Boeing 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

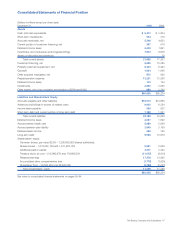

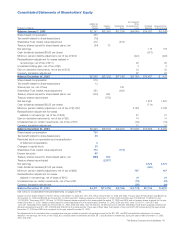

Consolidated Statements of Shareholders’ Equity

Accumulated

Additional Other

(Dollars in millions)

Paid-In

Capital

Treasury

Stock

ShareValue

Trust

Comprehensive

Loss

Retained

Earnings

Comprehensive

Income / (Loss)

Balance January 1, 2003 $2,141 $(8,397) $(1,324) $(4,045) $14,262 $(3,068)

Share-based compensation 456

Tax benefit related to share-based plans (79)

ShareValue Trust market value adjustment 416 (416)

Treasury shares issued for share-based plans, net (54) 75

Net earnings 718 718

Cash dividends declared ($0.68 per share) (573)

Minimum pension liability adjustment, net of tax of $132 (222) (222)

Reclassification adjustment for losses realized in

net earnings, net of tax of $(11) 20 20

Unrealized holding gain, net of tax of $(1) 3 3

Gain on derivative instruments, net of tax of $(18) 32 32

Currency translation adjustment 67 67

Balance December 31, 2003 $2,880 $(8,322) $(1,740) $(4,145) $14,407 $ 618

Share-based compensation 576

Tax benefit related to share-based plans 13

Shares paid out, net of fees 143

ShareValue Trust market value adjustment 283 (426)

Treasury shares issued for share-based plans, net (332) 264

Treasury shares repurchased (752)

Net earnings 1,872 1,872

Cash dividends declared ($0.85 per share) (714)

Minimum pension liability adjustment, net of tax of $(1,257) 2,188 2,188

Reclassification adjustment for losses

realized in net earnings, net of tax of $(12) 21 21

Gain on derivative instruments, net of tax of $(8) 14 14

Unrealized loss on certain investments, net of tax of $18 (34) (34)

Currency translation adjustment 31 31

Balance December 31, 2004 $3,420 $(8,810) $(2,023) $(1,925) $15,565 $ 4,092

Share-based compensation 720

Tax benefit related to share-based plans 35

Restricted stock compensation and reclassification

of deferred compensation 3

Changes in capital stock 23

ShareValue Trust market value adjustment 773 (773)

Excess tax pools 63

Treasury shares issued for share-based plans, net (666) 612

Treasury shares repurchased (2,877)

Net earnings 2,572 2,572

Cash dividends declared ($1.05 per share) (861)

Minimum pension liability adjustment, net of tax of $(45) 167 167

Reclassification adjustment for losses

realized in net earnings, net of taxes of $(15) 21 21

Unrealized loss on certain investments, net of tax of $8 (12) (12)

Currency translation adjustment (29) (29)

Balance December 31, 2005 $ 4,371 $(11,075) $ (2,796) $ (1,778) $17,276 $ 6,811

See notes to consolidated financial statements on pages 50–84.

Issued common shares totaled 1,012,261,159 as of December 31, 2005 and 1,011,870,159 as of December 31, 2004 and 2003. The par value of these shares was $5,061 as

of December 31, 2005 and $5,059 as of December 31 2004 and 2003. Treasury shares as of December 31, 2005, 2004 and 2003 were 212,090,978, 179,686,231 and

170,388,053. There were 45,217,300 and 14,708,856 treasury shares acquired for the years ended December 31, 2005 and 2004 and no treasury shares acquired for the year

ended December 31, 2003. Treasury shares issued for share-based plans for the years ended December 31, 2005, 2004 and 2003, were 12,812,111, 5,410,678 and

1,451,897. ShareValue Trust shares as of December 31, 2005, 2004 and 2003, were 39,593,463, 38,982,205 and 41,203,694. ShareValue Trust shares acquired primarily from

dividend reinvestment were 611,257, 645,866 and 829,884 for the same periods. There was a Share Value Trust payout of zero and 2,867,355 shares during the years ended

December 31, 2005 and 2004 and no payout for the year ended December 31, 2003.

No adjustments to Accumulated other comprehensive loss are included in reported net earnings except for the $21, $21, and $20 reclassification adjustment, for losses

realized in net earnings, net of tax, of which $(3), $10, and $20 relate to derivatives and $24, $11, and $0 relate to investments, during the years ended December 31, 2005,

2004, and 2003.

The Boeing Company and Subsidiaries 49