Xerox 2006 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

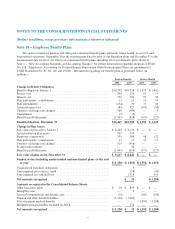

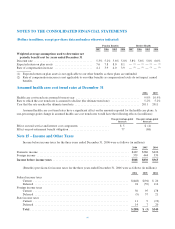

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

The estimated net loss and prior service credit for

the defined benefit pension plans that will be amortized

from accumulated other comprehensive loss into net

periodic benefit cost over the next fiscal year are $133

and $(21), respectively. The estimated net loss and prior

service credit for the other defined benefit postretirement

plans that will be amortized from accumulated other

comprehensive loss into net periodic benefit cost over the

next fiscal year are $11 and $(12) respectively.

Pension plan assets consist of both defined benefit

plan assets and assets legally restricted to the TRA

accounts. The combined investment results for these

plans, along with the results for our other defined benefit

plans, are shown above in the actual return on plan assets

caption. To the extent that investment results relate to

TRA, such results are charged directly to these accounts

as a component of interest cost.

Plan Amendment

During 2006 we amended one of our domestic

defined benefit pension plans. The amendment changed

the process of calculating benefits for certain employees

who retire from or leave the Company after 2012. The

new process ensures that certain benefit enhancements

are only provided to plan participants who qualify to

receive them based on age and years of service at

termination. The prior process for years after 2012

provided some plan participants with these benefit

enhancements regardless of qualification. The

amendment resulted in a net decrease of $173 in the PBO

and a net decrease of $20 in the ABO. The amendment

also decreased net periodic pension benefit cost by $31

for the full year 2006.

Plan Assets

Current Allocation and Investment Targets: As

of the 2006 and 2005 measurement dates, the global

pension plan assets were $9.2 billion and $8.4 billion,

respectively. These assets were invested among several

asset classes. The amount and percentage of assets

invested in each asset class as of each of these dates is

shown below:

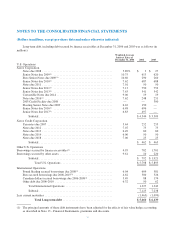

Asset Value

Percentage of

Total Assets

(in millions) 2006 2005 2006 2005

Asset Category

Equity securities(1) .... $4,971 $4,830 54% 57%

Debt securities(1) ..... 3,319 2,723 36 32

Real estate .......... 728 504 8 6

Other .............. 199 387 2 5

Total .............. $9,217 $8,444 100% 100%

(1) None of the investments include debt or equity

securities of Xerox Corporation.

Investment Strategy: The target asset allocations

for our worldwide plans for 2006 were 53% invested in

equities, 39% invested in fixed income, 7% invested in

real estate and 1% invested in Other. The target asset

allocations for our worldwide plans for 2005 were 54%

invested in equities, 39% invested in fixed income, 6%

invested in real estate and 1% invested in Other. The

pension assets outside of the U.S. as of the 2006 and

2005 measurement dates were $5.1 billion and $4.3

billion, respectively.

The target asset allocations for the U.S. pension plan

include 64% invested in equities, 30% in fixed income,

5% in real estate and 1% in other investments. Cash

investments are sufficient to handle expected cash

requirements for benefit payments and will vary

throughout the year. The expected long-term rate of

return on the U.S. pension assets is 8.75%.

We employ a total return investment approach

whereby a mix of equities and fixed income investments

are used to maximize the long-term return of plan assets

for a prudent level of risk. The intent of this strategy is to

minimize plan expenses by exceeding the interest growth

in long-term plan liabilities. Risk tolerance is established

through careful consideration of plan liabilities, plan

funded status, and corporate financial condition. This

consideration involves the use of long-term

87