Boeing 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

at September 30, 2005 and 2004.

Debt includes domestic and international debt securities, such

as U.S. Treasury securities, U.S. Government agency securi-

ties, corporate bonds and commercial paper; cash equivalents;

investments in bond derivatives such as bond futures, options,

swaps and currency forwards; and redeemable preferred stock

and convertible debt. Bond derivatives based on net notional

amounts totaled 3.9% and 4.6% of plan assets at September

30, 2005 and 2004.

Most of the trusts’ investment managers, who invest in debt

securities, invest in “To-Be-Announced” mortgage-backed

securities (TBA). A TBA represents a contract to buy or sell

mortgage-backed securities to be delivered at a future agreed

upon date. TBAs are deemed economically equivalent to pur-

chasing mortgage-backed securities outright, but are often

more attractively priced in comparison to traditional mortgage-

backed securities. If the investment manager wishes to main-

tain a certain level of investment in TBA securities, the manager

will sell them prior to settlement and buy new TBAs for another

future settlement; this approach is termed “rolling”. Most of the

TBA securities held were related to TBA roll strategies. Debt

included $1,464 and $1,632 related to TBA securities at

September 30, 2005 and 2004.

Real estate includes investments in private real estate invest-

ments. The Other category includes private equity investments

and hedge funds. Actual investment allocations vary from tar-

get allocations due to periodic investment strategy changes

and due to the nature of some asset classes such as real

estate and private equity where it could take a period of a few

years to reach the targets. Additionally, actual and target allo-

cations vary due to the timing of benefit payments or contribu-

tions made on or near the measurement date, September 30.

We held $82 and $72 in trust fund assets for OPB plans at

September 30, 2005 and 2004. Most of these funds are

invested in a balanced index fund which is comprised of

approximately 60% equities and 40% debt securities. The

expected rate of return on these assets does not have a mate-

rial effect on the net periodic benefit cost.

Cash Flows

Contributions Required pension contributions under Employee

Retirement Income Security Act (ERISA) regulations are not

expected to be material in 2006. However, we plan to make a

discretionary contribution to our plans of $500 (pre-tax) in the

first quarter of 2006. We will evaluate additional contributions

later in the year. We expect to contribute approximately $25 to

our OPB plans in 2006.

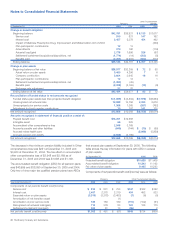

Estimated Future Benefit Payments The table below reflects the

total pension benefits expected to be paid from the plans or

from our assets, including both our share of the benefit cost

and the participants’ share of the cost, which is funded by par-

ticipant contributions. OPB payments reflect our portion only.

Other

Postretirement

Pensions Benefits

2006 $2,372 $3,529

2007 2,436 563

2008 2,495 586

2009 2,551 610

2010 2,614 636

2011-2015 14,527 3,423

Termination Provisions

Certain of the pension plans provide that, in the event there is a

change in control of the Company which is not approved by

the Board of Directors and the plans are terminated within five

years thereafter, the assets in the plan first will be used to pro-

vide the level of retirement benefits required by ERISA, and

then any surplus will be used to fund a trust to continue pres-

ent and future payments under the postretirement medical and

life insurance benefits in our group insurance benefit programs.

We have an agreement with the U.S. Government with respect

to certain pension plans. Under the agreement, should we ter-

minate any of the plans under conditions in which the plan’s

assets exceed that plan’s obligations, the U.S. Government will

be entitled to a fair allocation of any of the plan’s assets based

on plan contributions that were reimbursed under U.S.

Government contracts.

401(k)

We provide certain defined contribution plans to all eligible

employees. The principal plans are the Company-sponsored

401(k) plans and an unfunded plan for unused sick leave. The

expense for these defined contribution plans was $483, $468

and $464 in 2005, 2004 and 2003, respectively.

Note 18 - Share-Based Compensation and Deferred

Stock Compensation

On April 28, 2003, the shareholders approved The Boeing

Company 2003 Incentive Stock Plan (2003 Plan). The 2003

Plan permits awards of incentive stock options, nonqualified

stock options, restricted stock, stock units, Performance

Shares, performance units and other incentives to our employ-

ees, officers, consultants and independent contractors. The

aggregate number of shares of our stock available for issuance

under the 2003 Plan will not exceed 30,000,000. Under the

terms of the 2003 Plan, no more than an aggregate of

6,000,000 shares are available for issuance as restricted stock

awards.

Our 1997 Incentive Stock Plan (1997 Plan) permits the grant of

stock options, stock appreciation rights (SARs) and restricted

stock awards (denominated in stock or stock units) to employ-

ees and contract employees. Under the terms of the plan,

64,000,000 shares are authorized for issuance upon exercise

of options, as payment of SARs and as restricted stock

awards, of which no more than an aggregate of 6,000,000

70 The Boeing Company and Subsidiaries