Xerox 2006 Annual Report Download - page 102

Download and view the complete annual report

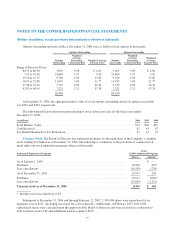

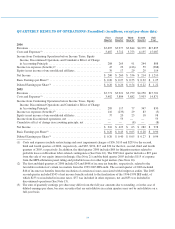

Please find page 102 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

On November 17, 2005, Xerox filed its 40-page

Reply (plus attachments) with the DCA. Xerox has sent

copies of the Xerox Reply to the SEC and DOJ in the

United States. In our Reply, we argue that the alleged

violations of Indian Company Law by means of alleged

improper payments and alleged defaults/failures of the

Xerox Modicorp Ltd. board of directors were

generally unsubstantiated and without any basis in law.

Further, we stated that the Report’s findings of other

alleged violations were unsubstantiated and unproven.

The DCA (now called the “Ministry of Company Affairs”

or “MCA”) will consider our Reply and will let us know

their conclusions in the coming months. There is the

possibility of fines or criminal penalties if conclusive

proof of wrongdoing is found. We have told the DCA that

Xerox’s conduct in voluntarily disclosing the initial

information and readily and willingly submitting to

investigation, coupled with the non-availability of earlier

records, warrants complete closure and early settlement.

In January 2006, we learned that the DCA has issued a

“Show Cause Notice” to certain former executives of

Xerox Modicorp Ltd. seeking a response to allegations of

potential violations of the Indian Companies Act. We

have also learned that Xerox Modicorp Ltd. has received

a formal Notice of Enquiry from the Indian

Monopolies & Restrictive Trade Practices Commission

(“MRTP Commission”) alleging that Xerox Modicorp

Ltd. committed unfair trading practices arising from the

events described in the DCA investigator’s Report.

Following a hearing on August 29, 2006, the MRTP

Commission ordered a process with deadlines between

Xerox Modicorp Ltd. and the investigating officer for

provision of relevant documents to Xerox Modicorp Ltd.,

after which Xerox Modicorp Ltd. will have four weeks to

file its reply. The MRTP Commission had scheduled a

hearing for framing of the issues on January 9, 2007, but

this hearing has been delayed. A new hearing was

scheduled for January 29, 2007 for consideration of

Xerox Modicorp Ltd.’s motion for the MRTP

Commission to direct the investigating officer to supply

us the relevant documents. At the hearing on January

29th, no additional documents were supplied to us. The

MRTP Commission directed us to file our reply to the

original Notice of Enquiry within four weeks. Our Indian

subsidiary plans to contest the Notice of Enquiry and has

been fully cooperating with the authorities.

In March 2005, following the completion of a share

buy-back program that increased our controlling

ownership interest in our Indian subsidiary to

approximately 89% from approximately 86% at year-end

2004, we changed the name of our Indian subsidiary to

Xerox India Ltd.

New York State School District Contracts: A local

New York State school district has raised questions

regarding the enforceability of their contracts, which may

have implications for contracts with similar customers.

We have reviewed this matter internally and have worked

with the appropriate state agencies in an effort to bring it

to a satisfactory resolution. We have received state

agency approval for a proposed resolution and are in the

process of implementing that resolution with the school

district that raised these questions as well as other

affected customers. Until this resolution is fully

implemented, it is not possible to estimate the amount of

loss, if any, or range of possible loss that might result

from this matter.

Note 17 – Preferred Stock

As of December 31, 2006, we had no preferred stock

shares outstanding and one class of preferred stock

purchase rights. We are authorized to issue approximately

22 million shares of cumulative preferred stock, $1.00 par

value.

Series C Mandatory Convertible Preferred Stock

Automatic Conversion: In July 2006, 9.2 million shares

of 6.25% Series C Mandatory Convertible Preferred

Stock were converted at a rate of 8.1301 shares of our

common stock, or 74.8 million common stock shares. The

recorded value of outstanding shares at the time of

conversion was $889. The conversion occurred pursuant

to the mandatory automatic conversion provisions set at

original issuance of the Series C Preferred Stock. As a

result of the automatic conversion, there are no remaining

outstanding shares of our Series C Mandatory

Convertible Preferred Stock.

Series B Convertible Preferred Stock Conversion:

In May 2004, all 6.2 million of our Convertible Preferred

shares were redeemed for 37 million common shares in

accordance with the original conversion provisions of the

100