Boeing 2005 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

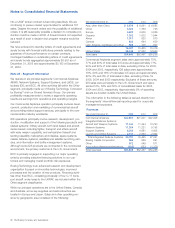

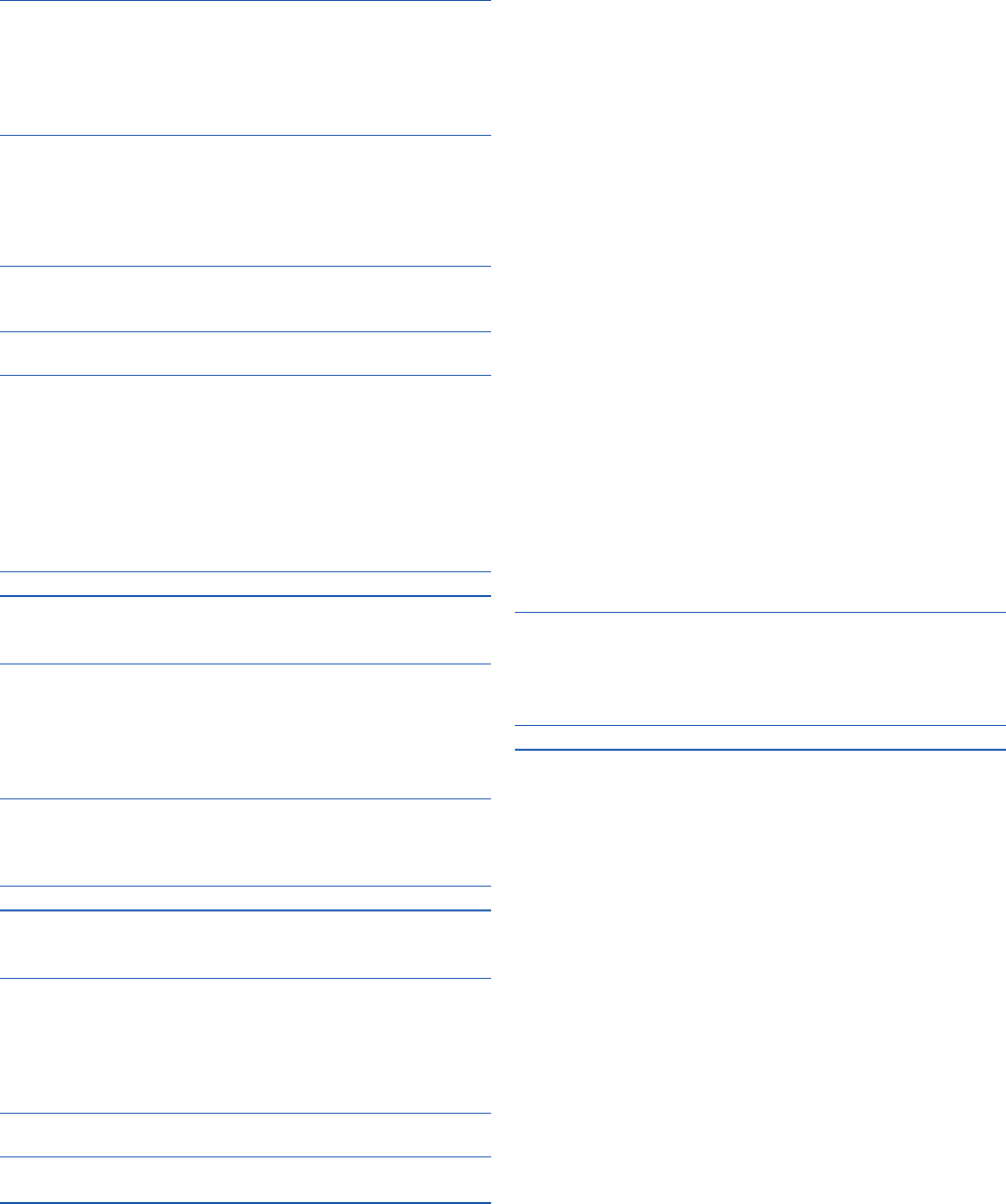

Notes to Consolidated Financial Statements

Net earnings

Year ended December 31, 2005 2004 2003

Commercial Airplanes $1,432 $ 753 $(1,707

Integrated Defense Systems:

Aircraft and Weapon Systems 1,707 1,636 1,420

Network Systems 638 969 645

Support Systems 765 662 455

Launch and Orbital Systems 780 (342) (1,754)

Total Integrated Defense Systems 3,890 2,925 766

Boeing Capital Corporation 232 183 91

Other (334) (535) (379)

Accounting differences/eliminations (989) (403) (11)

Share-based plans expense (852) (576) (456)

Unallocated expense (567) (340) (320)

Earnings from continuing operations 2,812 2,007 398

Other income, net 301 288 460

Interest and debt expense (294) (335) (358)

Earnings before income taxes

Income tax (expense)/benefit

Net earnings from continuing

operations

Income from discontinued

operations, net of taxes

Net (loss)/gain on disposal of

discontinued operations,

net of taxes

Cumulative effect of accounting

change, net of taxes

Net earnings

2,819

(257)

$2,562

(7)

17

$2,572

1,960

(140)

$1,820

10

42

$1,872

500

185

$(1,685

33

$(1,718

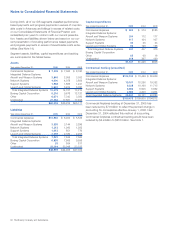

Depreciation and amortization

Year ended December 31, 2005 2004 2003

Commercial Airplanes $ 396 $ 460 $ 455

Integrated Defense Systems:

Aircraft and Weapon Systems 136 118 114

Network Systems 106 97 94

Support Systems 25 16 15

Launch and Orbital Systems 201 214 207

Total Integrated Defense Systems 468 445 430

Boeing Capital Corporation 257 226 217

Other 40 51 49

Unallocated 365 342 267

$1,526 $1,524 $1,418

Research and development expense

Year ended December 31, 2005 2004 2003

Commercial Airplanes $1,302 $ 941 $ 676

Integrated Defense Systems:

Aircraft and Weapon Systems 374 382 360

Network Systems 285 234 195

Support Systems 80 57 59

Launch and Orbital Systems 116 161 232

Total Integrated Defense Systems 855 834 846

Other 48 104 129

Total research and development

expense $2,205 $1,879 $1,651

For segment reporting purposes, we record Commercial

Airplanes segment revenues and cost of sales for airplanes

transferred to other segments. Such transfers may include air-

planes accounted for as operating leases and considered

transferred to the BCC segment and airplanes transferred to

the IDS segment for further modification prior to delivery to the

customer. The revenues and cost of sales for these transfers

are eliminated in the Accounting differences/eliminations cap-

tion. In the event an airplane accounted for as an operating

lease is subsequently sold, the ‘Accounting differences/elimina-

tions’ caption would reflect the recognition of revenue and cost

of sales on the consolidated financial statements.

For segment reporting purposes, we record IDS revenues and

cost of sales for only the modification performed on airplanes

received from Commercial Airplanes when the airplane is deliv-

ered to the customer or at the attainment of performance mile-

stones. The ‘Accounting differences/eliminations’ caption would

reflect the recognition of revenues and cost of sales for the pre-

modified airplane upon delivery to the customer or at the

attainment of performance milestones.

The Accounting differences/eliminations caption of net earnings

includes the impact of cost measurement differences between

GAAP and federal cost accounting standards. The table below

summarizes the Accounting differences/eliminations line in net

earnings.

Accounting differences/eliminations

Year ended December 31, 2005 2004 2003

Pension $(846) $(427 $(463

Post-retirement (5) (285) (257)

Capitalized interest (47) (48) (53)

Pre-modification aircraft elimination (10) 15 (128)

Other (81) (112) (36)

Total $(989) $(403) $4(11)

Unallocated expense includes the recognition of an expense or

a reduction to expense for deferred stock compensation plans

resulting from stock price changes as described in Note 16.

The cost attributable to share-based plans expense is not allo-

cated to other business segments except for the portion

related to BCC. Unallocated expense also includes corporate

costs not allocated to the operating segments. Unallocated

depreciation and amortization relates primarily to our Shared

Services Group.

Unallocated assets primarily consist of cash and investments,

prepaid pension expense, net deferred tax assets, capitalized

interest and assets held by our Shared Services Group as well

as intercompany eliminations. Unallocated liabilities include vari-

ous accrued employee compensation and benefit liabilities,

including accrued retiree health care, net deferred tax liabilities

and income taxes payable. Debentures and notes payable are

not allocated to other business segments except for the por-

tion related to BCC. Unallocated capital expenditures relate pri-

marily to Shared Services Group assets and segment assets

managed by Shared Services Group, primarily IDS.

The Boeing Company and Subsidiaries 83