorded

during 2005 and 2004.

Product Warranty Liabilities*

Beginning balance-January 1, 2004 $825

Additions for new warranties 114

Reductions for payments made (252)

Changes in estimates 94

Ending balance–December 31, 2004 781

Additions for new warranties 119

Reductions for payments made (146)

Changes in estimates 27

Ending balance–December 31, 2005 $781

*Amounts included in Accounts payable and other liabilities

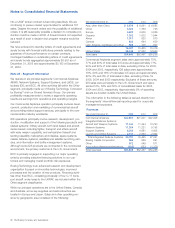

Material variable interests in unconsolidated entities

Our investments in an ETC, EETCs and other Variable Interest

Entities (VIEs) are included within the scope of Revised

Interpretation No. 46 (FIN 46(R)), Consolidation of Variable

Interest Entities. All entities that were required to be consoli-

dated under FIN 46(R) had been previously consolidated and

therefore, the adoption of FIN 46(R) had no impact on our con-

solidated financial statements.

We have investments in an ETC and EETCs, which were

acquired between 1999 through 2005. ETCs and EETCs are

trusts that passively hold investments in aircraft or pools of air-

craft. The ETC and EETCs provide investors with collateral

position in the related asset. The ETC provides investors with

rights to cash flows from a financial instrument. EETCs pro-

vides investors with tranched rights to cash flows from financial

instruments. Our investments in an ETC and EETCs do not

require consolidation under FIN 46(R). At December 31, 2005,

our maximum exposure to economic loss from the ETC and

EETCs is limited to our investment balance of $269.

Accounting losses from our investments in the ETC and

EETCs, if any, could differ from period to period. At December

31, 2005, the ETC and EETC transactions we participated in

had total assets of $3,985 and total debt (which is non-

recourse to us) of $3,716. During the year ended December

31, 2005, we recorded revenues of $36 and cash flows of $65.

From 1998 through 2005, we provided subordinated loans to

certain VIEs that are financial structures commonly utilized by

airlines, lenders and loan guarantors, including, for example,

the Export-Import Bank of the United States. These VIEs are

included in the scope of FIN 46(R); however, only certain VIEs

require consolidation. VIE arrangements are utilized to isolate

individual transactions for legal liability or tax purposes, or to

perfect security interests or for other structuring reasons. We

believe that our maximum exposure to economic loss from

these non-consolidated VIEs is $12, which represents our

investment balance. At December 31, 2005, VIEs of which we

were not the beneficiary, other than the ETC and EETCs noted

above, had total assets of $161 and total debt (which is non-

recourse to us) of $150. During 2005, we recorded revenues of

$1 and cash flows of $6 related to these VIEs.

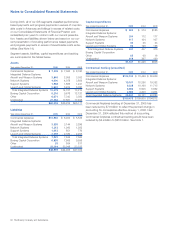

Industrial Revenue Bonds

We utilize Industrial Revenue Bonds (IRBs) issued by the City of

Wichita to finance the purchase and/or construction of real and

personal property at our Wichita site. Tax benefits associated

with IRBs include a provision for a ten-year property tax abate-

ment and a sales tax exemption from the Kansas Department

of Revenue. We record the property on our Consolidated

Statements of Financial Position, along with a capital lease obli-

gation to repay the proceeds of the IRB. We have also pur-

chased the IRBs and therefore are the Bondholder as well as

the Borrower/Lessee of the property purchased with the IRB

proceeds.

76 The Boeing Company and Subsidiaries