Boeing 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

transaction as operating leases each with a term of seven

years and were recognizing rental income over the term of the

lease. As of December 31, 2004, the present value of the

remaining deferred lease income was $379, discounted at a

rate of 5.0%.

During April 2005, we received full repayment for the financing

arrangement from TRM. Additionally, we signed an agreement

to eliminate any ongoing obligations for TRM’s expenses effec-

tive April 28, 2005. As a result, during the second quarter of

2005, we were able to recognize the remaining deferred lease

income of $369 and repayment for the financing arrangement

of $42 as Revenue and charged the remaining net asset value

to Cost of services. This transaction resulted in earnings before

income taxes of $63 for the year ended December 31, 2005.

During 2001, we delivered four C-17 transport aircraft to the

United Kingdom Royal Air Force (UKRAF), which were

accounted for as operating leases. The lease term is seven

years, at the end of which the UKRAF has the right to purchase

the aircraft for a stipulated value, continue the lease for two

additional years or return the aircraft. Concurrent with the

negotiation of this lease, we, along with UKRAF, arranged to

assign the contractual lease payments to an independent finan-

cial institution. We received proceeds from the financial institu-

tion in consideration of the assignment of the future lease

receivables from the UKRAF. The assignment of lease receiv-

ables is non-recourse to us. The initial proceeds represented

the present value of the assigned total lease receivables dis-

counted at a rate of 6.6%. As of December 31, 2005 and

2004, the balance of $269 and $366 represented the present

value of the remaining deferred lease income.

Note 16 - Debt

We have $3,000 currently available under credit line agree-

ments. BCC is named a subsidiary borrower for up to $1,500

under these arrangements. Total debt interest incurred, includ-

ing amounts capitalized, was $713, $790, and $873 for the

years ended December 31, 2005, 2004 and 2003, respectively.

Interest expense recorded by BCC is reflected as a separate

line item on our Consolidated Statements of Operations, and is

included in earnings from operations. Total company interest

payments were $671, $722, and $775 for the years ended

December 31, 2005, 2004 and 2003, respectively. We continue

to be in full compliance with all covenants contained in our

debt or credit facility agreements, including those at BCC.

On June 6, 2002, BCC established a Euro medium-term note

program in the amount of $1,500. At December 31, 2005 and

2004, BCC had zero debt outstanding under the program such

that $1,500 would normally be available for potential debt

issuance. However, debt issuance under this program requires

that documentation, information and other procedures relating

to BCC and the program be updated within the prior twelve

months. In view of BCC’s cash position and other available

funding sources, BCC determined during 2004 that it was

unlikely they would need to use this program in the foreseeable

future. The program is thus inactive but available with updated

registration statements.

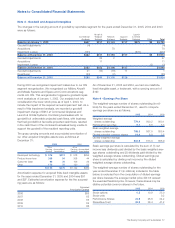

Short-term debt and current portion of long-term debt, con-

sisted of the following:

At December 31, 2005 At December 31, 2004

Consolidated BCC Consolidated BCC

Total Only Total Only

Senior Unsecured Debt Securities $1,015 $570 $1,131 $437

Capital lease obligations 54 45 71 53

Non-recourse debt and notes 39 4 36 4

Retail notes 77 77 62 62

Other notes 4 21

$1,189 $696 $1,321 $556

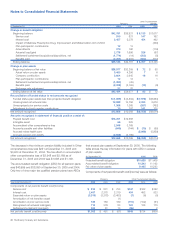

Debt consisted of the following:

December 31, December 31,

2005 2004

Boeing Capital Corporation debt:

Non-recourse debt and notes

3.560%–8.310% notes due through 2013 $ 80 $ 84

Senior debt securities

4.750%–7.380% due through 2013 4,367 4,441

Senior medium-term notes

4.760%–7.640% due through 2023 909 1,345

Capital lease obligations

1.670%–7.000% due through 2015 194 280

Retail notes

3.250%–6.350% due through 2013 772 874

Subtotal Boeing Capital Corporation debt $6,322 $7,024

Other Boeing debt:

Non-recourse debt and notes

Enhanced equipment trust $ 477 $ 509

Unsecured debentures and notes

200, 7.875% due Feb. 15, 2005 200

199, 0.000% due May 31, 2005* 195

300, 6.625% due Jun. 1, 2005 299

250, 6.875% due Nov. 1, 2006 250 250

175, 8.100% due Nov. 15, 2006 175 175

350, 9.750% due Apr. 1, 2012 349 349

600, 5.125% due Feb. 15, 2013 598 597

400, 8.750% due Aug.15, 2021 398 398

300, 7.950% due Aug. 15, 2024

(puttable at holder’s option on

Aug.15, 2012) 300 300

250, 7.250% due Jun. 15, 2025 247 247

250, 8.750% due Sep. 15, 2031 248 248

175, 8.625% due Nov. 15, 2031 173 173

400, 6.125% due Feb. 15, 2033 393 393

300, 6.625% due Feb. 15, 2038 300 300

100, 7.500% due Aug. 15, 2042 100 100

175, 7.875% due Apr. 15, 2043 173 173

125, 6.875% due Oct. 15, 2043 125 125

Senior medium-term notes

7.460% due through 2006 20 20

Capital lease obligations due through 2009 17 36

Other notes 62 89

Subtotal other Boeing debt $ 4,405 $ 5,176

Total debt $10,727 $12,200

*The $199 note due May 31, 2005, was a promissory note to

FlightSafety International for the purchase of its 50% interest in Alteon,

formerly FlightSafety Boeing Training International (FSBTI). The promis-

sory note carried a zero percent interest rate.

66 The Boeing Company and Subsidiaries