Xerox 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

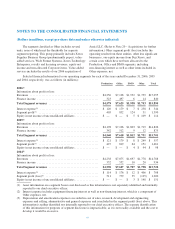

Contractual maturities of our gross finance receivables as of December 31, 2006 were as follows (including those

already billed of $273) (in millions):

2007 2008 2009 2010 2011 Thereafter Total

$3,530 $2,589 $1,813 $1,050 $362 $45 $9,389

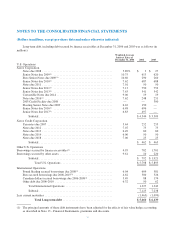

Secured Funding Arrangements

GE Secured Borrowings: We have an agreement in

the U.S. (the “Loan Agreement”) under which GE Vendor

Financial Services, a subsidiary of GE, provides secured

funding for our customer leasing activities in the U.S. The

maximum potential level of borrowing under the Loan

Agreement is a function of the size of the portfolio of

finance receivables generated by us that meet GE’s

funding requirements and cannot exceed $5 billion in any

event. There have been no new borrowings under the

Loan Agreement since December 2005.

Under this agreement, new lease originations,

including the bundled service and supply elements, are

transferred to a wholly-owned consolidated subsidiary

which receives funding from GE. The funds received

under this agreement are recorded as secured borrowings

and together with the associated lease receivables are

included in our Consolidated Balance Sheet. We and GE

intend the transfers of the lease contracts to be “true sales

at law” and that the wholly-owned consolidated

subsidiary be bankruptcy remote and have received

opinions to that effect from outside legal counsel. As a

result, the transferred receivables are not available to

satisfy any of our other obligations. GE’s funding

commitment is not subject to our credit ratings. There are

no credit rating defaults that could impair future funding

under this agreement. This agreement contains cross

default provisions related to certain financial covenants

contained in the 2006 Credit Facility and other significant

debt facilities. Any cross default would impair our ability

to receive subsequent funding until the default was cured

or waived but does not accelerate previous borrowings

except in the case of bankruptcy. However, in the event of

a default, we could be replaced as the maintenance

service provider for the associated equipment under lease.

We have similar long-term lease funding

arrangements with GE in both the U.K. and Canada.

These agreements contain similar terms and conditions as

those contained in the U.S. Loan Agreement with respect

to funding conditions and covenants. The final funding

date for U.S. and Canadian facilities is currently

December 2010. In November 2006, we delivered notice

to GE, moving the final funding date for the U.K.

program to June 2007.

France Secured Borrowings: We have an on-going

warehouse financing facility in France with Merrill Lynch

to fund new lease originations up to €420 million ($552

as of December 31, 2006) through July 2007. The Merill

Lynch facility can be extended via the optional extension

provision to 2009.

DLL Secured Borrowings: In 2002, we formed a

joint venture with De Lage Landen Bank (“the DLL Joint

Venture”) which became our primary equipment

financing provider for new lease originations in the

Netherlands through fundings from De Lage Landen

Bank. Our DLL Joint Venture is consolidated as we are

deemed to be the primary beneficiary of the joint

venture’s financial results (Refer to Note 1 – “Basis of

Consolidation”). The funds received by the DLL Joint

Venture are recorded as secured borrowings and together

with the associated lease receivables are included in our

Consolidated Balance Sheets.

67