Boeing 2005 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

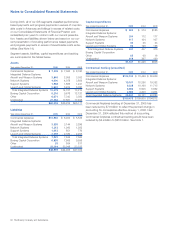

Other risk

The Commercial Airplanes segment is subject to both opera-

tional and external business environment risks. Operational

risks that can disrupt its ability to make timely delivery of its

commercial jet aircraft and meet its contractual commitments

include execution of internal performance plans, product per-

formance risks associated with regulatory certifications of its

commercial aircraft by the U.S. Government and foreign gov-

ernments, other regulatory uncertainties, collective bargaining

labor disputes, performance issues with key suppliers and sub-

contractors and the cost and availability of energy resources,

such as electrical power. Aircraft programs, particularly new air-

craft models, face the additional risk of pricing pressures and

cost management issues inherent in the design and production

of complex products. Financing support may be provided by us

to airlines, some of which are unable to obtain other financing.

External business environment risks include adverse govern-

mental export and import policies, factors that result in signifi-

cant and prolonged disruption to air travel worldwide and other

factors that affect the economic viability of the commercial air-

line industry. Examples of factors relating to external business

environment risks include the volatility of aircraft fuel prices,

global trade policies, worldwide political stability and economic

growth, acts of aggression that impact the perceived safety of

commercial flight, escalation trends inherent in pricing our air-

craft and a competitive industry structure which results in mar-

ket pressure to reduce product prices.

In addition to the foregoing risks associated with the

Commercial Airplanes segment, the IDS businesses are subject

to changing priorities or reductions in the U.S. Government

defense and space budget, and termination of government

contracts due to unilateral government action (termination for

convenience) or failure to perform (termination for default). Civil,

criminal or administrative proceedings involving fines, compen-

satory and treble damages, restitution, forfeiture and suspen-

sion or debarment from government contracts may result from

violations of business and cost classification regulations on

U.S. Government contracts.

The commercial launch and satellite service markets have

some degree of uncertainty since global demand is driven in

part by the launch customers’ access to capital markets.

Additionally, some of our competitors for launch services

receive direct or indirect government funding. The satellite mar-

ket includes some degree of risk and uncertainty relating to the

attainment of technological specifications and performance

requirements.

Risk associated with BCC includes interest rate risks, asset val-

uation risks, specifically, aircraft valuation risks, and credit and

collectibility risks of counterparties.

As of December 31, 2005, approximately 36% of our employ-

ees were represented by collective bargaining agreements,

none of which expires within one year.

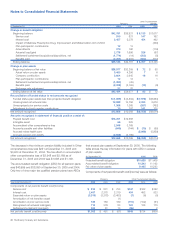

Note 23 - Disclosures about Fair Value of Financial

Instruments

The estimated fair value of our Accounts receivable, Accounts

payable, Investments, and Notes receivable balances at

December 31, 2005 and 2004 approximate their carrying value

as reflected in the Consolidated Statements of Financial

Position.

As of December 31, 2005 and 2004, the carrying amount of

debt, net of capital leases, was $10,516 and $11,884 and the

fair value of debt, based on current market rates for debt of the

same risk and maturities, was estimated at $11,643 and

$13,198. Our debt is generally not callable until maturity.

With regard to financial instruments with off-balance sheet risk,

it is not practicable to estimate the fair value of future financing

commitments because there is not a market for such future

commitments. Other off-balance sheet financial instruments,

including asset-related guarantees, credit guarantees, and

interest rate guarantees related to an ETC, are estimated to

have a fair value of $148 and $165 at December 31, 2005 and

2004.

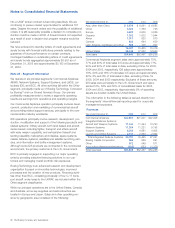

Note 24 - Contingencies

Legal

Various legal proceedings, claims and investigations related to

products, contracts and other matters are pending against us.

Most significant legal proceedings are related to matters cov-

ered by our insurance. Major contingencies are discussed

below.

Government investigations We are subject to various U.S.

Government investigations, including those related to procure-

ment activities and the alleged possession and misuse of third-

party proprietary data, from which civil, criminal or

administrative proceedings could result or have resulted. Such

proceedings involve, or could involve claims by the

Government for fines, penalties, compensatory and treble dam-

ages, restitution and/or forfeitures. Under government regula-

tions, a company, or one or more of its operating divisions or

subdivisions, can also be suspended or debarred from govern-

ment contracts, or lose its export privileges, based on the

results of investigations. We believe, based upon current infor-

mation, that the outcome of any such government disputes

and investigations will not have a material adverse effect on our

financial position, except as set forth below.

A-12 litigation In 1991, the U.S. Navy notified McDonnell

Douglas Corporation (now one of our subsidiaries) and General

Dynamics Corporation (the Team) that it was terminating for

default the Team’s contract for development and initial produc-

tion of the A-12 aircraft. The Team filed a legal action to con-

test the Navy’s default termination, to assert its rights to

convert the termination to one for “the convenience of the

Government,” and to obtain payment for work done and costs

incurred on the A-12 contract but not paid to date. As of

December 31, 2005, inventories included approximately $584

78 The Boeing Company and Subsidiaries