Boeing 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

sciences; and creates new products and services for space,

telecommunications, defense and automotive applications. We

have a 45% ownership of APB Winglets Company, LLC, which

was established for the purposes of designing, developing,

manufacturing, installing, certifying, retrofitting, marketing, sell-

ing, and providing after-sales support with respect to winglets

for retrofit aircraft.

We have a 50% partnership with ATA in BATA, which was

established to acquire aircraft and market and lease the aircraft

to third-parties. During 2003, we finalized an amendment to the

partnership, which gave us majority control in the management

of the business and affairs of BATA. As a result, BATA is now

consolidated in our financial statements.

The Sea Launch venture, in which we are a 40% partner with

RSC Energia (25%) of Russia, Kvaerner ASA (20%) of Norway,

and KB Yuzhnoye/PO Yuzhmash (15%) of Ukraine, provides

ocean-based launch services to commercial satellite cus-

tomers. The venture conducted four successful launches for

the year ended December 31, 2005. The venture also con-

ducted three successful launches in each of the years ended

December 31, 2004 and 2003. Our investment in this venture

reflects the recognition of our share of losses reported by Sea

Launch in prior years. The venture incurred losses in 2005,

2004 and 2003, due to the relatively low volume of launches,

driven by a depressed commercial satellite market. We have

financial exposure with respect to the venture, which relates to

guarantees by us provided to certain Sea Launch creditors,

performance guarantees provided by us to a Sea Launch cus-

tomer and financial exposure related to advances and other

assets reflected in the consolidated financial statements.

We suspended recording equity losses after writing our invest-

ment in and direct loans to Sea Launch down to zero and

accruing our obligation for third-party guarantees on Sea

Launch indebtedness. We are not committed to provide any

further financial support to the Sea Launch venture. However,

in the event that we do extend additional financial support to

Sea Launch in the future, we will recognize suspended losses

as appropriate.

During 2003, we recorded a charge of $55 related to Resource

21, a partnership entered into with three other parties several

years ago to develop commercial remote sensing and ground

monitoring. The charge resulted from a decision by NASA to

not award an imagery contract to Resource 21. During 2003,

we also recorded adjustments to equity investments in Ellipso,

SkyBridge and Teledesic resulting in the net write down of $27.

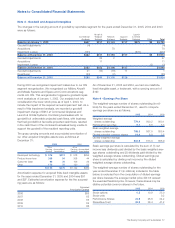

Note 13 - Accounts Payable and Other Liabilities

Accounts payable and other liabilities at December 31 con-

sisted of the following:

2005 2004

Accounts payable $ 5,124 $ 4,563

Accrued compensation and employee

benefit costs 4,165 3,360

Legal, environmental, and

other contingencies(c) 1,792 1,774

Other accrued insurance liability(a) 801 666

Forward loss recognition(b) 1,114 1,218

Pension liabilities 649 744

Product warranty liabilities 781 781

Lease and other deposits 431 362

Dividends payable 241 210

Deferred income and guarantee

residual values 207 195

Accrued interest 194 285

Other 1,014 711

$16,513 $14,869

(a) Accrued insurance liabilities relating to our wholly-owned captive

insurance agencies, Astro Inc. and Astro Ltd.

(b) Forward loss recognition relates primarily to launch and satellite

contracts.

(c) Represents items deemed probable and estimable as discussed in

Note 24.

Accounts payable included $204 and $344 at December 31,

2005 and 2004, attributable to checks written but not yet

cleared by the bank.

Payments associated with these liabilities may occur in periods

significantly beyond the next twelve months.

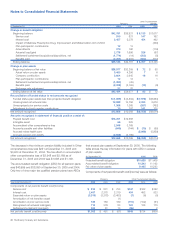

Note 14 - Advances and Billings in Excess of Related

Costs

We receive advance payments, performance based payments

and progress payments from our commercial and government

customers. Performance based payments and progress pay-

ments have historically been recorded as Inventories, net of

advances and progress billings. In 2005, we began classifying

performance based payments and progress payments in

excess of inventoriable cost in Advances and billings in excess

of related costs on the Consolidated Statements of Financial

Position and reclassified prior years to conform with our new

presentation. As of December 31, 2004, we reclassified $2,261

of performance based payments and progress payments in

excess of inventoriable costs from Inventories to Advances and

billings in excess of related costs. See Note 25 for reclassified

asset and liability balances as of December 31, 2004 for our

IDS segment.

Note 15 - Deferred Lease Income

During 2003 and 2004, we delivered a total of five 767 aircraft

to a joint venture named TRM Aircraft Leasing Co. Ltd (TRM),

which was established in order to provide financing and

arrange for such aircraft to be leased to Japan Airlines. We

provided financing of approximately $42 related to the five air-

craft, which in combination with an expense sharing arrange-

ment with TRM, caused us to retain substantial risk of

ownership in the aircraft. As a result, we accounted for the

The Boeing Company and Subsidiaries 65