Boeing 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

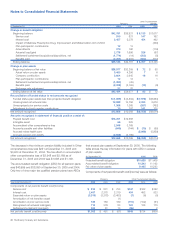

Notes to Consolidated Financial Statements

On March 4, 2005, we completed the exchange transaction of

our investment with Delta in a D tranche Delta Enhanced

Equipment Trust Certificate EETC with a carrying value of $145

and a face value of $176 for two C tranche Delta EETCs with

face values totaling $176. The assets we received were

recorded at their fair values of $143 and we recorded an asset

impairment charge of $2. On September 14, 2005, Delta filed

for Chapter 11 bankruptcy protection. Due to the current finan-

cial difficulties of Delta, during the third quarter of 2005, we

deemed these investments to be other-than-temporarily

impaired. We reduced the carrying value of these investments

to their fair value and recorded an asset impairment charge of

$27. This asset impairment charge was offset by the value of

other collateral available to us. During the fourth quarter of

2005, based on our assessment of Delta’s financial position

and planned reorganization, we concluded that these invest-

ments continue to be impaired.

As a result of the current financial difficulties of Northwest dur-

ing the third quarter of 2005, we deemed the Northwest ETC

and EETC to be other-than-temporarily impaired. We reduced

the carrying value of these investments to their fair value and

recorded an asset impairment charge of $24. During the fourth

quarter of 2005, based on our assessment of Northwest’s

financial position and planned reorganization, we concluded

that these investments continue to be impaired.

Our available-for-sale investments include subordinated debt

investments in two other EETCs. At December 31, 2005, these

investments had estimated fair values totaling $113.

Additionally, due to the commercial aviation market downturn in

the United States these securities with unrealized losses total-

ing $15 have been in a continuous unrealized loss position for

12 months or longer. Despite the unrealized loss position of

these debt securities we concluded that they are not other-

than-temporarily impaired. This assessment was based on the

value of the underlying collateral to the securities, the term of

the securities, our ability to hold the investment until it recovers

its carrying value and both internal and third party credit

reviews and analysis of the counterparties, principally major

domestic airlines. Accordingly, we have concluded that it is

probable that we will be able to collect all amounts due

according to the contractual terms of these debt securities. For

the year ended December 31, 2005, we received all payments

contractually required for these remaining debt securities.

At December 31, 2005, our available-for-sale investments

included an investment in mandatorily redeemable preferred

stock of ATA. During the second quarter of 2004, our assess-

ment of ATA’s continued financial difficulties led us to conclude

that the unsecured preferred stock investment maturing in

2015 was other-than-temporarily impaired. Accordingly, during

2004, we recorded total pre-tax non-cash charge to asset

impairment expense of $47, resulting in a reduction of the car-

rying value to zero.

There were no other-than-temporary impairments during the

year ended December 31, 2003.

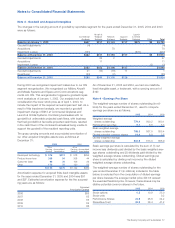

Maturities of available-for-sale debt securities at December 31,

2005, were as follows:

Amortized Estimated

Cost Fair Value

Due in 1 year or less $ 546 $ 554

Due from 1 to 5 years 1,838 1,802

Due from 5 to 10 years 162 173

Due after 10 years 777 765

$3,323 $3,294

Joint ventures and other investments

On May 2, 2005, we entered into an agreement with Lockheed

to create a 50/50 joint venture named United Launch Alliance

(ULA). ULA will combine the production, engineering, test and

launch operations associated with U.S. government launches

of Boeing Delta and Lockheed Martin Atlas rockets. It is

expected that ULA will reduce the cost of meeting the critical

national security and NASA expendable launch vehicle needs

of the United States. The closing of the ULA transaction is sub-

ject to government and regulatory approval in the United States

and internationally. On August 9, 2005, Boeing and Lockheed

received clearance regarding the formation of ULA from the

European Commission. On October 24, 2005, the Federal

Trade Commission (FTC) requested additional information from

us and Lockheed related to ULA in response to the pre-merger

notice under the Hart-Scott-Rodino Antitrust Improvements Act

of 1976 (HSR) submitted by the parties. The FTC’s “second

request” extends the period that the FTC is permitted to review

the transaction under the HSR Act. As a 50/50 joint venture,

ULA would be reported as an equity method investment in our

IDS segment. We do not expect this agreement to have a

material impact to our earnings, cash flows and/or financial

position for 2006. If the conditions to closing are not satisfied

and the ULA transaction is not consummated by March 31,

2006, either we or Lockheed Martin may terminate the joint

venture agreement.

On March 31, 2005, we executed a Purchase and Sale

Agreement to sell certain investments in technology related

funds and partnerships of $63 with related capital commitment

obligations of $76 for a purchase price of $24. During the first

quarter of 2005, we recorded an asset impairment charge of

$42 as a result of this agreement, which is included in Other

income. We have closed the sale on such investments totaling

$50 with net proceeds of $15 as of December 31, 2005.

The principal joint venture arrangements as of December 31,

2005 and 2004 are United Space Alliance; HRL Laboratories,

LLC; APB Winglets Company, LLC; BATA Leasing, LLC (BATA);

and Sea Launch. We have a 50% partnership with Lockheed

Martin in United Space Alliance, which is responsible for all

ground processing of the Space Shuttle fleet and for space-

related operations with the USAF. United Space Alliance also

performs modifications, testing and checkout operations that

are required to ready the Space Shuttle for launch. We are enti-

tled to 33% of the earnings from HRL Laboratories, LLC, which

conducts applied research in the electronics and information

64 The Boeing Company and Subsidiaries