Xerox 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

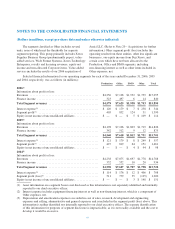

Depreciation expense was $277, $280 and $305 for the years ended December 31, 2006, 2005 and 2004,

respectively. We lease certain land, buildings and equipment, substantially all of which are accounted for as operating

leases. Total rent expense under operating leases for the years ended December 31, 2006, 2005 and 2004 amounted to

$269, $267, and $316, respectively. Future minimum operating lease commitments that have initial or remaining

non-cancelable lease terms in excess of one year at December 31, 2006 were as follows:

2007 2008 2009 2010 2011 Thereafter

$ 189 $ 161 $ 124 $ 102 $ 84 $ 158

In certain circumstances, we sublease space not

currently required in operations. Future minimum

sublease income under leases with non-cancelable terms

in excess of one year amounted to $30 at December 31,

2006.

We have an information technology contract with

Electronic Data Systems Corp. (“EDS”) through June 30,

2009. Services to be provided under this contract include

support of global mainframe system processing,

application maintenance, desktop and helpdesk support,

voice and data network management and server

management. There are no minimum payments due EDS

under the contract. Payments to EDS, which are primarily

recorded in selling, administrative and general expenses,

were $288, $305 and $328 for the years ended

December 31, 2006, 2005 and 2004, respectively.

In December 2006, we sold our Corporate

headquarters facility for $55 and recognized a gain of

$15. In connection with the sale, the secured mortgage on

the facility of $34 was defeased through the purchase of

treasury securities totaling $36. The difference of $2 was

recorded as a loss on extinguishment of debt. The gain on

the sale as well as the loss on extinguishment are included

in Other expenses, net within the Consolidated Statements

of Income. In connection with the sale, we entered into a

two-year lease agreement, which is cancelable upon 90

days notice. We intend to relocate our Corporate

headquarters facility within the surrounding area, when a

suitable replacement facility is identified.

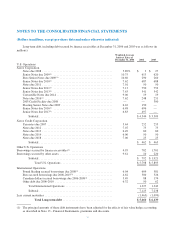

Note 7 – Investments in Affiliates, at Equity

Investments in corporate joint ventures and other

companies in which we generally have a 20% to 50%

ownership interest at December 31, 2006 and 2005 were

as follows (in millions): 2006 2005

Fuji Xerox(1) ........................ $834 $725

All other equity investments ............ 40 57

Investments in affiliates, at equity ..... $874 $782

(1) Fuji Xerox is headquartered in Tokyo and operates

in Japan, China, Australia, New Zealand and other

areas of the Pacific Rim. Our investment in Fuji

Xerox of $834 at December 31, 2006, differs from

our implied 25% interest in the underlying net assets,

or $916, due primarily to our deferral of gains

resulting from sales of assets by us to Fuji Xerox,

partially offset by goodwill related to the Fuji Xerox

investment established at the time we acquired our

remaining 20% of Xerox Limited from The Rank

Group plc.

Our equity in net income of our unconsolidated

affiliates for the three years ended December 31, 2006

was as follows:

2006 2005 2004

Fuji Xerox .................... $107 $90 $134

Other investments .............. 7 8 17

Total ..................... $114 $98 $151

Equity in net income of Fuji Xerox is affected by

certain adjustments to reflect the deferral of profit

associated with intercompany sales. These adjustments

may result in recorded equity income that is different than

that implied by our 25% ownership interest.

70