Xerox 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

Additional details about our restructuring programs

are as follows:

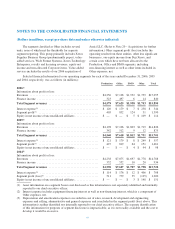

Reconciliation to Consolidated Statements of Cash

Flows

Years ended

December 31,

2006 2005 2004

Charges to reserve ........... $(284) $(247) $(190)

Pension curtailment, special

termination benefits and

settlements ............... — — 8

Asset impairments ........... 30 15 1

Effects of foreign currency and

other non-cash ............ (11) 18 (6)

Cash payments for

restructurings ............ $(265) $(214) $(187)

Restructuring: In recent years we have initiated a

series of ongoing restructuring initiatives designed to

leverage cost savings resulting from realized productivity

improvements, realign and lower our overall cost

structure and outsource certain internal functions. These

initiatives primarily include severance actions and impact

all major geographies and segments. Recent initiatives

include:

• During 2006, we provided $420 for ongoing

restructuring programs which consisted of $351 for

severance and related costs, $39 for lease and

contract terminations and $30 for asset

impairments. The charges primarily relate to the

elimination of approximately 3,400 positions

primarily in North America and Europe. The 2006

actions associated with these charges primarily

include the following: technical and professional

services infrastructure and global back-office

optimization; continued R&D efficiencies and

productivity improvements; supply chain

optimization to ensure, for example, alignment to

our global two-tier model implementation; and

selected off-shoring opportunities. The lease

termination and asset impairment charges primarily

related to the relocation of certain manufacturing

operations as well as an exit from certain leased and

owned facilities. These charges were offset by

reversals of $35 primarily related to changes in

estimates in severance costs from previously

recorded actions.

• During 2005, we provided $398 for ongoing

restructuring programs, which consisted of a charge

of $371 for severance costs, primarily related to the

elimination of approximately 3,900 positions

worldwide, a charge of $12 for lease terminations

and $15 for asset impairments. The initiatives in

2005 were focused on cost reductions in service,

manufacturing and back office support operations

primarily within the Office and Production

segments. These charges were offset by reversals of

$27 primarily related to changes in estimates in

severance costs from previously recorded actions.

• During 2004, we provided $104 for ongoing

restructuring programs, which consisted of a charge

of $87 related to the elimination of approximately

1,900 positions primarily in North America and

Latin America, $8 for pension settlements, $8 for

lease terminations and $1 for asset impairments.

These charges were offset by reversals of $11

related to changes in estimates for severance costs

from previously recorded actions.

We expect to utilize the majority of the

December 31, 2006 restructuring balance in 2007.

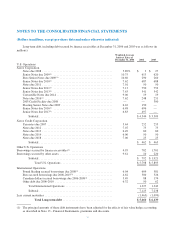

The following table summarizes the total amount of

costs incurred in connection with these restructuring

programs by segment for the three years ended

December 31, 2006 (in millions):

Years Ended December 31, 2006 2005 2004

Production .................... $142 $150 $ 27

Office ....................... 127 175 29

DMO........................ 21 22 30

Other ........................ 95 19 —

Total Provisions .............. $385 $366 $ 86

We expect to incur additional restructuring charges

in 2007 of approximately $11 related to initiatives

identified to date that have not yet been recognized in the

Consolidated Financial Statements as well as expected

interest accretion on the reserve.

74