Boeing 2005 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

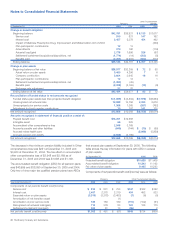

Notes to Consolidated Financial Statements

)

)

)

)

)

At September 30,

Change in benefit obligation

Beginning balance

Service cost

Interest cost

Impact of Medicare Prescription Drug, Improvement and Modernization Act of 2003

Plan participants’ contributions

Amendments

Actuarial loss/(gain)

Settlement/curtailment/acquisitions/dispositions, net

Benefits paid

Ending balance

Pe

2005

$42,781

910

2,457

12

270

2,778

(1,774)

(2,251)

$45,183

nsions

2004

$39,931

831

2,378

13

190

1,656

(14)

(2,204)

$42,781

2005

$ 8,135

147

454

326

(503)

(502)

$ 8,057

Other Postretirement

Benefits

2004

$ 8,617

162

492

(439

(119

(57

(8

(513

$ 8,135

Change in plan assets

)

Beginning balance at fair value $38,977 $33,209 $ 72 $ 58

Actual return on plan assets 5,460 4,296 7 6

Company contribution 2,604 3,645 16 16

Plan participants’ contributions 12 13 1

Settlement/curtailment/acquisitions/dispositions, net (1,393) (43)

Benefits paid (2,208) (2,163) (13) (9

Exchange rate adjustment 32 20

Ending balance at fair value $43,484 $38,977 $ 82 $ 72

Reconciliation of funded status to net amounts recognized

)

)

)

)

)

)

Funded status-plan assets less than projected benefit obligation $ (1,699) $ (3,804) $ (7,976) $(8,063

Unrecognized net actuarial loss 12,989 13,756 2,333 2,676

Unrecognized prior service costs 1,368 1,365 (557) (762

Adjustment for fourth quarter contributions 10 752 141 135

Net amount recognized $12,668 $12,069 $ (6,059) $(6,014

Amounts recognized in statement of financial position consist of:

Prepaid benefit cost $13,251 $12,588

Intangible asset 66 225

Accumulated other comprehensive loss 2,948 3,169

Accounts payable and other liabilities (649) (744) $ (70) $ (55

Accrued retiree health care (5,989) (5,959

Accrued pension plan liability (2,948) (3,169)

Net amount recognized $12,668 $12,069 $(6,059) $(6,014

The decrease in the minimum pension liability included in Other

comprehensive loss was $221 at December 31, 2005 and

$3,460 at December 31, 2004. The tax effect on accumulated

other comprehensive loss of $2,948 and $3,169 as of

December 31, 2005 and 2004 was $1,098 and $1,148.

The accumulated benefit obligation (ABO) for all pension plans

was $40,999 and $38,590 at September 30, 2005 and 2004.

Only two of nine major tax qualified pension plans have ABOs

that exceed plan assets at September 30, 2005. The following

table shows the key information for plans with ABO in excess

of plan assets.

At September 30, 2005 2004

Projected benefit obligation $10,638 $11,405

Accumulated benefit obligation 10,343 11,162

Fair value of plan assets 9,405 10,293

Components of net periodic benefit cost/(income) were as follows:

Pensions Other Postretirement Benefits

Year ended December 31, 2005 2004 2003 2005 2004 2003

)

)

Components of net periodic benefit cost/(income)

Service cost $ 910 $(3,831 $(3,753 $147 $162 $162

Interest cost 2,457 2,378 2,319 454 492 533

Expected return on plan assets (3,515) (3,378) (3,403) (7) (6) (5

Amortization of net transition asset (1)

Amortization of prior service costs 185 180 169 (110) (102) (61

Recognized net actuarial loss/(gain) 714 379 83 161 188 175

Settlement/curtailment loss/(gain) 552 61 13 (96) 2

Net periodic benefit cost/(income) $1,303 $(3,451 $3,4(67) $549 $734 $806

68 The Boeing Company and Subsidiaries