Boeing 2005 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operational Highlights

� Improved revenue growth

by 5 percent and increased

net income by 37 percent over

2004, despite strikes at two of

our business units and moder-

ating defense markets.

� Increased backlog by

34 percent to a record

$205 billion.

� Generated $7 billion of

operating cash flow, allowing us

to fund $1.9 billion into pen-

sion plans, buy back approxi-

mately $3 billion in stock and

invest in new products.

� Continued strong stock

performance — performing in

the top quartile of the S&P

500, with 36 percent growth

over 2004; increased earnings

per share by 42 percent.

� Captured a Boeing record

1,002 net (1,029 gross)

commercial airplane orders,

proving we have the right mar-

ket and product strategies.

� Reached significant

Commercial Airplanes program

milestones with launch of the

777 Freighter, 737-900

Extended Range and 747-8

airplanes and completion of

firm configuration for the 787

Dreamliner.

� Demonstrated outstanding

performance from Integrated

Defense Systems with a 33

percent operating earnings

increase over 2004; and oper-

ating margins at 12.6 percent

compared to 9.6 percent a

year ago.

� Achieved major IDS pro-

gram milestones with suc-

cessful Future Combat System

and Multi-mission Maritime

Aircraft program reviews, deliv-

ery of the first F-15K to the

Republic of Korea, rollout of

the Italian KC-767 Tanker, and

a successful Ground-based

Missile Defense test flight.

� Completed divestiture of

our Wichita operations,

Rocketdyne Propulsion &

Power and Boeing Electronic

Dynamic Devices, Inc., as we

sharpen our focus on large-

scale aerospace and defense

systems integration and give

these businesses the oppor-

tunity to grow through access

to broader markets.

delivering results

2005 Financial Highlights

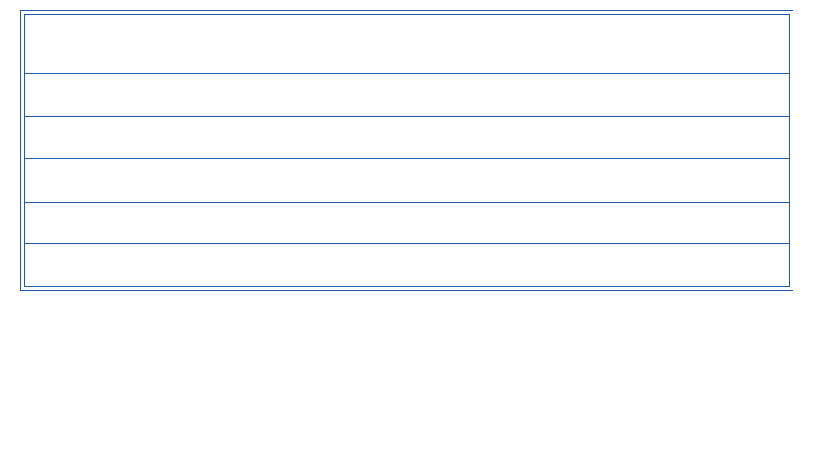

U.S. dollars in millions except per share data 2005 2004 2003 2002 2001

Revenues 54,845 52,457 50,256 53,831 57,970

Net earnings 2,572 1,872 718 492 2,827

Earnings per share* 3.19 2.24 0.85 2.84 3.40

Operating margins 5.1% 3.8% 0.8% 6.4% 6.2%

Contractual backlog† 160,473 109,600 104,812 104,173 106,591

* Before cumulative effect of accounting change and net gain (loss) from discontinued operations.

†Commercial Airplanes backlog at December 31, 2005, has been reduced by $7.8 billion to reflect the planned change

in accounting for concessions effective January 1, 2006. Had December 31, 2004, reflected this method of accounting,

Commercial Airplanes contractual backlog would have been reduced by $4.9 billion to $65.5 billion. Refer to Note 1 in

the Financial section.

NOTE: Page 3 of this report refers to earnings per share adjusted for special items “core earnings per share”. This is a

“non-GAAP financial measure” under SEC rules. The reasons we use core earnings per share and a reconcilliation to

GAAP earnings per share is included on page 21 of this report.

1 1