Xerox 2006 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

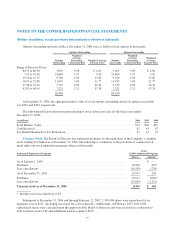

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

Options outstanding and exercisable at December 31, 2006 were as follows (stock options in thousands):

Options Outstanding Options Exercisable

Number

Outstanding

Weighted

Average

Remaining

Contractual Life

Weighted Average

Exercise Price

Number

Exercisable

Weighted

Average

Remaining

Contractual Life

Weighted

Average

Exercise Price

Range of Exercise Prices

$4.75 to $6.98 3,965 3.98 $ 4.91 3,665 3.89 $ 4.90

7.13 to 10.69 23,864 5.37 9.20 23,864 5.37 9.20

10.70 to 15.27 9,760 4.98 13.66 9,760 4.98 13.66

16.91 to 22.88 11,835 3.00 21.77 11,835 3.00 21.77

25.38 to 32.16 3,735 2.90 26.36 3,735 2.90 26.36

42.83 to 60.95 7,321 2.21 53.78 7,321 2.21 53.78

60,480 60,180

At December 31, 2006, the aggregate intrinsic value of stock options outstanding and stock options exercisable

was $267 and $263, respectively.

The following table provides information relating to stock option exercises for the three years ended

December 31, 2006:

(in millions) 2006 2005 2004

Total Intrinsic Value ............................................................. $72 $36 $67

Cash Received .................................................................. 82 41 67

Tax Benefit Realized for Tax Deductions ............................................. 25 12 23

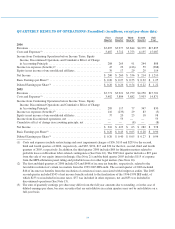

Treasury Stock: The Board of Directors has authorized programs for the repurchase of the Company’s common

stock totaling $2.0 billion as of December 31, 2006. The following is a summary of the purchases of common stock

made under our stock repurchase programs (shares in thousands):

Authorized Repurchase Programs

Total

$2,000 Authorized Programs

Shares Amount

As of January 1, 2005 ........................................................ — $ —

Purchases .................................................................. 30,502 433*

Less cancellations ........................................................... (16,585) (230)

As of December 31, 2005 ..................................................... 13,917 203

Purchases .................................................................. 70,111 1,069*

Less cancellations ........................................................... (75,665) (1,131)

Treasury stock as of December 31, 2006 ........................................ 8,363 $ 141

* Includes total associated fees of $3.

Subsequent to December 31, 2006 and through February 12, 2007, 7,399,400 shares were repurchased at an

aggregate cost of $127, (including associated fees of less than $1). Additionally, in February 2007, 8,813,000

repurchased shares were cancelled upon the approval of the Board of Directors and were recorded as a reduction to

both Common stock of $9 and Additional paid-in-capital of $139.

103