Boeing 2005 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

lites, BSSI filed a complaint for declaratory relief against ICO in

Los Angeles County Superior Court. BSSI’s suit seeks a

declaratory judgment that ICO’s prior termination of the con-

tracts for convenience extinguished all claims between the par-

ties. On September 16, 2004, ICO filed a cross-complaint

alleging breach of contract, and other claims, and seeking

recovery of all amounts it invested in the contracts, which are

alleged to be approximately $2,000. On October 28, 2005, ICO

filed a cross-complaint alleging similar claims against the

Company. On November 30, 2005, ICO filed an amended

cross-complaint against BSSI asserting the same claims in its

original cross-complaint. On January 13, 2006, BSSI filed a

cross-complaint against ICO, ICO Global Communications

(Holdings) Limited (“ICO Holdings”), ICO’s parent, and Eagle

River Investments, LLC, parent of both ICO and ICO Holdings,

alleging fraud and other claims. We believe that ICO’s claims

lack merit and intend to aggressively pursue our suit against

ICO for declaratory relief and to vigorously defend against ICO’s

cross-complaint.

It is not possible to determine whether any of the actions dis-

cussed would have a material adverse effect on our financial

position.

Other contingencies

We are subject to federal and state requirements for protection

of the environment, including those for discharge of hazardous

materials and remediation of contaminated sites. Such require-

ments have resulted in our being involved in legal proceedings,

claims and remediation obligations since the 1980s.

We routinely assess, based on in-depth studies, expert analy-

ses and legal reviews, our contingencies, obligations and com-

mitments for remediation of contaminated sites, including

assessments of ranges and probabilities of recoveries from

other responsible parties who have and have not agreed to a

settlement and of recoveries from insurance carriers. Our policy

is to immediately accrue and charge to current expense identi-

fied exposures related to environmental remediation sites

based on our best estimate within a range of potential expo-

sure for investigation, cleanup and monitoring costs to be

incurred.

The costs incurred and expected to be incurred in connection

with such activities have not had, and are not expected to

have, a material adverse effect on us. With respect to results of

operations, related charges have averaged less than 1% of his-

torical annual revenues. Although not considered likely, should

we be required to incur remediation charges at the high level of

the range of potential exposure, the additional charges would

be less than 3% of historical annual revenues.

Because of the regulatory complexities and risk of unidentified

contaminated sites and circumstances, the potential exists for

environmental remediation costs to be materially different from

the estimated costs accrued for identified contaminated sites.

However, based on all known facts and expert analyses, we

believe it is not reasonably likely that identified environmental

contingencies will result in additional costs that would have a

material adverse impact on our financial position or to our

operating results and cash flow trends.

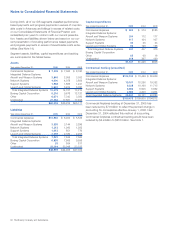

On January 12, 2005, we announced the conclusion of pro-

duction of the 717 airplane in 2006 due to the lack of overall

market demand for the airplane. The last 717 aircraft is

expected to be delivered in the second quarter of 2006. The

decision is expected to result in total pre-tax charges of

approximately $380, of which $280 was incorporated in the

2004 fourth quarter and year end results. The remaining bal-

ance is primarily made up of $60 of pension and $40 of shut-

down expenses of which $7 was expensed in 2005 and the

remaining balance will be expensed as incurred. The termina-

tion of the 717 line will result in $380 of cash expenditures that

are expected to occur through 2009.

The above charge was determined based on available informa-

tion in the fourth quarter of 2004. We have revised our esti-

mates accordingly as new information has become available.

The change in estimate is included in the program’s estimate at

completion (EAC).

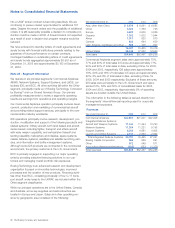

December 31, Change in December 31,

Termination Liability 2004 Payments estimate

Supplier termination $171 $ (1) $7 $177

Production disruption

and shutdown related 10 (7) 3

Pension/postretirement

related 42 1 43

Severance 28 (13) 4 19

Total $251 $(14) $5 $242

The 747 program accounting quantity was increased by 24

units during 2005 as a result of additional customer orders. In

November 2005, we launched the 747 Advanced which

included the 747-8 International passenger airplane and the

747-8 Freighter. This launch and additional anticipated firm

orders have extended the life of this program and have also

solidified product strategy. The probability of making a program

completion decision within the next 12 months is remote.

Due to lack of demand for the 757 program, a decision was

made in the third quarter of 2003 to complete production of

the program. Production of the 757 program ended in October

2004. The last aircraft was delivered in the second quarter of

2005. The vendor termination liability remaining in Accounts

payable and other liabilities was reduced from $121 to $62

during the twelve months ended December 31, 2005 due to

$73 in payments offset by an increase in estimate of $14. No

future charges related to the 757 airplane program are

expected.

Additionally, we have possible material exposures related to the

767 program, also attributable to termination costs that could

result from a lack of market demand. Given the timing and

changing requirements for new USAF tankers, the prospects

for the current 767 production program to extend uninterrupted

The Boeing Company and Subsidiaries 81

2005