Boeing 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

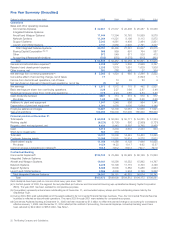

Management’s Discussion and Analysis

The following table shows operating earnings and corporate

items not allocated to our segments:

(Dollars in millilons)

Year ended December 31, 2005 2004 2003

Commercial Airplanes $«1,432 $««««753 $«707

Integrated Defense Systems 3,890 2,925 766

Boeing Capital Corporation 232 183 91

Other segment (334) (535) (379)

Items not allocated to segments (2,408) (1,319) (787)

Earnings from continuing operations $«2,812 $«2,007 $«398

The most significant items not allocated to segments are

shown in the following table:

Year ended December 31, 2005 2004 2003

Pension and post-retirement

(expense)/income $«««(851) $«««(258) $ 206

Share-based plans expense (852) (576) (456)

Deferred compensation expense (265) (72) (68)

Other (440) (413) (469)

Total items not allocated

to segments $(2,408) $(1,319) $(787)

Pension and other post-retirement accounting differences rep-

resent difference between costs recognized under GAAP in the

consolidated financial statements and federal cost accounting

standards required to be utilized by our business segments for

U.S. government contracting purposes. Higher pension and

post-retirement amounts in 2005 are primarily related to higher

amortization of actuarial losses and net settlement and curtail-

ment losses due to 2005 divestitures. The increase in 2004

from 2003 is due to higher GAAP pension expense in 2004

reflecting higher amortization of actuarial losses. The increase

in 2005 share-based plans expense is primarily due to the

increase in our stock price which resulted in additional com-

pensation expense due to an increase in the number of per-

formance shares meeting the price growth targets and being

converted to common stock. The increase in 2005 deferred

compensation plans expense is also due to the increase in our

stock price.

Income Taxes

The 2005 effective income tax rate of 9.1% differed from the

federal statutory tax rate of 35%, primarily due to a settlement

with the Internal Revenue Service (IRS) for the years 1998-

2001, Foreign Sales Corporation (FSC) and Extraterritorial

Income (ETI) tax benefits, reversal of valuation allowances, and

other provision adjustments.

The 2004 effective income tax rate of 7.1% differed from the

federal statutory tax rate of 35%, due to FSC and ETI tax ben-

efits, tax benefits from a settlement with the IRS for the years

1986-1997, tax benefits associated with state tax audit settle-

ments, and other provision adjustments.

For further discussion related to Income Taxes see Note 5.

Net Earnings

Net earnings increased in 2005 compared to 2004 largely due

to higher operating earnings. Interest and debt expense was

lower as we continued to pay down our debt in 2005.

Net earnings increased in 2004 compared to 2003 primarily

due to higher operating earnings which was partially offset by

lower other income and higher income taxes. Additionally,

included in 2004 net earnings is a $42 million net gain on

BCC’s sale of a substantial portion of its Commercial Financial

Services business.

Other income primarily consists of interest income. Other

income included interest of $100 million in 2005, $219 million

in 2004 and $397 million in 2003 related to federal income tax

settlements for prior years. Additionally in 2005, other income

included higher income from marketable securities and an

asset impairment charge for certain investments in technology

related funds and partnerships.

We early adopted the provisions of SFAS No. 123R as of

January 1, 2005 using the modified prospective method. Upon

adoption of SFAS No. 123R, we recorded an increase in net

earnings of $21 million, net of taxes of $12 million, as a cumu-

lative effect of accounting change. For Performance Shares

awarded in 2005, the fair value of each award is estimated

using a Monte Carlo simulation model instead of the grant date

market price used for previous awards. Additionally, we now

amortize compensation cost for share-based awards granted

after January 1, 2005 for retirement eligible employees using

the non-substantive vesting approach instead of amortizing

over the stated vesting period (See Note 18).

Backlog

Contractual backlog of unfilled orders excludes purchase

options, announced orders for which definitive contracts have

not been executed, and unobligated U.S. and foreign govern-

ment contract funding. The increase in contractual backlog

from 2004 to 2005 primarily relates to new orders for the 737,

777, and 787. The increase was partially offset by a decrease

in IDS contractual backlog.

The increase in contractual backlog from 2003 to 2004 related

primarily to new orders for the 777 and 787. The increase was

partially offset by a decrease in IDS contractual backlog.

Unobligated backlog includes U.S. and foreign government

definitive contracts for which funding has not been authorized.

The decrease in unobligated backlog in 2005 is mainly due to

strong sales in C-17 and F-15 programs for multi-year con-

tracts awarded in prior years.

For segment reporting purposes, we include airplanes ordered

by other segments in Commercial Airplanes contractual back-

log. Commercial Airplanes relieves contractual backlog upon

delivery of these airplanes to other segments.

IDS contractual backlog includes modifications to be per-

formed on intracompany airplane purchases from Commercial

Airplanes. IDS contractual backlog is reduced upon delivery to

the customer or at the attainment of performance milestones.

24 The Boeing Company and Subsidiaries