Boeing 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis

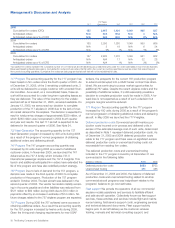

At December 31, 2005 2004

BCC Customer Financing and

Investment Portfolio $9,206 $9,680

% of Total Receivables in Valuation Allowance 2.0% 4.2%

Debt $6,322 $7,024

Debt-to-Equity Ratio 5.0-to-1 5.0-to-1

BCC’s customer financing and investment portfolio at

December 31, 2005 decreased from December 31, 2004 due

to normal portfolio run-off, the impact of restructuring certain

finance leases to operating leases resulting in a $200 million

charge-off to the allowance, the sale of certain portfolio assets,

and prepayments. At December 31, 2005 and 2004, BCC had

$47 million and $37 million of assets that were held for sale or

re-lease, which, as of December 31, 2005, included $36 million

of assets currently under lease. Of the remaining $11 million

and $37 million of assets held for sale or re-lease at December

31, 2005 and 2004, $6 million and $25 million had firm con-

tracts to be placed on lease. Additionally, leases with a carrying

value of approximately $363 million are scheduled to terminate

in the next 12 months. The related aircraft are being remar-

keted, of which $238 million were identified with firm contracts

in place at December 31, 2005, to be sold or placed on lease.

Other Segment

Other segment operating losses were $334 million during 2005

as compared to losses of $535 million during 2004. Major fac-

tors contributing to results for the other segment are described

below.

During 2003 and 2004, we delivered a total of five 767 aircraft

to a joint venture named TRM Aircraft Leasing Co. Ltd. (TRM).

Such arrangement was accounted for as an operating lease

due to additional financing and expense sharing arrangements

with TRM. As a result, as of December 31, 2004, we deferred

lease income of $379 million. During April 2005, we terminated

our ongoing obligations to TRM and also received full payment

from TRM for the financing arrangement and recognized the

remaining deferred lease income of $369 million and repayment

for the financing arrangement of $42 million as revenue and

charged the remaining net asset value to Cost of services. This

transaction resulted in earnings before income taxes of $63

million in our Consolidated Statements of Operations in 2005.

(See Note 15)

In 2005, we recorded provisions for customer financing losses

of $98 million, which consisted of losses of $76 million and

$22 million, due to the decrease in the collateral values of the

717 and 757, respectively. In 2004, such provisions were $82

million due to deteriorated airline credit ratings and depressed

aircraft values. Additionally, charges of $13 million were recog-

nized in 2004 related to the decline in lease rates on certain

aircraft.

In 2005, we sold real property and equipment which resulted in

a pretax gain of $29 million reported in the other segment.

During 2004, we recorded depreciation of $61 million related to

a demolished building and incurred an additional $18 million

pretax loss related to accounting for various real property

transactions.

In 2005, our research and development costs recorded at

Boeing Technology decreased by approximately $32 million pri-

marily due to cost reduction strategies implemented across the

business units during the year.

Critical Accounting Policies and Standards Issued and Not

Yet Implemented

Contract Accounting

Contract accounting involves a judgmental process of estimat-

ing the total sales and costs for each contract, which results in

the development of estimated cost of sales percentages. For

each contract, the amount reported as cost of sales is deter-

mined by applying the estimated cost of sales percentage to

the amount of revenue recognized.

Due to the size, length of time and nature of many of our con-

tracts, the estimation of total sales and costs through comple-

tion is complicated and subject to many variables. Total

contract sales estimates are based on negotiated contract

prices and quantities, modified by our assumptions regarding

contract options, change orders, incentive and award provi-

sions associated with technical performance, and price adjust-

ment clauses (such as inflation or index-based clauses). The

majority of these contracts are with the U.S. Government.

Generally the price is based on estimated cost to produce the

product or service plus profit. The Federal Acquisition

Regulations provide guidance on the types of cost that will be

reimbursed in establishing contract price. Total contract cost

estimates are largely based on negotiated or estimated pur-

chase contract terms, historical performance trends, business

base and other economic projections. Factors that influence

these estimates include inflationary trends, technical and

schedule risk, internal and subcontractor performance trends,

business volume assumptions, asset utilization, and anticipated

labor agreements.

The development of cost of sales percentages involves proce-

dures and personnel in all areas that provide financial or pro-

duction information on the status of contracts. Estimates of

each significant contract’s sales and costs are reviewed and

reassessed quarterly. Any changes in these estimates result in

recognition of cumulative adjustments to the contract profit in

the period in which changes are made.

Due to the significance of judgment in the estimation process

described above, it is likely that materially different cost of sales

amounts could be recorded if we used different assumptions,

or if the underlying circumstances were to change. Changes in

underlying assumptions/estimates, supplier performance, or

circumstances may adversely or positively affect financial per-

formance in future periods.

During all of 2005, IDS’s gross margin performance fell within

the historical range of plus or minus 1.0% change to gross

margin. If the combined gross margin for all contracts in IDS for

all of 2005 had been estimated to be higher or lower by 1.0%,

it would have increased or decreased income for the year by

approximately $308 million.

40 The Boeing Company and Subsidiaries