Boeing 2005 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

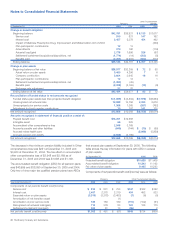

Notes to Consolidated Financial Statements

Settlement and curtailment losses/(gains) are primarily due to

divestitures. See Note 8.

The Medicare Prescription Drug, Improvement and

Modernization Act of 2003 reduced our APBO by $439 as of

September 30, 2004. On January 21, 2005, the Centers for

Medicare and Medicaid Services released final regulations

implementing the Medicare Prescription Drug, Improvement,

and Modernization Act of 2003. The final regulations provide for

greater flexibility in plan structuring and availability of direct fed-

eral subsidy for employer sponsored Medicare Health

Maintenance Organization (HMO) plans than originally antici-

pated, resulting in a reduction to our APBO of $156 at

September 30, 2005. These reductions/actuarial gains are

amortized over the expected average future service of current

employees.

Assumptions

At September 30, 2005 2004 2003 2002

Discount rate: pension and OPB 5.50% 5.75% 6.00% 6.50%

Expected return on plan assets 8.50% 8.50% 8.75% 9.00%

Rate of compensation increase 5.50% 5.50% 5.50% 5.50%

In 2005, we modified our method of determining the discount

rate. The key change in method is that the discount rate for

each individual pension plan will be determined separately

based on the duration of each plan’s liabilities. Prior to 2005 we

determined a single discount rate applicable to all our postre-

tirement benefit plans. The method change was largely attribut-

able to divergence in the characteristics of the populations of

our various plans over the last few years resulting from

changes within the company and between the plans, including

transfers, layoffs and divestitures. The new method continues

to include a matching of the plans’ expected future benefit pay-

ments against a yield curve developed using all high quality,

non-callable bonds in the Bloomberg index as of the measure-

ment date, omitting bonds with the ten percent highest and the

ten percent lowest yields. The disclosed rate is the average

rate for all the plans, weighted by the projected benefit obliga-

tion. As of September 30, 2005, the weighted average was

5.50%, and the rates for individual plans ranged from 5.00% to

6.00%.

The pension fund’s expected return on assets assumption is

derived from an extensive study conducted by our Trust

Investments group and its actuaries on a periodic basis. The

study includes a review of actual historical returns achieved by

the pension trust and anticipated future long-term performance

of individual asset classes with consideration given to the

related investment strategy. While the study gives appropriate

consideration to recent trust performance and historical

returns, the assumption represents a long-term prospective

return. The expected return on plan assets determined on each

measurement date is used to calculate the net periodic benefit

cost/(income) for the upcoming plan year.

At September 30, 2005 2004

Assumed health care cost trend rates

Health care cost trend rate assumed next year 9.00% 9.00%

Ultimate trend rate 5.00% 5.00%

Year that trend reached ultimate rate 2013 2009

Assumed health care cost trend rates have a significant effect

on the amounts reported for the health care plans. To deter-

mine the health care cost trend rates we look at a combination

of information including ongoing claims cost monitoring, annual

statistical analyses of claims data, reconciliation of forecast

claims against actual claims, review of trend assumptions of

other plan sponsors and national health trends, and adjust-

ments for plan design changes, workforce changes, and

changes in plan participant behavior. A one-percentage-point

change in assumed health care cost trend rates would have

the following effect:

1-Percentage 1-Percentage

Point Point

Increase Decrease

Effect on postretirement benefit obligation $712 $(624)

Effect on total of service and interest cost 62 (53)

Plan Assets

Pension assets totaled $43,484 and $38,977 at September 30,

2005 and 2004. Pension assets are allocated with a goal to

achieve diversification between and within various asset

classes. Pension investment managers are retained with a spe-

cific investment role and corresponding investment guidelines.

Investment managers have the ability to purchase securities on

behalf of the pension fund, and several of them have permis-

sion to invest in derivatives, such as equity or bond futures.

Derivatives are sometimes used to achieve the equivalent mar-

ket exposure of owning a security or to rebalance the total

portfolio to the target asset allocation. Derivatives are more

cost-effective investment alternatives when compared to own-

ing the corresponding security. In the instances in which deriva-

tives are used, cash balances must be maintained at a level

equal to the notional exposure of the derivatives.

The actual allocations for the pension assets at September 30,

2005 and 2004, and target allocations by asset category, are

as follows:

Percentage of Plan Assets Target

at September 30, Allocations

Asset Category 2005 2004 2005 2004

Equity 61% 60% 50% 50%

Debt 31 32 31 31

Real estate 3 3 6 6

Other 5 5 13 13

100% 100% 100% 100%

Equity includes domestic and international equity securities,

such as common, preferred or other capital stock, as well as

equity futures, currency forwards and residual cash allocated to

the equity managers. Equity includes our common stock in the

amounts of $1,494 (3.38% of plan assets) and $1,613 (4.19%

of plan assets) at September 30, 2005 and 2004. Equity deriv-

atives based on net notional amounts totaled 2.5% and 3.0%

The Boeing Company and Subsidiaries 69