Boeing 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis

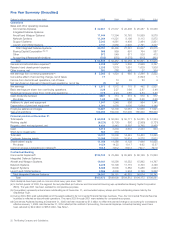

717

737 Next-

Generation 747 757 767 777

2005

Cumulative firm orders (CFO) 155 2,957 1,424 1,049 965 827

Anticipated orders N/A N/A N/A N/A 3 N/A

Anticipated orders as a % of CFO N/A N/A N/A N/A 0% N/A

2004

Cumulative firm orders 155 2,393 1,380 1,049 950 666

Anticipated orders N/A 5 19 N/A 6 34

Anticipated orders as a % of CFO N/A 0% 1% N/A 1% 5%

2003

Cumulative firm orders 147

Anticipated orders N/A

Anticipated orders as a % of CFO N/A

2,220 1,370 1,049 941 622

N/A 17 N/A 32 28

N/A 1% N/A 3% 5%

*Cumulative firm orders represent the cumulative number of commercial jet aircraft deliveries plus undelivered units under firm order (see tables in Commercial Airplanes

Revenues/Operating Results discussion). Cumulative firm orders include orders that fall within the current accounting quantities as well as orders that extend beyond

the current accounting quantities. Cumulative firm orders exclude program test aircraft that will not be refurbished for sale.

717 Program The accounting quantity for the 717 program has

been based on firm orders since the fourth quarter of 2001. As

of December 31, 2005, of the 5 remaining undelivered units, 3

units will be delivered to a single customer with uncertain finan-

cial condition. As a result, on a consolidated basis, these air-

craft will be accounted for under long-term operating leases as

they are delivered. The value of the inventory for the undeliv-

ered aircraft as of December 31, 2005, remained realizable. On

January 12, 2005, we announced our decision to complete

production of the 717 airplane in 2006 due to the lack of over-

all market demand for the airplane. The decision is expected to

result in total pre-tax charges of approximately $380 million, of

which $280 million was incorporated in 2004 fourth quarter

and year end results. The last 717 aircraft is expected to be

delivered in the second quarter of 2006. See Note 24.

737 Next-Generation The accounting quantity for the 737

Next-Generation program increased by 400 units during 2005

as a result of the programs’ normal progression of obtaining

additional orders and delivering aircraft.

747 Program The 747 program accounting quantity was

increased by 24 units during 2005 as a result of additional

customer orders. In November 2005, we launched the 747

Advanced as the 747-8 family, which includes 747-8

International passenger airplane and the 747-8 Freighter. This

launch and additional anticipated firm orders have extended the

life of this program and have also solidified product strategy.

757 Program Due to lack of demand for the 757 program, a

decision was made in the third quarter of 2003 to complete

production of the program. Production of the 757 program

ended in October 2004. The last aircraft was delivered in the

second quarter of 2005. The vendor termination liability remain-

ing in Accounts payable and other liabilities was reduced from

$121 million to $62 million during 2005 due to $73 million in

payments offset by an increase in estimate of $14 million. No

future charges related to the 757 airplane program are expected.

767 Program During 2005 the 767 achieved some success in

obtaining additional orders. As a result the accounting quantity

for the 767 program increased by twelve units during 2005.

Given the timing and changing requirements for new USAF

tankers, the prospects for the current 767 production program

to extend uninterrupted into a USAF tanker contract has dimin-

ished. We are continuing to pursue market opportunities for

additional 767 sales. Despite the recent airplane orders and the

possibility of additional orders, it is still reasonably possible a

decision to complete production could be made in 2006. A for-

ward loss is not expected as a result of such a decision but

program margins would be reduced.

777 Program The accounting quantity for the 777 program

increased by 100 units during 2005 as a result of the program’s

normal progression of obtaining additional orders and delivering

aircraft. In May 2005 we launched the 777-Freighter.

Deferred production costs Commercial aircraft inventory pro-

duction costs incurred on in-process and delivered units in

excess of the estimated average cost of such units, determined

as described in Note 1 represent deferred production costs. As

of December 31, 2005 and 2004 deferred production costs

relate to the 777 program and there were no significant excess

deferred production costs or unamortized tooling costs not

recoverable from existing firm orders.

The deferred production costs and unamortized tooling

included in the 777 program’s inventory at December 31 are

summarized in the following table:

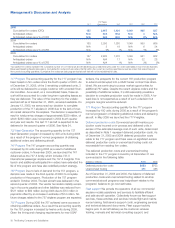

(Dollars in millions) 2005 2004

Deferred production costs $683 $703

Unamortized tooling 411 485

As of December 31, 2005 and 2004, the balance of deferred

production costs and unamortized tooling related to all other

commercial aircraft programs was insignificant relative to the

programs’ balance-to-go cost estimates.

Fleet support We provide the operators of all our commercial

airplane models assistance and services to facilitate efficient

and safe aircraft operation. Collectively known as fleet support

services, these activities and services include flight and mainte-

nance training, field service support costs, engineering services

and technical data and documents. Fleet support activity

begins prior to aircraft delivery as the customer receives

training, manuals and technical consulting support, and

30 The Boeing Company and Subsidiaries