Boeing 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

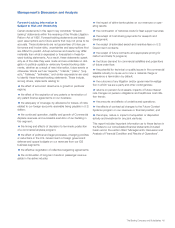

Management’s Discussion and Analysis

St Louis and several other smaller facilities. Along with

increased funding to support these areas of architecture and

network-centric capabilities development, we also maintained

our investment levels in Global Missile Defense and advanced

missile defense concepts and technologies.

Backlog Network Systems total backlog decreased 5% from

2004 to 2005 primarily due to sales in 2005 from large multi-

year orders received in prior years on FCS, GMD, and MMA,

partially offset by orders for Proprietary programs.

Total backlog increased 5% from 2003 to 2004 primarily due to

additional orders for FCS and the initial MMA award in 2004.

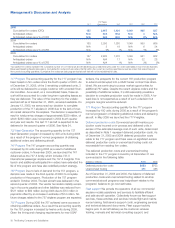

Support Systems

(Dollars in millions) 2005 2004 2003

Revenues $5,342 $4,881 $4,408

% of Total Company Revenues 10% 9% 9%

Operating Earnings $«««765 $«««662 $«««455

Operating Margins 14.3% 13.6% 10.3%

Research and Development $«««««80 $«««««57 $«««««59

Contractual Backlog $8,366 $6,505 $5,882

Unobligated Backlog $1,185 $1,573 $1,297

Revenues Support Systems revenues grew 9% from 2004 to

2005 due to increased volume in Integrated Support programs

such as C-17, F-15 Korea, AC-130, and CV-22, partially offset

by lower volume in Maintenance, Modification & Upgrade

(MM&U) programs like KC-135.

Revenues grew 11% from 2003 to 2004 due to increased vol-

ume in Supply Chain Services programs such as Apache

spares, Integrated Support programs like C-17, and Training &

Support Systems programs such as Fixed Wing and

Rotorcraft.

Operating Earnings Support Systems operating earnings grew

16% from 2004 to 2005 partly reflecting the revenue increase

mentioned above, partly due to continued performance

improvements in 2005 in Training & Support Systems, MM&U,

and Supply Chain Services programs and partly due to a 767

Tanker $18 million pre-tax write-off of pre-contract costs in

2004 due to a slip in the award of the USAF contract.

Earnings grew 45% from 2003 to 2004 primarily due to the sig-

nificant performance improvements from contract close-out

activities and lean initiatives in 2004 as well as the increased

revenue mentioned above, partially offset by the 2004 pre-tax

charge on the 767 Tanker program mentioned above.

Research and Development Support Systems continues to

focus investment strategies on its core businesses including

Engineering and Logistic Services, MM&U, Supply Chain

Services, Training and Support Systems, and Advanced

Logistics Services, as well as on moving into the innovative

Network Centric Logistics (NCL) areas. Investments have been

made to continue the development and implementation of

innovative and disciplined tools, processes and systems as

market discriminators in the delivery of integrated customer

solutions. Examples of successful programs stemming from

these investment strategies include the C-17 Globemaster

Sustainment partnership, the F/A-18 Integrated Readiness

Support Teaming (FIRST) program, and the F-15 Singapore

Performance Based Logistics contract.

Backlog Support Systems total backlog increased 18% from

2004 to 2005 primarily due to orders in Supply Chain Services

and Engineering and Logistics Services, partially offset by sales

throughout the segment.

Total backlog increased 13% from 2003 to 2004 primarily due

to orders in Life Cycle Customer Support programs, partially

offset by sales throughout the segment.

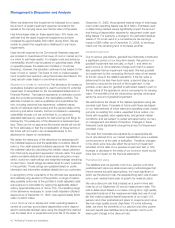

Launch & Orbital Systems

(Dollars in millions) 2005 2004 2003

Revenues $2,741 $«2,969 $«2,992

% of Total Company Revenues 5% 6% 6%

Operating Earnings $«««780 $«««(342) $(1,754)

Operating Margins 28.5% ÷(11.5)«% «« (58.6) %««

Research and Development $«««116 $««««161 $««««232

Contractual Backlog $2,586 $«4,200 $«3,934

Unobligated Backlog $2,252 $«2,403 $«2,184

Revenues L&OS revenues decreased 8% from 2004 to 2005

primarily due to launch slips caused by the strike by the IAM

and the Rocketdyne divestiture in 2005 and a favorable TFC

settlement on a commercial satellite program in 2004. This was

partially offset by higher contract values for Delta IV launch

contracts in 2005.

Revenues remained stable from 2003 to 2004 primarily due to

the favorable TFC settlement in 2004 mentioned above offset

by lower satellite and launch deliveries and milestone comple-

tions in 2004 compared to 2003.

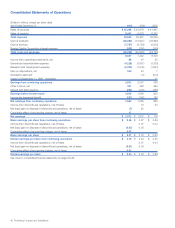

Deliveries of production units were as follows:

2005 2004 2003

Delta II 2 4 4

Delta IV 2

Commercial/Civil Satellites 3 2 3

Operating Earnings The L&OS operating earnings improvement

from 2004 to 2005 was driven by the net gains on the sale of

Rocketdyne $578 million, ($9 million of which was recognized

at the Other segment) and EDD ($25 million), gain from the sale

of a parcel of land at our Seal Beach, California facility, and

higher contract values for Delta IV launch contracts in 2005.

The operating losses recorded in 2004 were caused by per-

formance issues in the satellite business due to cost growth

from technical and quality issues and write-offs of slow moving

satellite inventory and also by cost growth on our Delta IV pro-

gram, partially offset by the favorable TFC settlement men-

tioned above.

The earnings improvement from 2003 to 2004 was primarily

driven by two significant events in 2003. First, a goodwill

impairment charge of $572 million was recorded in the first

quarter of 2003 as a result of an internal reorganization

whereby the SFAS No. 142 reportable segments, operating

segments, and reporting unit designations changed, causing

significantly different relationships between reporting unit carry-

ing values and fair values. Specifically, the new L&OS reporting

36 The Boeing Company and Subsidiaries