Boeing 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

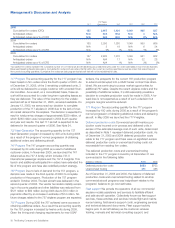

Management’s Discussion and Analysis

continues throughout the operational life of the aircraft.

Services provided after delivery include field service support,

consulting on maintenance, repair, and operational issues

brought forth by the customer or regulators, updating manuals

and engineering data, and the issuance of service bulletins that

impact the entire model’s fleet. Field service support involves

our personnel located at customer facilities providing and coor-

dinating fleet support activities and requests. The costs for fleet

support are expensed as incurred and have been historically

less than 1.5% of total consolidated costs of products and

services. This level of expenditures is anticipated to continue in

the upcoming years. These costs do not vary significantly with

current production rates.

Research and development We continually evaluate opportuni-

ties to improve current aircraft models, and assess the market-

place to ensure that our family of commercial jet aircraft is well

positioned to meet future requirements of the airline industry.

The fundamental strategy is to maintain a broad product line

that is responsive to changing market conditions by maximizing

commonality among our family of commercial aircraft.

Additionally, we are determined to continue to lead the industry

in customer satisfaction by offering products with the highest

standards of quality, safety, technical excellence, economic

performance and in-service support.

Our Research and Development spending increased $361 mil-

lion during 2005 and $265 million in 2004. The increase in

research and development during 2005 and 2004 was primarily

due to increased spending on the 787 program and was par-

tially offset by supplier development cost sharing payments.

For 2005, 787 supplier development cost sharing payments

received were $611 million compared to $205 million during

2004. We expect to receive a lesser amount of 787 supplier

development cost sharing payments in 2006, which will result

in an increase to our total research and development expense.

We are currently focusing our new airplane product develop-

ment efforts on the 787 program, which in three planned ver-

sions will seat 223 to 296 passengers in multiple class

configurations. In early 2004, we received the initial launch

order for the 787 and Board of Directors (BoD) approval to pro-

ceed with full development and production. Entry into service is

targeted for 2008. We are also continuing to develop deriva-

tives and features for our other programs primarily the 737,

747-8 and 777 programs.

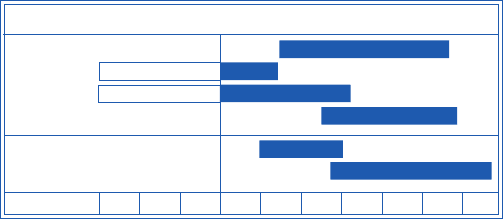

The following chart summarizes the time horizon between go-

ahead and certification/initial delivery for major Commercial

Airplanes derivatives and programs.

00 01 02 03 04 05 06 07 08 09

787-8

777-300ER*

777-200LR*

777-F

747-400BCF

747-8

Go-ahead and Certification/Delivery

Integrated Defense Systems

Business Environment and Trends

IDS is organized into four financial reporting segments: A&WS,

Network Systems, Support Systems, and L&OS. The first three

segments primarily address the U. S. defense market and other

limited defense spending worldwide. The fourth segment is

focused on the civil and commercial space markets along with

the defense market for launch capabilities.

On January 27, 2006 we announced in response to a changing

market and emerging defense requirements that the IDS

segments will be consolidated into three capabilities-driven

businesses: Precision Engagement and Mobility Systems,

Networks and Space Systems, and Support Systems. In

addition, a new Advanced Systems unit has been created.

Operations will be consolidated into three business profit and

loss centers organized around capabilities.

Defense Environment Overview The U.S. is faced with continu-

ous force deployments overseas, stability operations in

Afghanistan and Iraq, and the requirement both to recapitalize

important defense capabilities and to transform the force to

take advantage of available technologies to meet the changing

national security environment as outlined in the recently

released 2006 Quadrennial Defense Review (QDR) Report. All

of this must be carried out against a backdrop of significant

Federal budget deficits and an administration pledge to reduce

and ultimately eliminate annual deficit spending. We anticipate

that the national security environment will remain challenging

for at least the next decade. The global war on terrorism and

the national security threats posed by weapons of mass

destruction demand new and improved capabilities such as

persistent intelligence, surveillance, and reconnaissance (ISR),

global precision strike, and assured access to space. Recent

operations in support of the global war on terrorism have

demonstrated the value of networked and fused ISR combined

with advanced command, control and communications sys-

tems; interdependence across platforms, services, and Special

Forces; and the leveraging effects of precise, persistent, and

selective engagement. All of these enable and leverage new

capabilities while allowing use of traditional capabilities more

discretely and in new ways. The significance and advantage of

unmanned systems to perform many of these tasks will con-

tinue to be investigated. There is also recognition that technol-

ogy must be coupled with human intelligence and ground

forces to generate the greatest effect. These opportunities and

challenges are driving the U.S. DoD, along with militaries world-

wide, both friend and potential foe, to transform their forces

and weapons systems as well as the way they use them.

Because DoD spending makes up about half of worldwide

defense spending and represented greater than 90% of IDS

revenue in 2005, the trends and drivers associated with the

DoD budget are critical. The DoD budget has grown substan-

tially over the past decade, particularly after the terrorist attacks

of September 11, 2001, and we’ve seen that trend continue in

the 2007 Presidential budget submittal, although at a moder-

ated rate compared to the last few years. The President’s

*Go-ahead prior to 2003.

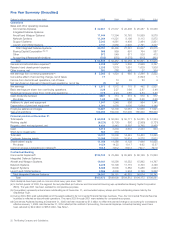

The Boeing Company and Subsidiaries 31