Boeing 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

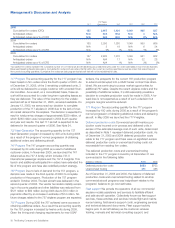

Management’s Discussion and Analysis

program, and 50,657 shares were repurchased in stock swaps.

There were no share repurchases in 2003. There were no debt

issuances during 2005 and 2004. We issued approximately $1

billion of debt in 2003 to refinance corporate debt that matured

in 2002 and 2003. Additionally, in 2003, we received proceeds

of $1 billion under our September 13, 2002 shelf registration.

On July 26, 2004, BCC redeemed $1 billion face value of its

outstanding senior notes, which had a carrying value of $999

million. BCC recognized a net loss of $42 million related to this

early debt redemption (See Note 16). Debt maturities were $1.3

billion in 2005, $1.1 billion in 2004, and $1.8 billion in 2003.

Credit Ratings

Our credit ratings are summarized below:

Fitch Moody’s Standard &

Poor’s

Long-term:

Boeing/BCC A+ A3 A

Short-term:

Boeing/BCC F-1 P-2 A-1

On January 25, 2006, Moody’s placed both Boeing and BCC’s

credit ratings (Senior Unsecured Long-term ratings and Short-

term ratings) under review for possible upgrade.

Capital Resources

We and BCC have commercial paper programs that continue

to serve as significant potential sources of short-term liquidity.

Throughout 2005 and at December 31, 2005, neither we nor

BCC had any commercial paper borrowings outstanding.

We believe we have substantial borrowing capacity. Currently,

we have $3.0 billion ($1.5 billion exclusively available for BCC)

of unused borrowing limits under revolving credit line agree-

ments. (See Note 16). In November 2005, we rolled over the

364-day revolving credit facility, reducing it from $2.0 billion to

$1.5 billion. Currently, there is $750 million allocated to BCC.

We also rolled over the 5-year credit facility we established in

November 2003, maintaining the total size of $1.5 billion, of

which $750 million remains allocated to BCC. We also have

$1.0 billion that remains available from a shelf registration filed

with the SEC on March 23, 2004 and BCC has an additional

$3.4 billion available for issuance. We believe our internally gen-

erated liquidity, together with access to external capital

resources, will be sufficient to satisfy existing commitments and

plans, and also to provide adequate financial flexibility to take

advantage of potential strategic business opportunities should

they arise within the next year.

As of December 31, 2005, we were in compliance with the

covenants for our debt and credit facilities.

Disclosures about Contractual Obligations

and Commercial Commitments

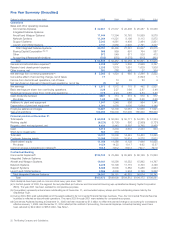

The following table summarizes our known obligations to make

future payments pursuant to certain contracts as of December

31, 2005, and the estimated timing thereof.

Contractual obligations

Less than 1 – 3 3– 5 After 5

(Dollars in millions) Total 1 year years years years

Long-term debt (including

current portion) $10,489 $ 1,136 $ 2,018 $ 1,194 $ 6,141

Interest on debt* 6,859 638 1,067 913 4,241

Capital lease obligations 210 53 87 18 52

Operating lease obligations 1,995 283 381 260 1,071

Purchase obligations not

recorded on statement

of financial position:

Production related 58,532 24,599 22,060 9,169 2,704

Pension and other

post retirement

cash requirements 6,847 629 1,349 1,446 3,423

Purchase obligations

recorded on statement

of financial position 7,952 6,625 455 467 405

Total contractual

obligations $92,884 $33,963 $27,417 $13,467 $18,037

*Includes interest on variable rate debt calculated based on interest rates at

December 31, 2005. Variable rate debt was approximately 3% of our total debt at

December 31, 2005.

Purchase obligations Purchase obligations represent contrac-

tual agreements to purchase goods or services that are legally

binding; specify a fixed, minimum or range of quantities; specify

a fixed, minimum, variable, or indexed price provision; and

specify approximate timing of the transaction. In addition, the

agreements are not cancelable without a substantial penalty.

Long-term debt, interest on debt, capital leases, and operating

leases are shown in the above table regardless of whether they

meet the characteristics of purchase obligations. Purchase obli-

gations include amounts recorded as well as amounts that are

not recorded on the statements of financial position.

Approximately 24% of the purchase obligations disclosed

above are reimbursable to us pursuant to cost-type govern-

ment contracts.

Purchase obligations not recorded on the Consolidated

Statement of Financial Position

Pension and other postretirement benefits Pension cash require-

ments is an estimate of our minimum funding requirements,

pursuant to the ERISA regulations, although we may make

additional discretionary contributions. Estimates of other postre-

tirement benefits are based on both our estimated future bene-

fit payments and the estimated contribution to the one plan that

is funded through a trust.

Production related Production related purchase obligations

include agreements for production goods, tooling costs, elec-

tricity and natural gas contracts, property, plant and equipment,

and other miscellaneous production related obligations. The

most significant obligation relates to inventory procurement

contracts. We have entered into certain significant inventory

procurement contracts that specify determinable prices and

quantities, and long-term delivery timeframes. In addition, we

purchase raw materials on behalf of our suppliers. These agree-

ments require suppliers and vendors to be prepared to build

26 The Boeing Company and Subsidiaries