Xerox 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

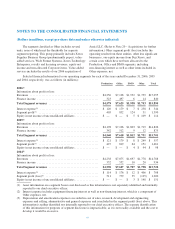

Condensed financial data of Fuji Xerox for the three calendar years ended December 31, 2006 was as follows (in

millions):

2006 2005 2004

Summary of Operations:

Revenues ................................................................ $9,859 $10,009 $9,450

Costs and expenses ........................................................ 9,119 9,406 8,595

Income before income taxes ................................................. 740 603 855

Income taxes ............................................................. 281 215 331

Minorities’ interests ........................................................ 5 8 18

Net income .............................................................. $ 454 $ 380 $ 506

Balance Sheet Data:

Assets:

Current assets ............................................................. $3,731 $ 3,454 $3,613

Long-term assets .......................................................... 4,184 4,168 4,606

Total Assets .............................................................. $7,915 $ 7,622 $8,219

Liabilities and Shareholders’ Equity:

Current liabilities .......................................................... $2,954 $ 2,991 $2,757

Long-term debt ........................................................... 685 434 616

Other long-term liabilities ................................................... 590 936 1,383

Minorities’ interests in equity of subsidiaries .................................... 21 17 104

Shareholders’ equity ....................................................... 3,665 3,244 3,359

Total Liabilities and Shareholders’ Equity .................................... $7,915 $ 7,622 $8,219

In 2006, 2005 and 2004, we received dividends of

$41, $38 and $50, respectively, which were reflected as a

reduction in our investment. Additionally, we have a

technology agreement with Fuji Xerox whereby we

receive royalty payments for their use of our Xerox brand

trademark, as well as, rights to access their patent

portfolio in exchange for access to our patent portfolio.

Effective April 2006, we renewed our technology

agreement with Fuji Xerox (the “2006 Technology

Agreement”). The 2006 Technology Agreement provides

that Fuji Xerox will pay us a royalty that is based on Fuji

Xerox’s revenue. The 2006 Technology Agreement will

not result in a material change to the royalty revenues we

receive from Fuji Xerox. In general, all other existing

agreements with respect to intellectual property between

the parties will remain in full force and effect. Therefore,

all technology licenses previously granted between the

parties will not be subject to the 2006 Technology

Agreement but will generally remain subject to the terms

of any such prior arrangements. The only exception is that

the licenses previously granted under the 1999

Technology Agreement will be converted into fully

paid-up and royalty free licenses.

In 2006, 2005 and 2004, we earned royalty revenues

under this agreement of $117, $123 and $119,

respectively, which are included in Service, outsourcing

and rental revenues in the Consolidated Statements of

Income. We also have arrangements with Fuji Xerox

whereby we purchase inventory from and sell inventory

to Fuji Xerox. Pricing of the transactions under these

arrangements is based upon negotiations conducted at

arm’s length. Certain of these inventory purchases and

sales are the result of mutual research and development

arrangements. Our purchase commitments with Fuji

Xerox are in the normal course of business and typically

have a lead time of three months. Purchases from and

sales to Fuji Xerox for the three years ended

December 31, 2006 were as follows (in millions):

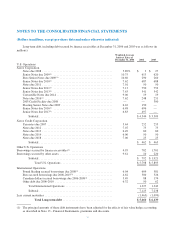

2006 2005 2004

Sales .................... $ 168 $ 163 $ 166

Purchases ................ $1,677 $1,517 $1,135

71