Boeing 2005 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

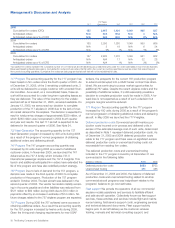

Management’s Discussion and Analysis

Liquidity and Capital Resources

The primary sources of our liquidity and capital resources

include cash flow from operations and substantial unused

borrowing capacity through commercial paper programs,

long-term capital markets and revolving credit line agreements.

The primary factors that affect our investment requirements

and liquidity position, other than operating results associated

with current sales activity, include the following: timing of new

and derivative aircraft programs requiring both high develop-

mental expenditures and initial inventory buildup; growth and

contractions in business cycles; customer financing assistance;

the timing of federal income tax payments/refunds and contri-

butions to our pension plans as well as interest, debt and divi-

dend payments; our stock repurchase plan; internal

investments; and acquisitions and divestitures.

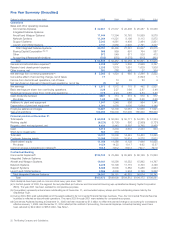

Cash Flow Summary

(Dollars in millions)

Year ended December 31, 2005 2004 2003

Net earnings $«2,572 $«1,872 $««««718

Non-cash items 3,310 3,047 3,137

Changes in working capital 1,118 (1,415) (1,079)

Net cash provided by

operating activities 7,000 3,504 2,776

Net cash (used)/provided by

investing activities (98) (1,446) 60

Net cash used by

financing activities (4,657) (3,487) (536)

Effect of exchange rate changes

on cash and cash equivalents (37)

Net increase/(decrease) in cash

and cash equivalents

Cash and cash equivalents

at beginning of year

Cash and cash equivalents

at end of year

2,208

3,204

$«5,412

(1,429)

4,633

$«3,204

2,300

2,333

$«4,633

Non-cash items Non-cash items in earnings primarily include

depreciation, share-based plans expense, impairments, pen-

sion expense, and gains/losses on dispositions. Corresponding

amounts are listed in our Consolidated Statements of Cash

Flows.

Working capital During the year ended December 31, 2005,

our investment in working capital decreased. This decrease is

primarily due to the following:

� lower pension contributions in 2005 compared to 2004,

� decreased investment in customer financing, and

� higher advances and billings in excess of related costs.

These decreases in working capital were partially offset by

increased investment in inventories.

Working capital includes customer financing transactions pri-

marily in the form of notes receivable, sales-type/finance leases

and property subject to operating leases. These transactions

occur as the result of customer financing activities associated

with items recorded in inventory. The origination and subse-

quent principal collections for some of these transactions were

previously presented as investing activities in our Consolidated

Statements of Cash Flows, consistent with the presentation by

BCC in their stand alone financial statements. Effective for the

year ended December 31, 2004, we changed the classification

of the cash flow effects of customer financing transactions

based on views expressed by the Securities and Exchange

Commission (SEC) staff. The amounts for prior periods have

been reclassified to be consistent with current year presenta-

tion. For the years ended December 31, 2005, 2004 and 2003,

the net impact on operating cash flow was $589 million, ($421)

million and ($1.3) billion, respectively, for customer financing

transactions.

During the year ended December 31, 2005, we received fed-

eral income tax refunds totaling $738 million (of which $145

million represents interest). These refunds related to the settle-

ment of federal income tax audits for the 1987-2001 tax years.

For the years ended December 31, 2005 and 2004, we con-

tributed $1.9 billion and $4.4 billion to our pension plans which

are included in operating cash flow. Almost all of the 2005 and

2004 contributions were voluntary to improve the funded status

of our plans.

Investing activities In 2005, cash used for investing activities

decreased by $1.3 billion compared to 2004. The decrease

was primarily due to higher net contributions in 2004 to invest-

ment grade fixed income securities partially offset by lower pro-

ceeds from business dispositions in 2005 and higher Property,

plant and equipment additions in 2005.

During 2004, we invested $3.0 billion of cash in an externally

managed portfolio of investment grade fixed income instru-

ments. The portfolio is diversified and highly liquid and primarily

consists of investment fixed income instruments (U.S. dollar

debt obligations of the United States Treasury, other govern-

ment agencies, corporations, mortgage-backed and asset-

backed securities). As of December 31, 2005, the portfolio had

an average duration of 1.6 years. We do not intend to hold

these investments to maturity, nor do we intend to actively and

frequently buy and sell these securities with the objective of

generating profits on short-term differences in price.

During 2005, we received $1.7 billion of cash proceeds from

dispositions. This is primarily related to the sale of our

Commercial Airplanes operations in Wichita, Kansas, and Tulsa

and McAlester, Oklahoma and the sale of Rocketdyne. During

2004, we received cash of $2.0 billion from the sale of a sub-

stantial portion of BCC’s Commercial Financial Services busi-

ness. Property, plant and equipment additions increased by

approximately $0.3 billion to $1.5 billion in 2005.

Financing activities Cash used by financing activities increased

to $4.6 billion in 2005 from $3.5 billion in 2004 primarily due to

a $2.1 billion increase in share repurchases partially offset by

lower debt repayments.

During 2005, we repurchased 45,217,300 shares at an aver-

age price of $63.60 pursuant to our open market share repur-

chase program, and 33,360 shares in stock swaps. During

2004, 14,708,856 shares were repurchased at an average

price of $51.09 pursuant to our open market share repurchase

The Boeing Company and Subsidiaries 25