Xerox 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

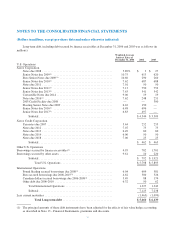

Fair Value of Financial Instruments: The estimated fair values of our financial instruments at December 31,

2006 and 2005 were as follows:

2006 2005

(in millions)

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

Cash and cash equivalents ........................................... $1,399 $1,399 $1,322 $1,322

Short-term investments ............................................. 137 137 244 244

Accounts receivable, net ............................................ 2,199 2,199 2,037 2,037

Short-term debt ................................................... 1,485 1,487 1,139 1,134

Long-term debt ................................................... 5,660 5,917 6,139 6,312

Short-term liabilities to trusts issuing preferred securities(1) ................. — — 98 96

Long-term liabilities to trusts issuing preferred securities .................. 624 640 626 642

(1) Recognized as a component of Other current liabilities within the Consolidated Balance Sheet.

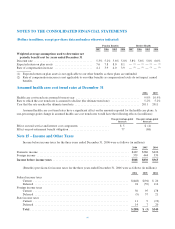

The fair value amounts for Cash and cash

equivalents and Accounts receivable, net approximate

carrying amounts due to the short maturities of these

instruments. The fair value of Short and Long-term debt,

as well as Liabilities to subsidiary trusts issuing preferred

securities, was estimated based on quoted market prices

for publicly traded securities or on the current rates

offered to us for debt of similar maturities. The difference

between the fair value and the carrying value represents

the theoretical net premium or discount we would pay or

receive to retire all debt at such date.

84