Boeing 2005 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

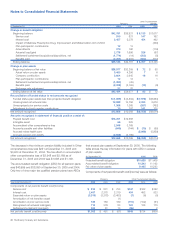

Deferred Stock Compensation

We had issued 12,913,910 and 10,343,380 stock units as of

December 31, 2005 and 2004 that are convertible to either

stock or a cash equivalent, of which 12,401,316 and

9,549,837 are vested as of December 31, 2005 and 2004, and

the remainder generally vest with employee service through

retirement. These stock units which principally represent a

method of deferring employee compensation are stated at mar-

ket value and re-measured at each balance sheet date. Market

value adjustments are recorded within General and administra-

tive expense and stated as liabilities based upon the current

stock price. Total expense related to deferred stock compensa-

tion was $265, $72, and $68 in 2005, 2004, and 2003,

respectively. Additionally, for employees who elect to defer their

compensation in stock units, the Company will match 25% of

the deferral in additional stock units. Upon retirement, the 25%

match may be settled in cash or stock; however, effective

January 1, 2006 all matching contributions will be settled in

stock. As a result, we reclassified $102 from Other liabilities to

Additional paid-in capital at December 31, 2005 related to the

25% matching contribution. This modification resulted in no

incremental compensation.

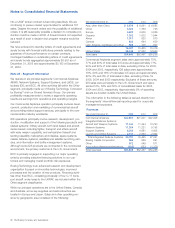

Note 19 - Shareholders’ Equity

In December 2000, a stock repurchase program was author-

ized by our Board of Directors, authorizing the repurchase of

up to 85 million shares of our stock. In June 2005, repurchase

of an additional 40 million shares was authorized. We repur-

chased 45,217,300 and 14,708,856 shares during the years

ended December 31, 2005 and 2004. We did not repurchase

any shares during the year ended December 31, 2003. At

December 31, 2005 24.3 million shares may still be purchased

under the program.

20 million shares of authorized preferred stock remain unissued.

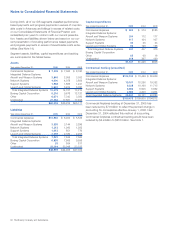

Note 20 - Derivative Financial Instruments

Derivative and hedging activities

We are exposed to a variety of market risks, including the

effects of changes in interest rates, foreign currency exchange

rates and commodity prices. These exposures are managed, in

part, with the use of derivatives. The following is a summary of

our uses of derivatives and the effects of these uses on the

consolidated financial statements.

Cash flow hedges

Our cash flow hedges include certain interest rate swaps, cross

currency swaps, foreign currency forward contracts, foreign

currency option contracts and commodity purchase contracts.

Interest rate swap contracts under which we agree to pay fixed

rates of interest are designated as cash flow hedges of vari-

able-rate debt obligations. We use foreign currency forward

contracts to manage currency risk associated with certain fore-

casted transactions, specifically sales and purchase commit-

ments made in foreign currencies. Our foreign currency forward

contracts hedge forecasted transactions principally occurring

up to five years in the future. We use commodity derivatives,

such as fixed-price purchase commitments, to hedge against

potentially unfavorable price changes for items used in produc-

tion. These include commitments to purchase electricity at

fixed prices through December 2007. The changes in fair value

of the percentage of the commodity derivatives that are not

designated in a hedging relationship are recorded in earnings

immediately. There were no significant changes in fair value

reported in earnings for the years ended December 31, 2005,

2004 and 2003.

At December 31, 2005 and 2004, net gains of $32 and $35

(net of tax) were recorded in Accumulated other comprehensive

loss associated with our cash flow hedging transactions.

Ineffectiveness for cash flow hedges was insignificant for the

years ended December 31, 2005, 2004 and 2003. For the

years ended December 31, 2005, 2004 and 2003,

gains/(losses) of $3, ($16), and ($20), respectively, (net of tax)

were reclassified to cost of products and services. Based on

our current portfolio of cash flow hedges, we expect to reclas-

sify to cost of products and services a gain of $23 (net of tax)

during the next year.

Fair value hedges

Interest rate swaps under which we agree to pay variable rates

of interest are designated as fair value hedges of fixed-rate

debt. The net change in fair value of the derivatives and the

hedged items is reported in earnings. Ineffectiveness related to

the interest rate swaps was insignificant for the years ended

December 31, 2005, 2004 and 2003.

For the years ended December 31, 2005, 2004 and 2003,

$12, $24, and $13 of gains related to the basis adjustment of

certain terminated interest rate swaps and forward-starting

interest rate swaps were amortized to earnings.

Derivative financial instruments not receiving hedge

accounting treatment

We also hold certain non-hedging instruments, such as interest

exchange agreements, interest rate swaps, warrants, and for-

eign currency forward contracts. The changes in fair value of

these instruments are recorded in earnings. For the years

ended December 31, 2005, 2004 and 2003, these non-hedg-

ing instruments resulted in gains of $11, $19, and $38, respec-

tively.

We held forward-starting interest rate swap agreements to fix

the cost of funding a firmly committed lease for which payment

terms are determined in advance of funding. During the year

ended December 31, 2003, the forward starting interest rate

swaps no longer qualified for fair value hedge accounting treat-

ment. As a result, we recognized a pre-tax charge of $21. For

the year ended December 31, 2003, ineffectiveness loss of $1

was recorded in BCC interest expense related to the forward-

starting interest rate swaps.

74 The Boeing Company and Subsidiaries