Boeing 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Technologies Corporation for cash proceeds of approximately

$700 under an asset purchase agreement. This divestiture

includes assets and sites in California, Alabama, Mississippi,

and Florida. The Rocketdyne business primarily develops and

builds rocket engines and provides booster engines for the

space shuttle and the Delta family as well as propulsion sys-

tems for missile defense systems. We recorded the sale in the

quarter ending September 30, 2005, and the 2005 net pre-tax

gain of approximately $578, predominantly in the L&OS seg-

ment. In addition, we recorded a related pre-tax loss of $200

for estimated pension and postretirement curtailments and set-

tlements in the fourth quarter of 2005 in our Other segment.

On June 16, 2005, we completed the sale of substantially all of

the assets at our Commercial Airplanes facilities in Wichita,

Kansas and Tulsa and McAlester, Oklahoma under an asset

purchase agreement to a new entity which was subsequently

named Spirit Aerosystems, Inc. (Spirit) and is owned by Onex

Partners LP. Transaction consideration given to us included

cash of approximately $900, together with the transfer of cer-

tain liabilities and long-term supply agreements that provide us

with ongoing cost savings. The consolidated net loss on this

sale recorded in 2005 was $287, including pension and postre-

tirement impacts. We recognized a loss of $103 in 2005 in the

Consolidated Statement of Operations as Gain on dispositions,

net, of which $68 was recognized by the Commercial Airplanes

segment and $35 was recognized as Accounting

differences/eliminations and Unallocated expense. The remain-

ing loss of $184 related to estimated pension and postretire-

ment curtailments and settlements, was recorded in our Other

segment in the third quarter of 2005.

See Note 21 for discussion of the environmental indemnifica-

tion provisions of these agreements.

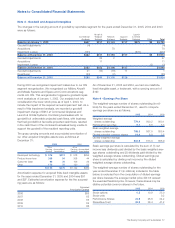

The following table summarizes the asset and liability balances

related to the Rocketdyne and Wichita/Tulsa divestitures for

2005:

Wichita/

Rocketdyne Tulsa

Assets

Accounts receivable $ 62

Inventory 72 $ 467

Property, plant and equipment 96 523

Other assets 3 38

Prepaid pension expense 228 250

$ 461 $ 1,278

Liabilities

Accounts payable $ 14 $ 48

Employment and other 13 46

Environmental 12

Accrued retiree health care liability 28 66

$ 67 $ 160

Note 9 - Discontinued Operations - Commercial Financial

Services

On May 24, 2004, Boeing Capital Corporation (BCC) entered

into a purchase and sale agreement with General Electric

Capital Corporation (GECC) to sell substantially all of the assets

related to its Commercial Financial Services (CFS) business and

the final asset sale closed on December 27, 2004. The assets

sold to GECC consisted of leases and financing arrangements

which had a carrying value of $1,872 as of May 31, 2004.

Part of the purchase and sale agreement with GECC includes a

loss sharing arrangement for losses that may exist at the end

of the initial financing terms of the transferred portfolio assets,

or, in some instances, prior to the end of the financing term,

such as certain events of default and repossession. The loss

sharing arrangement provides that cumulative net losses (if any)

are to be shared between BCC and GECC in accordance with

the following formula: (i) with respect to the first $150 of cumu-

lative net losses, BCC is liable to GECC for 80% of the amount

thereof (in such event GECC will bear 20% of such losses); (ii)

with respect to cumulative net losses between $150 and $275,

BCC is liable to GECC for 100% of such additional cumulative

net losses; and (iii) if cumulative losses exceed $275, GECC

bears 100% of the loss risk above $275. These provisions

effectively limit BCC’s exposure to any losses to $245. In the

event there are cumulative net gains on the portfolio, GECC is

required to make an earn-out payment to BCC in an amount

equal to 80% of such cumulative net gain.

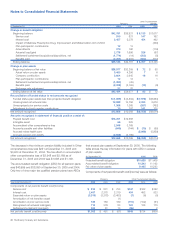

Liability under the loss sharing arrangement was as follows for

the years ended December 31:

2005 2004

Accrued liability at beginning of year $90

Increase in reserve 25 $90

Payments made to GECC (34)

Accrued liability at end of year $81 $90

Operating results of the discontinued operations for the years

ended December 31 were as follows:

2005 2004 2003

Revenues $ 3 $96 $229

Income from discontinued operations 16 51

Provision for income tax (6) (18)

Income from discontinued operations,

net of taxes $10 $33

Net (loss) gain on disposal of

discontinued operations $(12) $66

Benefit (provision) for income taxes 5 (24)

Net (loss) gain on disposal of

discontinued operations, net of taxes $ (7) $42

The Boeing Company and Subsidiaries 61