Xerox 2006 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

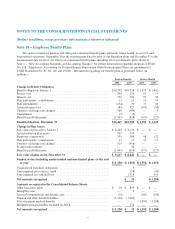

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

A reconciliation of the U.S. federal statutory income tax rate to the consolidated effective income tax rate for the

three years ended December 31, 2006 was as follows:

2006 2005 2004

U.S. federal statutory income tax rate .............................................. 35.0% 35.0% 35.0%

Nondeductible expenses ........................................................ 1.4 3.4 3.4

Effect of tax law changes ....................................................... (1.8) 0.3 (1.5)

Change in valuation allowance for deferred tax assets ................................. 1.4 (4.6) 1.3

State taxes, net of federal benefit ................................................. 1.8 1.6 1.3

Audit and other tax return adjustments ............................................. (62.5) (25.5) 0.7

Tax-exempt income ............................................................ (0.9) (0.7) (0.7)

Dividends on Series B convertible preferred stock .................................... — — (0.6)

Other foreign, including earnings taxed at different rates .............................. (10.5) (10.3) (2.4)

Other ....................................................................... 0.5 0.2 (1.3)

Effective income tax rate .................................................. (35.6)% (0.6)% 35.2%

On a consolidated basis, we paid a total of $76,

$186, and $253 in income taxes to federal, foreign and

state jurisdictions in 2006, 2005 and 2004, respectively.

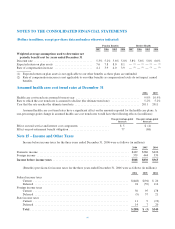

Total income tax (benefit) expense for the three

years ended December 31, 2006 was allocated as follows

(in millions):

2006 2005 2004

Income taxes on income ...... $(288) $ (5) $340

Common shareholders’

equity(1) ................. (466) (43) (20)

Total ..................... $(754) $(48) $320

(1) This consists of the tax effects of items in

accumulated other comprehensive loss and tax

benefits related to stock option and incentive plans.

2006 includes the effects of the adoption of FAS

158-See Note 1 for further information.

General Tax Contingencies and Audit Resolutions:

We are subject to ongoing tax examinations and

assessments in various jurisdictions. Accordingly, we

may record incremental tax expense based upon the

probable outcomes of such matters. In addition, when

applicable, we adjust the previously recorded tax expense

to reflect examination results. Our ongoing assessments

of the probable outcomes of the examinations and related

tax positions require judgment and can materially

increase or decrease our effective tax rate, as well as

impact our operating results.

2006: In the first quarter 2006, we recognized an

income tax benefit of $24 from the favorable resolution of

certain tax issues associated with our 1999–2003 Internal

Revenue Service (“IRS”) audit which at the time had not

yet been finalized. In the second quarter 2006, we

recognized an income tax benefit of $46 related to the

favorable resolution of certain tax matters associated with

the finalization of foreign tax audits. In the third quarter

2006, we received notice that the U.S. Joint Committee

on Taxation had completed its review of our 1999–2003

IRS audit and as a result of that review our audit for those

years had been finalized. Accordingly, we recorded an

aggregate income tax benefit of $448 associated with the

favorable resolution of certain tax matters from this audit.

The recorded benefit will not result in a significant cash

refund, but we expect it to increase tax credit

carryforwards and reduce taxes otherwise potentially due.

2005: In June 2005, the 1996-1998 IRS audit was

finalized. As a result, we recorded an aggregate second

quarter 2005 net income benefit of $343. $260 of this

benefit, which includes an after-tax benefit of $33 for

interest ($54 pre-tax benefit), is the result of a change in

tax law that allowed us to recognize a benefit for $1.2

billion of capital losses associated with the disposition of

our insurance group operations in those years. The claim

of additional losses and related tax benefits required

review by the U.S. Joint Committee on Taxation, which

was completed in June 2005. The benefit did not result in

a significant cash refund, but increased tax credit

carryforwards and reduced taxes otherwise potentially

due.

90