Boeing 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Note 21 - Arrangements with Off-Balance Sheet Risk

We enter into arrangements with off-balance sheet risk in the

normal course of business, as discussed below. These

arrangements are primarily in the form of guarantees, EETCs

and ETC, and product warranties.

Third-party guarantees

The following tables provide quantitative data regarding our

third-party guarantees. The maximum potential payments rep-

resent a “worst-case scenario,” and do not necessarily reflect

our expected results. Estimated proceeds from collateral and

recourse represent the anticipated values of assets we could

liquidate or receive from other parties to offset our payments

under guarantees. The carrying amount of liabilities recorded

on the Consolidated Statements of Financial Position reflects

our best estimate of future payments we may incur as part of

fulfilling our guarantee obligations.

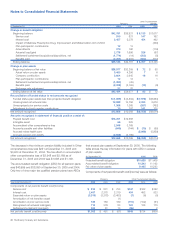

Estimated

Proceeds

Maximum from Carrying

Potential Collateral/ Amount of

As of December 31, 2005 Payments Recourse Liabilities*

Contingent repurchase

commitments $4,067 $4,059

Residual value guarantees 352 288 $115

Credit guarantees related to the

Sea Launch venture 490 294 196

Other credit guarantees 41 13 8

Performance guarantees 48 21 1

*Amounts included in Accounts payable and other liabilities

Estimated

Proceeds

Maximum from Carrying

Potential Collateral/ Amount of

As of December 31, 2004 Payments Recourse Liabilities*

Contingent repurchase

commitments

Residual value guarantees

Credit guarantees related to the

Sea Launch venture

Other credit guarantees

Performance guarantees

Equipment trust certificates

$3,751 $3,743

408 296 $212

510 306 204

60 19 10

64 21 1

28

*Amounts included in Accounts payable and other liabilities

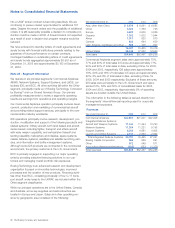

Contingent repurchase commitments In conjunction with sign-

ing a definitive agreement for the sale of new aircraft (Sale

Aircraft), we have entered into contingent repurchase commit-

ments with certain customers wherein we agree to repurchase

the Sale Aircraft at a specified price, generally ten years after

delivery of the Sale Aircraft. Our repurchase of the Sale Aircraft

is contingent upon a future, mutually acceptable agreement for

the sale of additional new aircraft.

Residual value guarantees We have issued various residual

value guarantees principally to facilitate the sale of certain com-

mercial aircraft. Under these guarantees, we are obligated to

make payments to the guaranteed party if the related aircraft or

equipment fair values fall below a specified amount at a future

time. These obligations are collateralized principally by com-

mercial aircraft and expire in 3 to 13 years.

Credit guarantees related to the Sea Launch venture We have

issued credit guarantees to creditors of the Sea Launch ven-

ture, of which we are a 40% partner, to assist the venture in

obtaining financing. Under these credit guarantees, we are obli-

gated to make payments to a guaranteed party in the event

that Sea Launch does not make its loan payments. We have

substantive guarantees from the other venture partners, who

are obligated to reimburse us for their share (in proportion to

their Sea Launch ownership percentages) of any guarantee

payment we may make related to the Sea Launch obligations.

These guarantees expire within the next 10 years.

Other credit guarantees In addition, we have issued credit

guarantees, principally to facilitate the sale of commercial air-

craft. Under these arrangements, we are obligated to make

payments to a guaranteed party in the event that lease or loan

payments are not made by the original debtor or lessee. A sub-

stantial portion of these guarantees has been extended on

behalf of original debtors or lessees with less than investment-

grade credit. Our commercial aircraft credit-related guarantees

are collateralized by the underlying commercial aircraft. Current

outstanding credit guarantees expire within the next 10 years.

Performance guarantees We have outstanding performance

guarantees issued in conjunction with joint venture invest-

ments. Pursuant to these guarantees, we would be required to

make payments in the event a third-party fails to perform speci-

fied services. We have guarantees from the other venture part-

ners, who are obligated to reimburse us for a portion of any

guarantee payments we may make related to the performance

guarantee. Current performance guarantees expire within the

next 12 years.

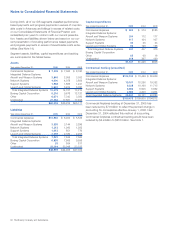

Equipment trust certificate Relating to our ETC, we had poten-

tial obligations of $28 as of December 31, 2004 relating to

shortfall interest payments in the event that the interest rates in

the underlying agreements were reset below levels specified in

these agreements. These obligations would have ceased had

United defaulted on its interest payments to the trust. These

obligations were terminated in 2005.

Indemnifications Our sales agreement for EDD provides indem-

nification to L-3 Communications for third-party litigation and

damages relating to pre-closing environmental contamination.

The term of the indemnification is indefinite. Our sales agree-

ment for Rocketdyne contains similar indemnification provi-

sions. As it is impossible to assess whether there will be any

third-party litigation or damages in the future or the amounts

thereof, we cannot estimate the maximum potential amount of

future payments under these guarantees. Therefore, no liability

has been recorded.

The Boeing Company and Subsidiaries 75