Xerox 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

Termination of 2003 Credit Facility

In connection with the effectiveness of the 2006

Credit Facility, we terminated the 2003 Credit Facility in

April 2006 and repaid all advances and loans outstanding

thereunder. The termination of the 2003 Credit Facility

resulted in the write-off of unamortized deferred debt

issuance costs of $13, as well as termination of the

guaranty by Xerox International Joint Marketing Inc. of

our outstanding Senior Notes due 2009, 2010, 2011, 2013

and 2016.

Senior Notes Offerings

In March 2006, we issued $700 aggregate principal

amount of Senior Notes due 2016 (“2016 Senior Notes”)

at 99.413% of par, resulting in net proceeds of $689. The

2016 Senior Notes accrue interest at the rate of 6.40% per

annum, payable semiannually, and as a result of the

discount, have a weighted average effective interest rate

of 6.481%. In conjunction with the issuance of the 2016

Senior Notes, debt issuance costs of $7 were deferred.

In August 2006, we issued $500 aggregate principal

amount of Senior Notes due 2017 (“2017 Senior Notes”)

and $150 aggregate principal amount of floating rate

Senior Notes due 2009 (“Floating 2009 Senior Notes”).

The 2017 Senior Notes aggregate principal amount was

issued at 99.392% of par, resulting in net proceeds of

$492. Interest on the 2017 Senior Notes accrues at the rate

of 6.75% per annum and is payable semiannually and, as

a result of the discount, has a weighted average effective

interest rate of 6.833%. The Floating 2009 Senior Notes

aggregate principal amount was issued at 100% of par,

resulting in net proceeds of $149. Interest on the Floating

2009 Senior Notes accrues at a rate per annum, reset

quarterly, equal to three-month LIBOR plus 0.75% and is

payable quarterly. In conjunction with the issuance of the

2017 Senior Notes and the Floating 2009 Senior Notes,

debt issuance costs of $6 were deferred.

Debt repayments and maturities: During 2006, we

repaid $24 of public unsecured debt prior to its scheduled

maturity. There were no other scheduled public debt

maturities in 2006.

Guarantees: At December 31, 2006, we have

guaranteed $31 of indebtedness of our foreign

subsidiaries. This debt is included in our Consolidated

Balance Sheet as of such date. In addition, as of

December 31, 2006, $40 of letters of credit have been

issued in connection with insurance guarantees.

Interest: Interest paid on our short-term debt, long-

term debt and liabilities to subsidiary trusts issuing

preferred securities amounted to $512, $555 and $710 for

the years ended December 31, 2006, 2005 and 2004,

respectively.

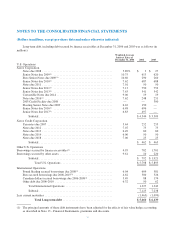

Interest expense and interest income for the three

years ended December 31, 2006 was as follows (in

millions):

Year Ended December 31,

2006 2005 2004

Interest expense(1) ......... $544 $ 557 $ 708

Interest income(2) ......... (909) (1,013) (1,009)

(1) Includes Equipment financing interest expense, as

well as, non-financing interest expense included in

Other expenses, net in the Consolidated Statements

of Income.

(2) Includes Finance income, as well as, other interest

income that is included in Other expenses, net in the

Consolidated Statements of Income.

Equipment financing interest is determined based on

an estimated cost of funds, applied against the estimated

level of debt required to support our net finance

receivables. Prior to 2006, the estimated cost of funds was

primarily based on our secured borrowing rates. As a

result of the recent reduction in our level of secured

borrowings, effective January 1, 2006 the estimated cost

of funds is based on a blended rate for term and duration

comparable to available borrowing rates for a BBB rated

company, which were reviewed at the end of each period.

This change in basis did not materially impact the

calculated amount of Equipment finance interest expense

and accordingly did not impact comparability between the

periods. The estimated level of debt is based on an

assumed 7 to 1 leverage ratio of debt/equity as compared

to our average finance receivable balance during the

applicable period.

79