Xerox 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

In addition to the amounts described above, in 2006,

2005 and 2004, we paid Fuji Xerox $28, $28 and $27,

respectively, and Fuji Xerox paid us $3 in 2006 and $9

for 2005 and 2004, respectively, for unique research and

development. As of December 31, 2006 and 2005,

amounts due to Fuji Xerox were $169 and $157,

respectively.

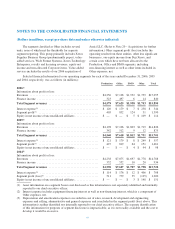

Note 8 – Goodwill and Intangible Assets, Net

Goodwill:

The following table presents the changes in the carrying amount of goodwill, by operating segment, for the three

years ended December 31, 2006 (in millions):

Production Office DMO Other Total

Balance at January 1, 2004 ..................................... $ 771 $827 $— $124 $1,722

Foreign currency translation adjustment ........................ 77 54 — 1 132

Other .................................................... — — — (6) (6)

Balance at December 31, 2004 ................................... 848 881 — 119 1,848

Foreign currency translation adjustment ........................ (103) (74) — — (177)

Balance at December 31, 2005 ................................... 745 807 — 119 1,671

Foreign currency translation adjustment ........................ 99 69 — 1 169

Acquisition of Amici LLC ................................... — — — 136 136

Acquisition of XMPie, Inc. .................................. 48 — — — 48

Balance at December 31, 2006 ................................... $ 892 $876 $— $256 $2,024

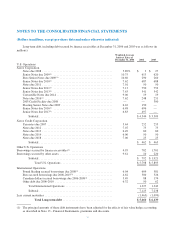

Intangible Assets, Net:

Intangible assets primarily relate to the Office operating segment. Intangible assets were comprised of the

following as of December 31, 2006 and 2005 (in millions):

Weighted

Average

Amortization

Period

As of December 31, 2006: As of December 31, 2005:

Gross

Carrying

Amount

Accumulated

Amortization

Net

Amount

Gross

Carrying

Amount

Accumulated

Amortization

Net

Amount

Installed customer base ......... 16years $258 $ 89 $169 $226 $ 72 $154

Distribution network ........... 25years 123 35 88 123 30 93

Technology and trademarks ..... 7years 165 136 29 156 114 42

$546 $260 $286 $505 $216 $289

Amortization expense related to intangible assets

was $45, $42, and $38 for the years ended December 31,

2006, 2005 and 2004, respectively, and is expected to

approximate $27 in 2007 and approximate $25 annually

from 2008 through 2011. Amortization expense is

primarily recorded in Other expenses, net, with the

exception of amortization expense associated with

licensed technology, which is recorded in Cost of sales

and Cost of service, outsourcing and rentals, as

appropriate.

72