Xerox 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

Note 20 – Acquisitions

Amici LLC: In July 2006, we acquired substantially

all of the net assets of Amici LLC (“Amici”), a provider

of electronic-discovery (e-discovery), services for $175 in

cash, including transaction costs. Amici provides

comprehensive litigation discovery management services,

including the conversion, hosting and production of

electronic and hardcopy documents. Amici also provides

consulting and professional services to assist attorneys in

the discovery process. The purchase agreement requires

us to pay the sellers an additional $20 if certain

performance targets are achieved in 2008, which would

be an addition to the acquired cost of the entity. The

operating results of Amici were not material to our

financial statements and are included within our Other

segment from the date of acquisition.

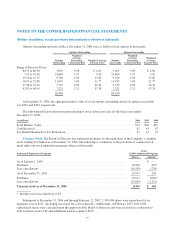

The table below presents the estimated purchase price allocation based upon third-party valuations and

management estimates. The Goodwill was assigned to our Other segment. The primary elements that generated the

Goodwill are the value of synergies and the acquired assembled workforce, neither of which qualify as an amortizable

intangible asset.

(in millions)

Amortization

Period in Years

Purchase Price

Allocation

Net assets, less cash acquired ............................................... $ 2

Goodwill ............................................................... N/A 136

Intangible assets:

Customer relationships ................................................ 13 29

Software ........................................................... 5 8

Total Purchase price ..................................................... $175

XMPie, Inc: In November 2006, we acquired the

stock of XMPie, Inc. (“XMPie”), a provider of variable

information software, for $54 in cash, including

transaction costs. XMPie’s software enables printers and

marketers to create and print personalized and customized

marketing materials to help improve response rates. We

had an existing relationship with XMPie, as its largest

reseller, and its software is primarily sold together with

our Production systems including the iGen3. The

operating results of XMPie are not material to our

financial statements, and are included within our

Production segment from the date of acquisition. The

purchase price was primarily allocated to Goodwill $48,

Intangible assets, net $9 and deferred tax liabilities $(3).

The primary element that generated the Goodwill is the

value of synergies between the entities, which do not

qualify as an amortizable intangible asset. The allocations

were based on third-party valuations and management

estimates which have not yet been finalized. Accordingly,

the allocation of purchase price is preliminary and

revisions may be necessary, although not expected to be

material.

Note 21 – Divestitures and Other Sales

During the three years ended December 31, 2006,

the following significant divestitures occurred:

Ridge Re: In March 2006, Ridge Re, a wholly owned

subsidiary included in our net investment in discontinued

operations (within Other long-term assets), completed an

agreement to transfer its obligations under its remaining

reinsurance agreement, together with related investments

held in trust, to another insurance company as part of a

complete exit from this business. As a result of this

transaction, the remaining investments held by Ridge Re

were sold and the excess cash held by Ridge Re of $119,

after the payment of its remaining liabilities, was

distributed back to the Company as part of a plan of

liquidation. This amount is presented within investing

activities in the Consolidated Statements of Cash Flows.

Integic: In March 2005, we completed the sale of our

entire equity interest in Integic Corporation (“Integic”)

for $96 in cash, net of transaction costs. The sale resulted

in a pre-tax gain of $93. Prior to this transaction, our

investment in Integic was accounted for using the equity

105