Boeing 2005 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

shares are available for issuance as restricted stock awards.

This authorization for issuance under the 1997 Plan will termi-

nate on April 30, 2007.

Shares issued as a result of stock option exercise or conver-

sion of stock unit awards will be funded out of treasury shares

except to the extent there are insufficient treasury shares in

which case new shares will be issued. We believe we currently

have adequate treasury shares to meet any requirements to

issue shares during 2006.

Share-based plans expense is included in general and adminis-

trative expense since it is incentive compensation issued prima-

rily to our executives. The share-based plans expense and

related income tax benefit follow:

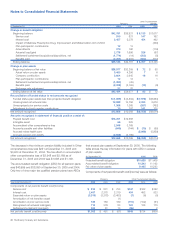

2005 2004 2003

Performance Shares $723 $449 $316

Stock options, other 50 53 69

ShareValue Trust 79 74 71

Share-based plans expense $852 $576 $456

Income tax benefit $253 $209 $168

Adoption of SFAS No. 123R

We early adopted the provisions of SFAS No. 123R as of

January 1, 2005 using the modified prospective method. Upon

adoption of SFAS No. 123R, we recorded an increase in net

earnings of $21, net of taxes of $12, as a cumulative effect of

accounting change due to SFAS No. 123R’s requirement to

apply an estimated forfeiture rate to unvested awards.

Previously we expensed forfeitures as incurred. SFAS No. 123R

also resulted in changes in our methods of measuring and

amortizing compensation cost of our Performance Shares.

For Performance Shares granted prior to 2005, share-based

expense was measured based on the market price of our stock

on date of the award and was generally amortized over a five-

year period. For Performance Shares granted in 2005, the fair

value of each award was measured on the date of grant using

a Monte Carlo simulation model. The Monte Carlo model also

computed an expected term for each Performance Share. We

changed our valuation method based on further clarification

provided in SFAS No. 123R and the fact that our Performance

Shares contain a market condition, which should be reflected in

the grant date fair value of an award. The Monte Carlo simula-

tion model utilizes multiple input variables that determine the

probability of satisfying each market condition stipulated in the

award grant.

Additionally, prior to the adoption of SFAS No. 123R, we amor-

tized compensation cost for share-based awards over the

stated vesting period for retirement eligible employees and, if

an employee retired before the end of the vesting period, we

recognized any remaining unrecognized compensation cost at

the date of retirement. As a result of adopting SFAS No. 123R,

for all share-based awards granted after January 1, 2005, we

recognize compensation cost for retirement eligible employees

over the greater of one year from the date of grant or the

period from the date of grant to the employee’s retirement eligi-

bility date (non-substantive vesting approach). Had we also

applied the non-substantive vesting approach to awards

granted prior to 2005, compensation expense would have

been $96 lower, $59 higher and $12 lower for the years ended

December 31, 2005, 2004 and 2003.

Performance Shares

Performance Shares are stock units that are convertible to

common stock, on a one-to-one basis, contingent upon stock

price performance. If, at any time up to five years after award,

the stock price reaches and maintains for twenty consecutive

days a price equal to stated price growth targets, a stated per-

centage (up to 125%) of the Performance Shares awarded are

vested and convertible to common stock. The following table

shows the cumulative vesting percentages based on the cumu-

lative growth rate of the stock above the stock price at the

grant date for performance shares awarded in 2001 and 2002:

Cumulative Growth 61.0% 68.5% 76.2% 84.2% 92.5% 101.1%

Cumulative Vesting 25% 40% 55% 75% 100% 125%

Cumulative stock price growth targets and vesting percentages for 2003, 2004 and 2005 awards follow:

Cumulative Growth 40% 50% 60% 70% 80% 90% 100% 110% 120% 125%

Cumulative Vesting 15% 30% 45% 60% 75% 90% 100% 110% 120% 125%

Performance Shares not converted to common stock expire

five years after the date of the award. Awards may vest based

on total shareholder return as follows:

� For 2001 and 2002 awards, up to 100% of the award may

vest if our total shareholder return (stock price appreciation

plus dividends) during the five-year period exceeds the

average total shareholder return of the S&P 500 over the

same period.

� For 2003 and 2004 awards, up to 125% of the award may

vest based on an award formula using the total shareholder

return performance relative to the S&P 500.

� For 2005 award, up to 125% of the award may vest based

on an award formula using the total shareholder return per-

formance relative to the S&P 100 and the five-year Treasury

Bill rate.

In the event a participant’s employment terminates due to

retirement, layoff, disability, or death, the participant (or benefi-

ciary) continues to participate in Performance Shares awards

that have been outstanding for at least one year. In all other

cases, participants forfeit unvested awards if their employment

terminates.

The Boeing Company and Subsidiaries 71