Boeing 2005 Annual Report Download - page 25

Download and view the complete annual report

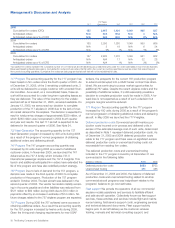

Please find page 25 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis of Financial Condition and Results of Operations

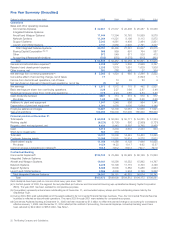

Consolidated Results of Operations

and Financial Condition

Overview

We are a global market leader in design, development, manu-

facturing, sale and support of commercial jetliners, military air-

craft, satellites, missile defense, human space flight and launch

systems and services. We are one of the two major manufac-

turers of 100+ seat airplanes for the worldwide commercial air-

line industry and the second-largest defense contractor in the

U.S. While our principal operations are in the U.S., we rely

extensively on a network of partners, key suppliers and sub-

contractors located around the world.

Our business strategy is centered on successful execution in

healthy core businesses - Commercial Airplanes and Integrated

Defense Systems (IDS) - supplemented and supported by

Boeing Capital Corporation (BCC). Taken together, these core

businesses generate substantial earnings and cash flow that

permit us to invest in new products and services and to open

new frontiers in aerospace. We are focused on producing the

airplanes the market demands and we price our products to

provide a fair return for our shareholders while continuing to

find new ways to improve efficiency and quality. IDS is a

defense systems business that integrates its resources in

defense, intelligence, communications and space to deliver

capability-driven solutions to its customers at reduced costs.

Our strategy is to overlay the strong positions in Commercial

Airplanes and IDS with a simultaneously intense focus on

growth and productivity. Our strategy also benefits as commer-

cial and defense markets often offset each others’ cyclicality.

BCC delivers value through supporting our business units and

reducing our customer financing exposures. Boeing

Technology, our advanced research and development unit, pro-

vides new systems, technologies and processes to position us

for future growth. Connexion by BoeingSM makes an airplane

seem more like the office or home with internet connection

anytime and anywhere.

Our financial results improved significantly in 2005 over 2004.

Revenues grew by 5 percent, operating earnings grew by 40%,

operating margin increased by 1.3 percentage points and fully

diluted earnings per share grew by 39%. We continued to invest

in key growth programs and Research and Development

expense grew by 17% to $2.2 billion, primarily reflecting in-

creased spending on our new 787 aircraft. We generated oper-

ating cash flow of $7.0 billion after contributing $1.9 billion to

our pension plans. We reduced debt by $1.5 billion and repur-

chased more than 45 million shares. Our contractual backlog

grew 46% to $160 billion, driven by 76% growth at Commercial

Airplanes while our total backlog grew 30% to $205 billion.

Our major businesses delivered strong performance in 2005.

Commercial Airplanes grew revenues by 8% to $22.7 billion

while operating earnings increased by 90% to $1.4 billion or

6.3% of revenues compared with operating margins of 3.6% of

revenues in 2004. IDS revenues grew by 1% to a record $30.8

billion, operating earnings increased 33% to $3.9 billion and

operating earnings as a percent of revenues were 12.6% in

2005 up from 9.6% in 2004. A gain of $569 million from the

sale of Rocketdyne in 2005 increased IDS operating margin by

1.8%. BCC grew revenue by 1% and increased operating earn-

ings by 27%. The operating earnings growth at our major busi-

nesses was partially offset by higher expenses for pension and

share-based plans.

We expect strong growth in Commercial Airplane revenues and

deliveries as we execute our record backlog and respond to

global demand. We are ramping up commercial aircraft pro-

duction and are focused on successfully executing our back-

log. We expect IDS revenue growth to moderate as we

anticipate that the U.S. Department of Defense (U.S. DoD)

budget will remain relatively flat over the next several years. We

are focused on improving financial performance through a

combination of productivity and customer-focused growth.

Consolidated Results of Operations

Revenues

Higher consolidated revenues in 2005 were primarily due to the

growth at Commercial Airplanes driven by higher new aircraft

deliveries, increased spares and aircraft modifications, and

higher used aircraft sales. IDS revenues remained stable in

2005 after strong growth in 2004. BCC revenues were essen-

tially unchanged in 2005.

Consolidated revenues also increased in 2004 as compared to

2003. The increase was driven by strong growth at IDS

defense and intelligence businesses. Despite increased new

aircraft deliveries, Commercial Airplanes revenues declined in

2004. The decline is primarily due to delivery mix as more sin-

gle-aisle aircraft and fewer twin-aisle aircraft were delivered in

2004. BCC revenues were down slightly in 2004.

Operating Earnings

Our 2005 operating earnings increased primarily due to strong

operating performance by our business segments, which are

discussed in the Segment Results of Operations and Financial

Condition on page 27, partially offset by higher pension and

share-based plan expenses. Sharply higher operating earnings

in 2004 compared to 2003 were primarily due to higher operat-

ing earnings by IDS. Included in 2004 results is a charge of

$555 million related to the United States Air Force (USAF) 767

tanker program and expenses incurred to end production of

the 717 aircraft. Included in 2003 results are goodwill impair-

ment charges of $572 million recorded at IDS and $341 million

recorded at Commercial Airplanes. In addition, 2003 earnings

were further impacted by a second quarter charge of $1,030

million, of which $835 million was attributable to the Delta IV

program and $195 million to Boeing Satellite Systems incurring

additional costs as a result of satellite program complexities.

The Boeing Company and Subsidiaries 23