Boeing 2005 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis

requirements, that our 767 aircraft was the most cost-effective

solution that met those requirements and, therefore, that it was

probable we would be awarded the USAF 767 Tanker contract.

Based on prior DoD contracting practices, we also believed it

was probable that we would be awarded the initial support

contracts.

On January 14, 2005, as a result of our 2004 year-end review,

we updated our assessment of the probability of securing the

USAF 767 Tanker contract and announced our plan to recog-

nize pre-tax charges totaling $275 million in our year-end 2004

financial statements based on the continued delay of the con-

tract award and the likely re-competition of the contract.

Commercial Airplanes share was $195 million and IDS’ share

was $80 million. Within IDS, A&WS and Support Systems were

impacted by the charge. The charge included $47 million of

incurred design and development cost and $33 million for

anticipated supplier penalties.

Through 2005, the 767 Tanker program has orders for eight

767 Tankers, four from the Italian Air Force and four from the

Japan Self Defense Agency. The first aircraft for Italy will be

tendered for acceptance in late 2006 and our first delivery to

Japan will occur in early 2007. Work continues on the

Company Sponsored Research and Development (CSR&D)

effort as we entered the flight test phase of the program in

2005 and expect to complete it in 2006.

The USAF is continuing to pursue a replacement for the KC-

135 tanker. Funding has been included in the DoD

Appropriation Act for both of its fiscal years 2005 and 2006,

and has also been included in the fiscal year 2007 DoD budget

request. The USAF has announced that the replacement for

the KC-135 will be awarded through a competition which will

be held in 2006. We remain firmly committed to the USAF

Tanker program and are ready to support our customer in

whatever decision is made regarding the recapitalization of the

nation’s current aerial refueling fleet.

Comanche On February 23, 2004 the U.S. Government

announced plans to terminate for convenience (TFC) the RAH-

66 Comanche Engineering and Manufacturing Development

contract. The joint venture between us and Sikorsky Aircraft, a

division of United Technologies Corporation, had a 50/50 share

in program work and earnings. On March 19, 2004 the U.S.

Government issued a partial TFC notification. A termination

proposal was submitted to the U.S. Government on February

25, 2005. An updated proposal was submitted in January

2006 to reflect actual costs through 2005. We expect that a

settlement will be reached by the end of the first quarter of

2006. The program represented less than 1% of our 2005 rev-

enues. No material impact on our financial statements is

expected.

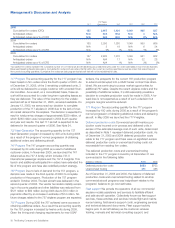

Integrated Defense Systems

(Dollars in millions) 2005 2004 2003

Revenues $30,791 $30,465 $27,361

% of Total Company Revenues 56% 58% 54%

Operating Earnings $««3,890 $««2,925 $«««««766

Operating Margins 12.6% 9.6% 2.8%%

Research and Development $«««««855 $«««««834 $«««««846

Contractual Backlog $36,341 $39,151 $40,883

Unobligated Backlog $43,759 $47,270 $50,564

Since our operating cycle is long-term and involves many differ-

ent types of development and production contracts with vary-

ing delivery and milestone schedules, the operating results of a

particular year, or year-to-year comparisons of revenues and

earnings, may not be indicative of future operating results. In

addition, depending on the customer and their funding

sources, our orders might be structured as annual follow-on

contracts, or as one large multi-year order or long-term

awards. As a result, period-to-period comparisons of orders

and backlog are not necessarily indicative of future workloads.

The following discussions of comparative results among peri-

ods should be viewed in this context.

IDS revenues remained stable in 2005 due to moderating

defense budgets, up 1% from 2004, after strong growth of

11% in 2004 over 2003. The operating earnings increase of

$965 million from 2004 to 2005 was primarily due to higher

L&OS earnings largely driven by the net gain of $578 million ($9

million of which was recognized at the Other segment) from the

Rocketdyne divestiture in 2005.

Total backlog is comprised of contractual backlog, which repre-

sents funded work to perform, and unobligated backlog, which

represents unfunded work to perform. IDS total backlog

decreased 7% in 2005, from $86.4 billion to $80.1 billion, yet

still remains industry-leading. Given our annual revenue of

almost $31 billion, we have 2.6 years worth of sales in backlog,

an important indicator of future workload.

For further details on the changes between periods, refer to the

discussions of the individual segments below.

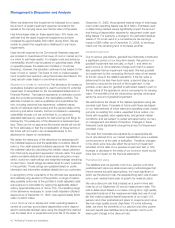

Aircraft and Weapons Systems

(Dollars in millions) 2005 2004 2003

Revenues $11,444 $11,394 $10,763

% of Total Company Revenues 21% 22% 21%

Operating Earnings $««1,707 $««1,636 $««1,420

Operating Margins 14.9% 14.4% 13.2%%%

Research and Development $«««««374 $«««««382 $«««««360

Contractual Backlog $19,161 $18,256 $19,352

Unobligated Backlog $12,006 $17,197 $24,176

Revenues A&WS revenues remained stable between 2004 and

2005 primarily due to increased deliveries on F-15 and Apache

and higher volume on C-40 and F-22. This was offset by

decreased deliveries on F/A-18 and lower volume on Chinook,

V-22, and the Comanche termination.

Revenues grew 6% from 2003 to 2004 due to increased deliv-

eries on F/A-18 and Apache and higher volume on F-22 and

Chinook. This was partially offset by fewer deliveries on T-45

34 The Boeing Company and Subsidiaries