Xerox 2006 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

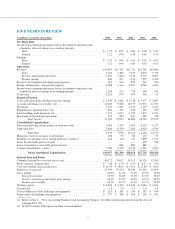

FIVE YEARS IN REVIEW

(in millions, except per-share data) 2006 2005 2004 2003 2002

Per-Share Data

Income from continuing operations before discontinued operations and

cumulative effect of change in accounting principle

Basic ...................................................... $ 1.25 $ 0.91 $ 0.84 $ 0.38 $ 0.11

Diluted ..................................................... 1.22 0.90 0.78 0.36 0.10

Earnings

Basic ...................................................... $ 1.25 $ 0.96 $ 0.94 $ 0.38 $ 0.02

Diluted ..................................................... 1.22 0.94 0.86 0.36 0.02

Operations

Revenues ....................................................... $15,895 $15,701 $15,722 $15,701 $15,849

Sales ...................................................... 7,464 7,400 7,259 6,970 6,752

Service, outsourcing and rentals ................................. 7,591 7,426 7,529 7,734 8,097

Finance income .............................................. 840 875 934 997 1,000

Research, development and engineering expenses ....................... 922 943 914 962 980

Selling, administrative and general expenses ........................... 4,008 4,110 4,203 4,249 4,437

Income from continuing operations before discontinued operations and

cumulative effect of change in accounting principle ................... 1,210 933 776 360 154

Net income ..................................................... 1,210 978 859 360 91

Financial Position

Cash, cash equivalents and Short-term investments ...................... $ 1,536 $ 1,566 $ 3,218 $ 2,477 $ 2,887

Accounts and finance receivables, net ................................ 10,043 9,886 10,573 10,972 11,077

Inventories ...................................................... 1,163 1,201 1,143 1,152 1,231

Equipment on operating leases, net ................................... 481 431 398 364 450

Land, buildings and equipment, net .................................. 1,527 1,627 1,759 1,827 1,757

Investment in discontinued operations ................................ 295 420 440 449 728

Total Assets(1) ........................................... 21,709 21,953 24,884 24,591 25,550

Consolidated Capitalization

Short-term debt and current portion of long-term debt .................... 1,485 1,139 3,074 4,236 4,377

Long-term debt .................................................. 5,660 6,139 7,050 6,930 9,794

Total Debt .............................................. 7,145 7,278 10,124 11,166 14,171

Minorities’ interests in equity of subsidiaries ........................... 108 90 80 102 73

Liabilities to subsidiary trusts issuing preferred securities(2) ............... 624 724 717 1,809 1,793

Series B convertible preferred stock .................................. — — — 499 508

Series C mandatory convertible preferred stock ......................... — 889 889 889 —

Common shareholders’ equity(1) ..................................... 7,080 6,319 6,244 3,291 1,893

Total Consolidated Capitalization .......................... $14,957 $15,300 $18,054 $17,756 $18,438

Selected Data and Ratios

Common shareholders of record at year-end ........................... 40,372 53,017 55,152 56,326 57,300

Book value per common share ...................................... $ 7.48 $ 6.79 $ 6.53 $ 4.15 $ 2.56

Year-end common stock market price ................................ $ 16.95 $ 14.65 $ 17.01 $ 13.80 $ 8.05

Employees at year-end ............................................ 53,700 55,220 58,100 61,100 67,800

Gross margin .................................................... 40.6% 41.2% 41.6% 42.6% 42.8%

Sales gross margin ........................................... 35.7% 36.6% 37.4% 37.6% 38.2%

Service, outsourcing and rentals gross margin ...................... 43.0% 43.3% 43.0% 44.3% 44.5%

Finance gross margin ......................................... 63.7% 62.7% 63.1% 63.7% 59.9%

Working capital .................................................. $ 4,056 $ 4,390 $ 4,628 $ 2,666 $ 3,242

Current ratio .................................................... 1.9 2.0 1.7 1.4 1.4

Cost of additions to land, buildings and equipment ...................... $ 215 $ 181 $ 204 $ 197 $ 146

Depreciation on buildings and equipment ............................. $ 277 $ 280 $ 305 $ 299 $ 341

(1) Refer to Note 1 – “New Accounting Standards and Accounting Changes” for further information representing the effect of

adopting FAS 158.

(2) In 2005, includes $98 reported in other current liabilities.

111