Boeing 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

IRS Audit Overview

During 2005 we received various refunds of federal income tax

and interest totaling $738 for tax years 1987-2001. Included in

such amounts are settlements reached in the current year for

tax years 1998-2001 of $537, which had the effect of decreas-

ing federal income tax expense by $368 and interest expense

by $64 (net of tax of $24) during the year-ended December 31,

2005. During 2004 we received refunds of federal income tax

and interest totaling $1,113 for which estimated accruals had

primarily been recorded in prior periods. We have filed protests

contesting certain adjustments made by the IRS in the 1998-

2001 audit. IRS examinations have been completed through

2001 and income taxes have been settled with the IRS for all

years through 1996 and for McDonnell Douglas Corporation for

all years through 1992. We have filed appeals with the IRS for

1993 through 1997 for McDonnell Douglas Corporation. We

believe adequate provisions for all outstanding issues have

been made for all open years.

Contingencies

We are subject to income taxes in the U.S. and numerous

foreign jurisdictions.

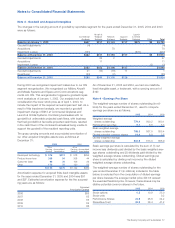

Amounts accrued for potential tax assessments recorded in

current tax liabilities total $867 and $1,678 at December 31,

2005 and 2004. The decrease is primarily due to a settlement

with the IRS for the years 1998-2001. Accruals relate to tax

issues for U.S. federal, U.S. state, and taxation of foreign earn-

ings as follows:

� The accruals associated with U.S. federal tax issues such

as the tax benefits from the FSC/ETI tax rules, the amount

of research and development tax credits claimed, deduc-

tions associated with employee benefit plans, U.S. taxation

of foreign earnings, and valuation issues regarding charita-

ble contributions claimed were $738 at December 31,

2005, and $1,412 at December 31, 2004.

� The accruals for U.S. state tax issues such as the allocation

of income among various state tax jurisdictions and the

amount of state tax credits claimed were $98 at December

31, 2005 and $214 at December 31, 2004, net of federal

benefit.

� The accruals associated with taxation of foreign earnings were

$31 at December 31, 2005 and $52 at December 31, 2004.

Legislative Update

The American Jobs Creation Act of 2004 (the Act) provides for

a special deduction for qualified domestic production activities

and a two-year phase-out of the existing ETI exclusion tax ben-

efit for foreign sales which the World Trade Organization (WTO)

ruled was an illegal export subsidy. These new provisions did

not have a material impact on the 2005 income tax rate.

The European Union filed a complaint with the WTO challeng-

ing the transitional provisions of the Act. On September 30,

2005 the WTO ruled that the Act failed to comply with its prior

ruling and the U.S. appealed. On January 9, 2006, the WTO

appellate body heard arguments regarding the U.S. appeal. On

February 13, 2006, the appellate body upheld the WTO’s prior

ruling from September 30, 2005. The U.S. has three months to

act to avoid the re-imposition of retaliatory measures. As such,

it is not possible to predict what impact this issue will have on

future earnings, cash flows and/or financial position pending

the final resolution of this matter.

Effective December 31, 2005, the U.S. research tax credit

expired. The House of Representatives and the Senate have

passed bills to reinstate the credit. However, a bill has not been

signed into law. If the proposed legislation is not signed into

law, there could be an unfavorable impact on our 2006 effec-

tive income tax rate. The impact of the R&D credit reduced the

2005 effective income tax rate by 1.2%.

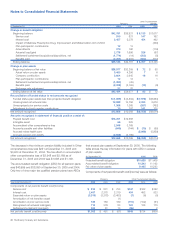

Note 6 - Accounts Receivable

Accounts receivable at December 31 consisted of the following:

2005 2004

U.S. Government contracts $2,620 $2,701

Commercial and customers 1,155 985

Other 1,561 1,075

Less valuation allowance (90) (108)

$5,246 $4,653

The following table summarizes our accounts receivable under

U.S. Government contracts and commercial satellite contracts

that were not billable or related to outstanding claims as of

December 31:

2005 2004

Unbillable

Current $ 687 $ 413

Expected to be collected after one year 404 708

$1,091 $1,121

Claims

Current $««« «15 $ ««8

Expected to be collected after one year 90 23

$«« 105 $« «31

Unbillable receivables on U.S. Government contracts and com-

mercial satellite contracts arise when the sales or revenues

based on performance attainment, though appropriately recog-

nized, cannot be billed yet under terms of the contract as of

the balance sheet date. Accounts receivable related to claims

are items that we believe are earned, but are subject to uncer-

tainty concerning their determination or ultimate realization.

Accounts receivable, other than those described above,

expected to be collected after one year are not material.

As of December 31, 2005 and 2004, other accounts receivable

included $621 and $671 of reinsurance receivables held by

Astro Ltd., a wholly-owned subsidiary, which operates as a

captive insurance company. Currently, Astro Ltd. insures avia-

tion liability, workers compensation, general liability, property, as

well as various other smaller risk liability insurances. Other also

included $650 and $194 at December 31, 2005 and 2004,

related to foreign military contracts.

The Boeing Company and Subsidiaries 59