Boeing 2005 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

We also have a similar arrangement in place with the

Development Authority of Fulton County, Georgia where we are

both borrower and bondholder. Tax benefits associated with

these IRBs are the provision of a ten-year partial property tax

abatement.

The capital lease obligation and IRB asset are recorded net in

the Consolidated Statements of Financial Position pursuant to

FIN 39, Offsetting of Amounts Related to Certain Contracts. As

of December 31, 2005 and 2004, the assets and liabilities

associated with the City of Wichita IRBs were $1,416 and

$2,852, and the amounts associated with the Fulton County

IRBs were $17 and $19.

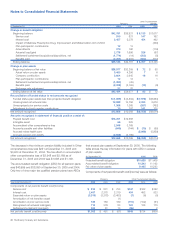

Other commitments

As of December 31, 2005 and 2004 we had $58,532 and

$44,676 of production related purchase obligations not

recorded on the Consolidated Statement of Financial Position.

Such obligations include agreements for production goods,

tooling costs, electricity and natural gas contracts, property,

plant and equipment, inventory procurement contracts, and

other miscellaneous production related obligations. As of

December 31, 2005, the amounts of production related pur-

chase obligations for each of the next five years were as fol-

lows: $24,599 in 2006, $14,826 in 2007, $7,234 in 2008,

$5,429 in 2009, and $3,740 in 2010.

Financing commitments related to aircraft on order, including

options, scheduled for delivery through 2012 totaled $13,496

and $6,661 as of December 31, 2005 and 2004. We anticipate

that not all of these commitments will be utilized and that we

will be able to arrange for third-party investors to assume a

portion of the remaining commitments, if necessary.

As of December 31, 2005 and 2004, future lease commitments

on aircraft and other commitments not recorded on the

Consolidated Statements of Financial Position totaled $371

and $483. These lease commitments extend through 2020,

and our intent is to recover these lease commitments through

sublease arrangements. As of December 31, 2005 and 2004,

Accounts payable and other liabilities included $76 and $89

attributable to adverse commitments under these lease

arrangements.

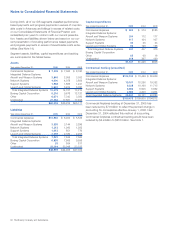

In conjunction with signing a definitive agreement for the sale of

new aircraft (Sale Aircraft), we have entered into specified-price

trade-in commitments with certain customers that give them

the right to trade in their used aircraft for the purchase of Sale

Aircraft. The total contractual trade-in value was $1,395 and

$1,167 as of December 31, 2005 and 2004. Based on the

best market information available at the time, it was probable

that we would be obligated to perform on trade-in commit-

ments with net amounts payable to customers totaling $72 and

$116 as of December 31, 2005 and 2004. The estimated fair

value of trade-in aircraft related to probable contractual trade-in

commitments was $50 and $91 as of December 31, 2005 and

2004. Probable losses of $22 and $25 have been charged to

Cost of products and were included in Accounts payable and

other liabilities as of December 31, 2005 and 2004.

On March 31, 2005, we executed a Purchase and Sale

Agreement to sell certain investments in technology related

funds and partnerships of $63 with related capital commitment

obligations of $76. During 2005, we have closed the sale on

investments of $50 reducing the remaining commitment obliga-

tions for those being sold to $13. (See Note 12 for details of

the sale.)

McDonnell Douglas Corporation insured its executives with

Company Owned Life Insurance (COLI), which are life insur-

ance policies with a cash surrender value. Although we do not

use COLI currently, these obligations from the merger with

McDonnell Douglas Corporation are still a commitment at this

time. We have loans in place to cover costs paid or incurred to

carry the underlying life insurance policies. During the third

quarter of 2005, we terminated 4 out of 5 outstanding COLI

policies. The termination had no material impact on the

Consolidated Statements of Operations in 2005. As of

December 31, 2005 and 2004, the cash surrender value was

$259 and $1,468 and the total loans were $252 and $1,356.

As we have the right to offset the loans against the cash sur-

render value of the policies, we present the net asset in Other

assets on the Consolidated Statements of Financial Position as

of December 31, 2005 and 2004.

Commitments for the future purchase of capital assets unpaid

at year end were $1,132 and $959 for the years ended

December 31, 2005 and 2004. The majority of these commit-

ments relate to the development of the Large Cargo Freighter,

787 buildup, and the purchase of computing servers.

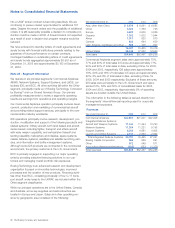

Note 22 - Significant Group Concentrations of Risk

Credit risk

Financial instruments involving potential credit risk are predomi-

nantly with commercial aircraft customers and the U.S.

Government. Of the $15,252 in Accounts receivable and

Customer financing included in the Consolidated Statements of

Financial Position as of December 31, 2005, $9,711 related to

commercial aircraft customers ($221 of Accounts receivable

and $9,490 of Customer financing) and $2,797 related to the

U.S. Government. Of the $9,490 of aircraft customer financing,

$8,917 related to customers we believe have less than invest-

ment-grade credit. AirTran Airways, United, and AMR

Corporation were associated with 18%, 11% and 12%,

respectively, of our aircraft financing portfolio. Financing for air-

craft is collateralized by security in the related asset, and histor-

ically we have not experienced a problem in accessing such

collateral.

As of December 31, 2005, off-balance sheet financial instru-

ments described in Note 21 predominantly related to commer-

cial aircraft customers. $12,045 of financing commitments

related to aircraft on order including options related to cus-

tomers we believe have less than investment-grade credit.

The Boeing Company and Subsidiaries 77