Boeing 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

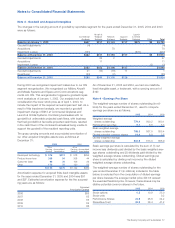

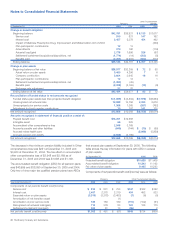

Notes to Consolidated Financial Statements

At December 31, 2005, $194 of BCC debt was collateralized

by portfolio assets and underlying equipment totaling $200.

The debt consists of the 1.67% to 7.00% notes due through

2015.

Maturities of long-term debt for the next five years are as fol-

lows:

2006 2007 2008 2009 2010

BCC $«««696 $1,323 $701 $526 $661

Other Boeing 493 45 26 20 19

$1,189 $1,368 $727 $546 $680

In 2004, BCC redeemed $1,000 face value of its outstanding

senior notes, which had a carrying value of $999. BCC recog-

nized a loss of $42 related to this early debt redemption which

consisted of a $52 prepayment penalty for early redemption

offset by $10 related to the amount by which the fair value of

our hedged redeemed debt exceeded the carrying value of our

hedged redeemed debt.

Financing activities

On March 23, 2004, we filed a shelf registration with the SEC

for $1,000 for the issuance of debt securities and underlying

common stock. The entire amount remains available for poten-

tial debt issuance. BCC has $3,421 that remains available from

shelf registrations filed with the SEC.

Note 17 - Postretirement Plans

We have various pension plans covering substantially all

employees. We fund all our major pension plans through trusts.

The key objective of holding pension funds in a trust is to sat-

isfy the retirement benefit obligations of the pension plans.

Pension assets are placed in trust solely for the benefit of the

pension plans’ participants, and are structured to maintain liq-

uidity that is sufficient to pay benefit obligations as well as to

keep pace over the long term with the growth of obligations for

future benefit payments.

We also have postretirement benefits other than pensions

which consist principally of health care coverage for eligible

retirees and qualifying dependents, and to a lesser extent, life

insurance to certain groups of retirees. Retiree health care is

provided principally until age 65 for approximately half those

retirees who are eligible for health care coverage. Certain

employee groups, including employees covered by most United

Auto Workers bargaining agreements, are provided lifetime

health care coverage. We use a measurement date of

September 30 for our pension and other postretirement benefit

(OPB) plans.

The following shows changes in the benefit obligation, plan

assets and funded status of both pensions and OPB. Benefit

obligation balances presented below reflect the projected ben-

efit obligation (PBO) for our pension plans, and accumulated

postretirement benefit obligations (APBO) for our OPB plans.

The Boeing Company and Subsidiaries 67