Boeing 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

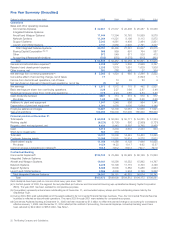

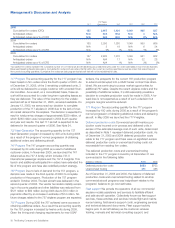

Reconciliation of Non-GAAP Measures

Adjusted Earnings Per Share (Unaudited)

In addition to disclosing results that are determined in accordance with The company believes that discussion of results excluding certain sig-

U.S. generally accepted accounting principles (GAAP), the company nificant charges or credits provides additional insights into underlying

also discloses non-GAAP results that exclude certain significant business performance. Adjusted earnings per share is not a measure

charges or credits that are important to an understanding of the com- recognized under GAAP. The determination of significant charges or

pany’s ongoing operations. The company provides reconciliations of its credits may not be comparable to similarly titled measures used by

non-GAAP financial reporting to the most comparable GAAP reporting. other companies and may vary from quarter to quarter.

Twelve months ended

December 31

Dollars in millions except per share data 2005 2004 Increase

GAAP Diluted earnings per share* $««3.20 $««2.30 39%

Asset Dispositions/Divestitures (0.04) (a)

Air Force 767 Tanker and 717 Program completion 0.44 (b)

Interest associated with income tax benefits (0.05) «(c) (0.17) (d)

Income tax benefits (0.71) (e) (0.45) (f)

Cumulative effect of Accounting Change, Net of Taxes (0.02) (g)

Net (gain)/loss on Discontinued Operations, Net of Taxes ««««««««««««««««0.01) (h) (0.06) (i)

Adjusted earnings per share* “Core Earnings” per share $««2.39 $««2.06 16%

Weighted average diluted shares (millions) 802.9 813.0

(a) Represents the net earnings per share impact including pension and other post retirement benefits on the sale of Rocketdyne, Wichita, and EDD. The per share amount for the

year is presented net of income taxes at 37.8%.

(b) Represents pre-tax charges of $280 related to the 717 Program completion and $275 related to 767 United States Air Force Tanker Program. The per share amount is net of

income taxes computed using a 36.3% tax rate.

(c) Represents interest income of $64 related to income tax audit settlements. The per share amount is net of income taxes at 37.8%

(d) Represents interest income of $219 related to income tax audit settlements. The per share amount is net of income taxes at 36.3%

(e) Represents tax benefits of $570 due to a settlement with the Internal Revenue Service for the years 1998–2001, a change in valuation allowances and provision adjustments

related to tax filings for 2004 and prior years partly offset by the tax cost of repatriating foreign earnings.

(f) Represents tax benefits of $367 from a settlement with the Internal Revenue Service (IRS) of the years 1986–1997, tax benefits associated with state tax audit settlements and

other provision adjustments.

(g) Primarily represents the adoption of SFAS No. 123 (revised 2004) Share-Based Payment in Q1 2005 and the adoption of FASB Interpretation No. 47, Accounting for Conditional

Asset Retirement Obligations in Q4 2005.

(h) Represents the net loss from the disposal of discontinued operations from the sale of assets from BCC’s Commercial Financial Services to General Electric Capital Corporation.

(i) Represents the net gain from the disposal of discontinued operations from the sale of assets from BCC’s Commercial Financial Services to General Electric Capital Corporation.

*GAAP diluted earnings per share and adjusted earnings per share include the impact of the International Association of Machinists (IAM) strike, which resulted in 29 fewer deliveries

than planned.The strike reduced EPS by $0.35 per share.

Quantitative and Qualitative Disclosures

About Market Risk

Interest rate risk

We have financial instruments that are subject to interest rate risk, prin-

cipally investments, fixed-rate debt obligations, and customer financing

assets and liabilities. Historically, we have not experienced material

gains or losses on these instruments due to interest rate changes.

Additionally, Boeing Capital Corporation (BCC) uses interest rate swaps

with certain debt obligations to manage exposure to interest rate changes.

Based on the current holdings of investments, as well as related

swaps, the unhedged exposure to interest rate risk is not material for

these instruments. The investors in the fixed-rate debt obligations that

we issue, do not have the right to demand we pay off these obligations

prior to maturity. Therefore, exposure to interest rate risk is not believed

to be material for our fixed-rate debt.

The principal source of BCC’s market risk relates to interest rate

changes. This risk is managed by matching the profile of BCC’s liabili-

ties with the profile of assets. In a state of perfect matching, assets

would be funded by debt of an equivalent term and other attributes.

Perfect matching is impractical and inefficient given the irregular and

unexpected amortization of some assets compared to how capital

markets function as a source of funding. The ensuing exposure to mis-

match risk is measured and managed with the use of interest rate

derivatives. We do not use interest rate derivatives for speculative or

trading purposes.

Every quarter BCC uses duration-based measures and analysis to esti-

mate the impact of changes in interest rates. Potential changes in the

net fair value of assets, liabilities and derivatives are calculated based

on the amount and timing of projected cash flows. It is important to

note that these measures and sensitivity analysis are estimates and

tools that depend on the assumptions and parameters used in the

related models. These models must be complemented by the experi-

ence and judgment of management. Although the assets, liabilities and

derivatives affected by a change in interest rates are not traded, based

on an immediate, one-time, 100 basis-point increase in market rates at

December 31, 2005, BCC estimated that the tax-adjusted net fair value

of these items would have decreased by $15 million compared to a

decrease of $7 million at December 31, 2004.

Foreign currency exchange rate risk

We are subject to foreign currency exchange rate risk relating to

receipts from customers and payments to suppliers in foreign curren-

cies. We use foreign currency forward and option contracts to hedge

the price risk associated with firmly committed and forecasted foreign

denominated payments and receipts related to our ongoing business

and operational financing activities. Foreign currency contracts are sen-

sitive to changes in foreign currency exchange rates. At December 31,

2005, a 10% unfavorable exchange rate movement in our portfolio of

foreign currency forward contracts would have reduced our unrealized

gains by $28.0 million. Consistent with the use of these contracts to

neutralize the effect of exchange rate fluctuations, such unrealized

losses or gains would be offset by corresponding gains or losses,

respectively, in the remeasurement of the underlying transactions being

hedged. When taken together, these forward contracts and the offset-

ting underlying commitments do not create material market risk.

Commodity price risk

We are subject to commodity price risk relating principally to energy

used in production. We periodically use commodity derivatives, such

as fixed-price purchase commitments, to hedge against potentially un-

favorable price changes of commodities. Commodity price exposure

related to unhedged contracts is not material.

The Boeing Company and Subsidiaries 21