Boeing 2005 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

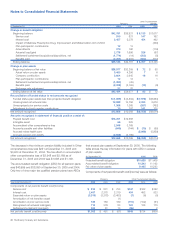

The following table summarizes the activity of stock options

issued to directors, officers and other employees:

December 31, 2005

Weighted-

Average

Excercise

(Shares in thousands) Shares Price

Weighted-

Average

Remaining

Contractual

Life (years)

Aggregate

Intrinsic

Value

(in millions)

Number of shares

under option:

Outstanding at

beginning

of year

Granted

Exercised

Forfeited

Expired

Outstanding at

end of year

24,727

4

(8,216)

(107)

(50)

16,358

$44.49

67.53

42.68

43.35

46.02

45.40 4.15 $406

Exercisable at

end of year 13,660 $46.20 3.60 $328

The total intrinsic value of options exercised was $170, $44

and $11 during the years ended December 31, 2005, 2004

and 2003. Cash received from options exercised for the years

ended December 31, 2005, 2004 and 2003 was $348, $98

and $18 with a related tax benefit of $59, $13 and $3 derived

from the compensation deductions resulting from these option

exercises. Stock options granted during 2005, 2004, and 2003

were not material. At December 31, 2005, there was $6 of total

unrecognized compensation cost related to the Stock Option

plan which is expected to be recognized over a weighted aver-

age period of 2.2 years.

The fair value of stock-based compensation awards granted

was estimated using a binomial option-pricing model with the

following assumptions:

Risk Weighted-

Free Average

Grant Grant Expected Expected Dividend Interest Grant Date

Year Date Life Volatility Yeild Rate Fair Value

2005 8/23/05 9 years 29% 1.5% 4.2% $25.01

2004 12/17/04 9 years 31% 1.1% 4.2% 18.60

2003 9/29/03 9 years 31% 1.1% 4.1% 13.76

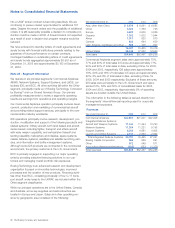

ShareValue Trust

The ShareValue Trust, established effective July 1, 1996, is a

14-year irrevocable trust that holds our common stock,

receives dividends and distributes to employees the apprecia-

tion in value above a 3% per annum threshold rate of return.

The total compensation expense to be recognized over the life

of the trust was determined using a binomial option-pricing

model and was not affected by adoption of SFAS No.123R.

The Trust was split between two funds, “fund 1” and “fund 2”,

upon its initial funding. Each fund consists of investment peri-

ods which result in overlapping periods as follows:

Period 1 (fund 1): July 1, 1996 to June 30, 1998

Period 2 (fund 2): July 1, 1996 to June 30, 2000

Period 3 (fund 1): July 1, 1998 to June 30, 2002

Period 4 (fund 2): July 1, 2000 to June 30, 2004

Period 5 (fund 1): July 1, 2002 to June 30, 2006

Period 6 (fund 2): July 1, 2004 to June 30, 2008

Period 7 (fund 1): July 1, 2006 to June 30, 2010

An initial investment value is established for each investment

period based on the lesser of either (1) fair market value of the

fund or (2) the prior ending balance of that fund. This amount is

then compounded by the 3% per annum to determine the

threshold amount that must be met for that investment period.

At the end of the investment period, the value of the invest-

ment in excess of the threshold amount will result in a distribu-

tion to participants. A distribution is proportionally distributed in

the ratio each participant’s number of months of participation

relates to the total number of months earned by all participants

in the investment period. At December 31, 2005, the Trust held

39,593,463 shares of our common stock in the two funds.

On June 30, 2004, the market value of fund 2 exceeded $913

(the threshold representing a 3% per annum rate of return).

Based on the average stock price of $50.825 as of June 30,

2004, the market value of fund 2 exceeded the threshold by

$143 resulting in a distribution to participants. The distribution

was paid in Boeing common stock, except for partial shares,

distributions to foreign employees and beneficiaries of

deceased participants, which were paid in cash. After

employee withholding taxes, approximately 1.7 million shares of

common stock were distributed to participants. These transac-

tions were recorded as a deduction from additional paid-in

capital.

If on June 30, 2006, the market value of fund 1 exceeds

$1,004, the amount in excess of the threshold will be distrib-

uted to employees in shares of common stock. Similarly, if on

June 30, 2008, the market value of fund 2 exceeds $1,028, the

amount in excess of the threshold will be distributed to employ-

ees in shares of common stock.

The ShareValue Trust is accounted for as a contra-equity

account and stated at market value. Market value adjustments

are offset to additional paid-in capital. At December 31, 2005,

there was $325 of total unrecognized compensation cost

related to the ShareValue Trust which is expected to be recog-

nized over a period of 4.5 years.

Other stock unit awards

The total number of stock unit awards that are convertible only

to common stock and not contingent upon stock price were

2,037,438, 2,019,250 and 1,910,293 at December 31, 2005,

2004 and 2003.

The Boeing Company and Subsidiaries 73