Xerox 2006 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

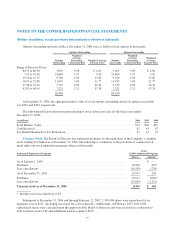

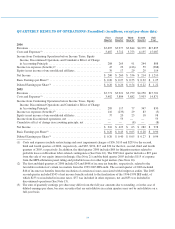

QUARTERLY RESULTS OF OPERATIONS (Unaudited) (in millions, except per-share data)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Full

Year

2006

Revenues ................................................. $3,695 $3,977 $3,844 $4,379 $15,895

Costs and Expenses(1) ....................................... 3,487 3,712 3,753 4,135 15,087

Income from Continuing Operations before Income Taxes, Equity

Income, Discontinued Operations and Cumulative Effect of Change

in Accounting Principle .................................... 208 265 91 244 808

Income tax expenses (benefits)(2) .............................. 47 22 (416) 59 (288)

Equity in net income of unconsolidated affiliates .................. 39 17 29 29 114

Net Income ............................................... $ 200 $ 260 $ 536 $ 214 $ 1,210

Basic Earnings per Share(3) ................................... $ 0.20 $ 0.27 $ 0.55 $ 0.22 $ 1.25

Diluted Earnings per Share(3) ................................. $ 0.20 $ 0.26 $ 0.54 $ 0.22 $ 1.22

2005

Revenues ................................................. $3,771 $3,921 $3,759 $4,250 $15,701

Costs and Expenses(1) ....................................... 3,482 3,804 3,682 3,903 14,871

Income from Continuing Operations before Income Taxes, Equity

Income, Discontinued Operations and Cumulative Effect of Change

in Accounting Principle .................................... 289 117 77 347 830

Income tax expenses (benefits)(2) .............................. 116 (233) 29 83 (5)

Equity in net income of unconsolidated affiliates .................. 37 20 23 18 98

Income from discontinued operations, net ....................... — 53 — — 53

Cumulative effect of change in accounting principle, net ........... — — (8) — (8)

Net Income ............................................... $ 210 $ 423 $ 63 $ 282 $ 978

Basic Earnings per Share(3) ................................... $ 0.20 $ 0.43 $ 0.05 $ 0.28 $ 0.96

Diluted Earnings per Share(3) ................................. $ 0.20 $ 0.40 $ 0.05 $ 0.27 $ 0.94

(1) Costs and expenses include restructuring and asset impairment charges of $36, $110 and $239 for the second,

third and fourth quarters of 2006, respectively, and $85, $194, $17 and $70 for the first, second, third and fourth

quarters of 2005, respectively. In addition, the third quarter 2006 includes $68 for litigation matters related to

probable losses on Brazilian labor-related contingencies (See Note 16). The 2005 first quarter includes a $93 gain

from the sale of our equity interest in Integic (See Note 21) and the third quarter 2005 includes $115 of expense

from the MPI arbitration panel ruling and probable losses for other legal matters (See Note 16).

(2) The first and third quarters of 2006 include $24 and $448 of income tax benefits, respectively, related to the

favorable resolution of certain tax matters from the 1999-2003 IRS audit. The second quarter of 2006 included

$46 of income tax benefits from the resolution of certain tax issues associated with foreign tax audits. The 2005

second quarter included $343 of net income benefits related to the finalization of the 1996-1998 IRS audit, of

which $233 was included in income taxes, $57 was included in other expenses, net and $53 was included in

discontinued operations (See Note 15).

(3) The sum of quarterly earnings per share may differ from the full-year amounts due to rounding, or in the case of

diluted earnings per share, because securities that are anti-dilutive in certain quarters may not be anti-dilutive on a

full-year basis.

110